– Meet The Brand New, And Shocking, Third Largest Foreign Holder Of US Treasurys (Zerohedge, March 18, 2014):

Something hilarious, and at the same time pathetic, happened earlier today: at precisely 9 am the US Treasury released its delayed Treasury International Capital data (which was supposed to be released yesterday but was delayed because it snowed) which disclosed all the latest foreign Treasury holdings for the month of January. Among the key numbers tracked and disclosed, was that China’s official holdings increased from $1.270 trillion to $1.284 trillion, that Japan holdings declined by a tiny $0.2 billion, that UK holdings increased by $7.8 billion to $171 billion, and that holdings of Caribbean Banking Centers, aka hedge funds, declined by $16.7 billion. Here is Reuters with the full data summary (save it before this article is pulled).

So why is it hilarious and pathetic? Because just three short hours later, the Treasury – that organization that has billions of dollars at its budgetary disposal to collate, analyze and disseminate accurate and error-free data – admitted that all the previously reported data was in effect made up!

Of course, it didn’t phrase it as such. Instead, what TIC did was release an entire set of January numbers shortly after it had released the “old” numbers, which differed by a small amount but differed across the board – in other words, not a small typo here and there: a wholesale data fudging exercise gone horribly wrong. For example:

- Instead of a $14 billion increase, China’s revised holdings were only $3.5 billion higher.

- Instead of unchanged, Japan’s holdings suddenly mysteriously increased by $19 billion in January.

- Instead of plunging by $17 billion, the Caribbean Banking Centers were down by a tiny $1 billion.

- And instead of the previously reported increase of just under $1 billion, the all important Russia was revised to have sold $7 billion, bringing its new total to just $132 billion ahead of the alleged previously reported dump of Fed custody holdings in mid-March.

That this glaring confirmation that all TIC data is made up on the fly, without any real backing, and merely goalseeked is disturbing enough. For what it’s worth, the latest TIC data is here. Feel free to peruse it before it is revised again

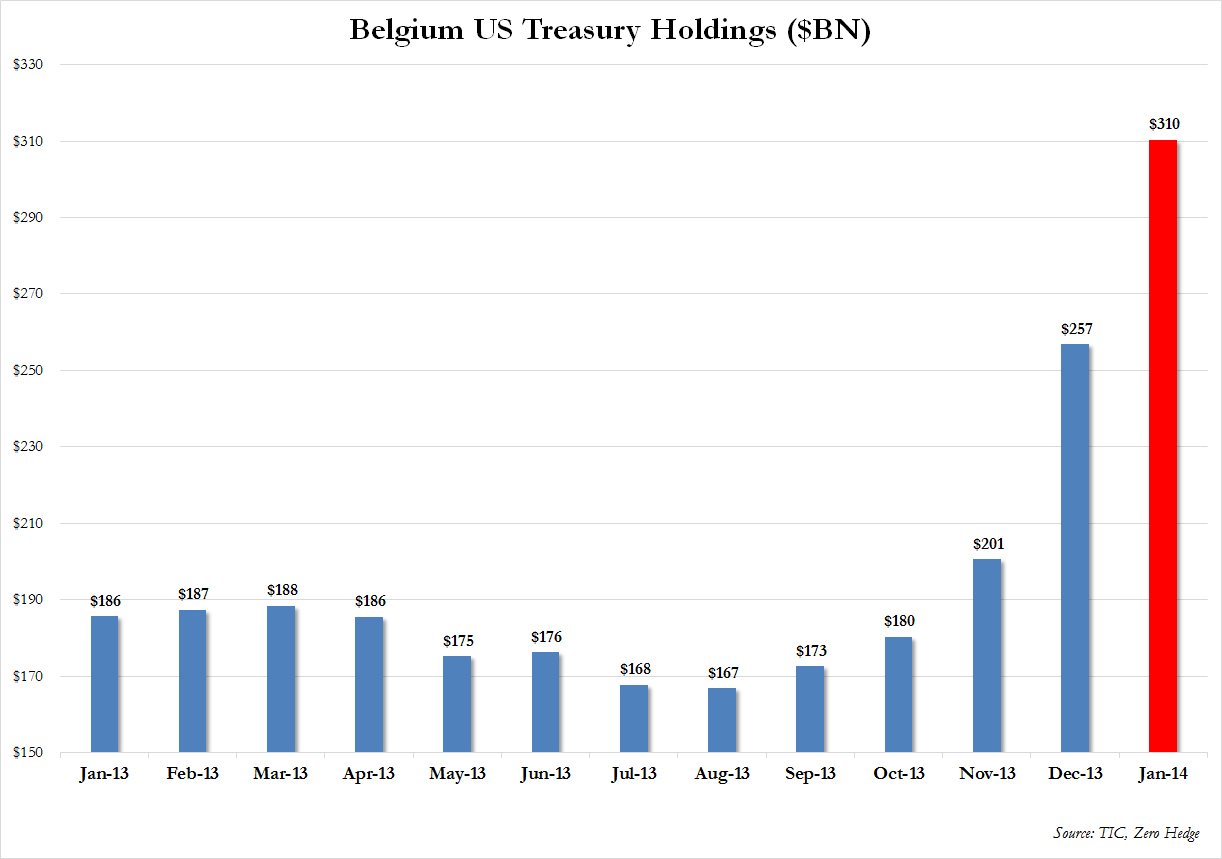

However, what was perhaps more disturbing than even that was the revelation that as of January, the US has a brand new third largest holder of US Treasurys, one which in the past two months has added over $100 billion in US Treasury paper, bringing its total from $201 billion in November, to $257 billion in December, to a whopping $310 billion at January 31.

The country? Belgium

The same Belgium which at the end of 2013 had a GDP of just over €100 billion, or a little over one-third what its alleged UST holdings are.

And somehow the Treasury expects us to believe that tiny Belgium – the center of the doomed Eurozone which is all too busy running debt ponzi scheme of its own – bought in two months nearly as much US Treasurys as its entire GDP?

Apparently yes. However we are not that naive.

So our question is: just who is Belgium being used as a front for?

Recall that for years, the “UK” line item on TIC data was simply offshore accounts transaction on behalf of China. Of course, since China hasn’t added any net US paper holdings in the past year, the UK, and China, are both irrelevant in the grand scheme of things.

But not Belgium. Because with Russia (or someone else) rumored to have sold or otherwise reallocated $100 billion in US Treasurys in March away from the Fed, we wouldn’t be surprised if the Belgium total holdings somehow soared to over $400 billion when the March data is revealed some time in May. Courtesy of the excel goalseeking function of course.

Needless to say, this all ignores the initially confirmed fact that all the data presented above is made up gibberish, goalseeked by a bored intern at the Treasury, and whose work got zero error-proofing before its released to the entire world earlier today.

So… just what is going on with this most critical of data sets – official foreign holdings of US paper, and how long before an Edward Snowden emerges from the depths of the US Treasury building and reveals that behind all the data manipulation and unaudited figures was none other than the Fed, whose holdings, far greater than represented, are all that matter, and everything else is merely one grand, theatrical plug?

$201 billion is now the 3rd highest investor in US debt?

Go back, and compare what it was four years ago……..this is a pittance……

Nobody is really investing here. Belgium is one step from total bankruptcy, so we know they are a front…..probably for the FED or some oligarch with a plan in mind……not friendly to US interests. Don’t believe the FED has our best interests at heart, either, they are a private banking concern, and their interests are global.

I have been watching foreign investment drop in this country since 2008, and these number are shockingly tiny.

As less nations use the dollar (need for a world reserve currency now obsolete thanks to electronic currencies), you will see more lies like this……the US is sitting on a lot of paper money with nothing behind it but ink…..the world has stopped buying US debt and using the dollar.

Right now, (this list is incomplete) China, Russia, India, Brazil, Japan, Iran, Turkey, many nations in South America and emerging African nations no longer use the dollar. New Zealand and Australian dumped the dollar last year. The US dollar was involved in 100% of international trade in Jan 2010……today, it is less than half and falling fast.

It is happening faster than I thought it would. Our nonsense with Syria and Russia has not helped, our aggression over the past 15 years has turned most countries away from us. At this point, I would not be surprised to see a concerted effort by oligarchs to wipe the floor with the dollar. A few hundred billion is nothing to these clowns……trillions were. As long as they were heavily invested in US debt, we were safe.

At this point, I would really like to see an accurate representation of foreign investment, not some made up fiction to keep the fools appeased.

Since 2010, once it became clear the US would do nothing to clean up it’s financial markets (a grave mistake!!), all big investors in US debt began to quietly divest themselves from investment in our debt. The FED began to pick up the slack…..the last number I saw (many months ago), the FED was carrying 79% of our debt.

It is higher now, and these numbers convince me the dollar is in deep trouble. Belgium is one step from total bankruptcy, and the idea they have any money to waste in the US declining economy is a bitter joke.

I knew there was something behind all this war talk, that it was cheap political diversion to keep us from focusing on the truth……the dollar is collapsing as less nations use it and the buying power declines so rapidly.

This was the Achilles heel in the paper printing game, and Hugo Chavez’s introduction of the Sucre in Summer of 2010 was the beginning of the end for the US dollar and its status as the world reserve currency. The complacent jerks here in the US would not see it, and they kept the printing presses going. Now, the trouble is upon us.

Electronic currencies take any nation’s currency and translate it’s value during an international trade making conversion to the dollar obsolete and unnecessary. The loss of this status has dealt a death blow to the US economy because it has relied on it too completely.

All our exports are offshored. We have no living GDP, it is all financial….. on paper. In 1995, 16% of the US GDP was in financials, in 2010 it grew to 69% of US GDP. Today, who knows? They no longer tell us.

Our incredibly aggressive stance in the world has turned the other nations against us. They have struck back in the one way they had…….by dumping the dollar….our Achilles heel.

The US may be the world military leader, but exporting death isn’t a good long term business plan. We have no friends left, and this game with Putin was about it for us……they have a lot of money, lots of oligarchs with billions in gold, and we have nothing but a greedy corporate leadership that doesn’t have enough sense to fuel the real economy.

This is a huge story. Bet it doesn’t make it to any US media outlet. But, the falling buying power of the dollar isn’t fooling a soul, and all the Fox propaganda cannot amend the truth. The dollar, and the US economy is sinking fast.

Thanks for printing this story.

It seems we must accept that official figures are lies and treat them all with the contempt they deserve.

Having studied “statistics” as part of my education, I became quite proficient at fudging reality for financial benefit.

Inflation, as Tyler Durden of Zero Hedge said yesterday:~

As long you don’t eat, sleep under a roof, or use energy, things are positive for you as Core CPI dropped to its lowest in 10 years.

Joe Public never took on board the ridiculously insulting implications of removing Mortgage Interest, Food items and energy costs from the calculations.

Unemployment, Immigration, Growth, National Debt, Military spending, Food Production, Climate, Energy costs, and so on are all lies.

On 911, the missing trillions of the Military Expenditure fraud was being collated in WTC7 for the Congressional Hearing….just an example of yet another desperate measure to stop Joe learning the truth, when the ferrets get too close.

We will never ever be allowed to know the real truth about anything anymore.

So much so, that if they ever did tell the truth, we would NEVER believe them. (That is a hypothetical assumption anyway!)

To Squodgy: I studied history with an emphasis on the art and science of propaganda. Statistics are the most useful and convincing parts of a debate or argument. I learned their value long ago as ways to convince. Numbers sound good, but only as long as the folks receiving them believe them…….back to the greatest loss the US has experienced…..credibility.

The numbers used by these fools today are beyond belief, as you put it, nobody believes them. When a nation loses credibility, it has lost all. Putin now is more believable than Obama because he says what he will do, and does it. There are many reasons, the main one being the fact he is one man in control, he has no gaggle of fools to contend with called congress……he has total authority, so can get things done. In Obama’s case, he has betrayed every person who ever supported him, he lies when there is no reason to do so…….so nobody believes him.

This endless war talk is like the boy who called “wolf.” After a while, nobody listens, and the ass he has as secretary of state is even worse………how can you tell if he is lying? His mouth is moving…….

The US is now the rogue nation. The entire world stage has been shifted. Its only export is death, and the world is going to do everything to eliminate it………..

Group rule does not work. The Great Experiment of the Enlightenment period has failed.

When given all the power the US voters used to enjoy, they were too lazy to read up or vote. Now, all their power and wonderful civil rights are gone, and many are too stupid to even know it. I have no sympathy, Cannibals elect cannibal kings. The brave men who won them these rights (some were ancestors of mine) would be sick to their stomach if they could see the results of their hard work.

Some of my people served in the American Revolution. I now wish they had stayed in England or moved to Canada as many Tory members did. What a bunch of losers the US has generated………it is disgusting to me.

The fact nobody protested the way inflation isn’t counted ought to say plenty……..