See also:

– China Is Crashing … As Predicted

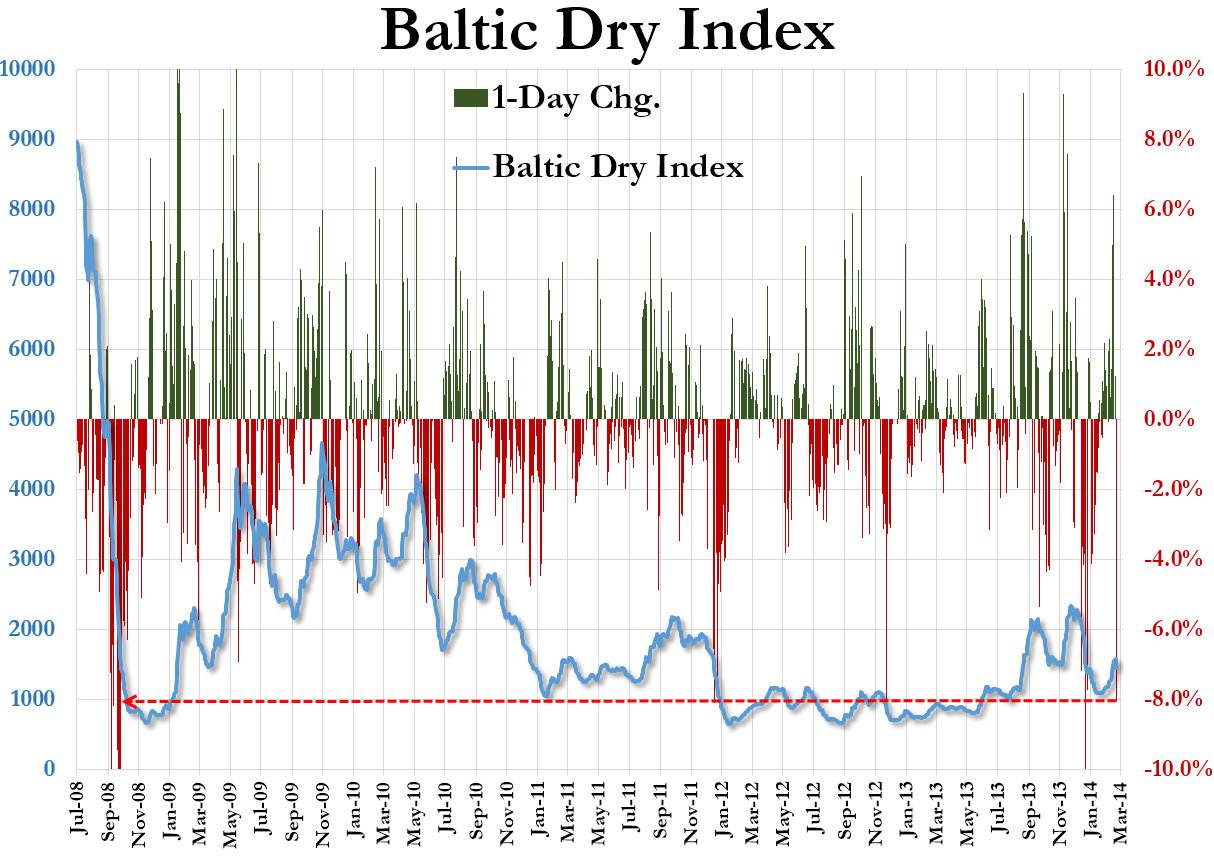

– Baltic Dry Plunges 8%, Near Most In 6 Years As Iron Ore At Chinese Ports Hits All Time High (ZeroHedge, March 12, 2014):

It would appear record inventories of Iron ore and plunging prices due to China’s shadow-banking unwind have started to weigh on the all-too-important-when-it-is-going-up-but-let’s-blame-supply-when-dropping Baltic Dry Index. With the worst start to a year in over a decade, the recent recovery in prices provided faint hope that the worst of the global trade collapse was over… however, today’s 8% plunge – on par with the biggest drops in the last 6 years – suggests things are far from self-sustaining. Still think we are insulated from the arcane China shadow-banking system, which suddenly everyone is an expert of suddenly? Think again.

Why? Perhaps the following chart showing Chinese iron ore steel stockpiles at the country’s 34 major ports will provide the answer:

Charts: Bloomberg

The BDI is the revered indicator of forward booking orders of all dry cargo ships both schedules and charters.

It has been in the doldrums (sic) since 2007.

That means international trade is at crap levels.

Again, we are being lied to.

But the late Richard Douthwaite wrote a very interesting book called THE GROWTH ILLUSION, in which he reasoned that the holy grail of economic growth only benefited BANKSTERS. And enslaved us as a result.

Of course he was ridiculed by the bought press.

Personally I must agree with him.