– Home Prices Are Back… To 1894’s Levels (ZeroHedge, Feb 14, 2013):

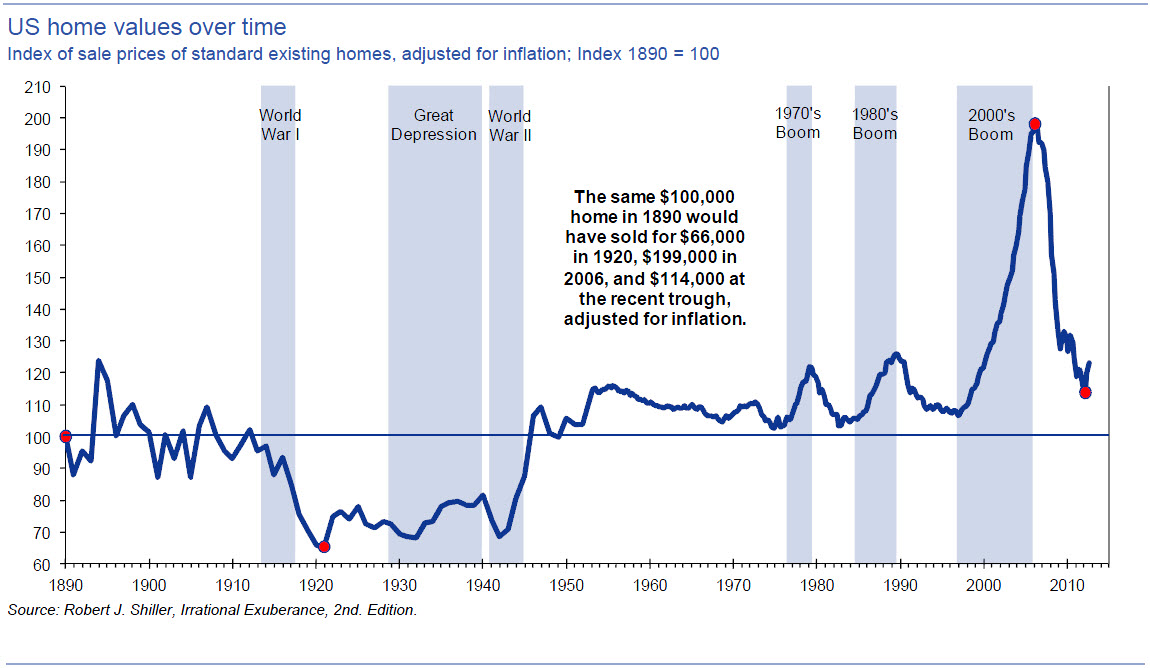

Six years after the onset of the traumatic US housing crisis, the optics are there that suggest a stabilization is occurring. Whether real or manufactured by record-low foreclosures, bank supply withdrawals, and fed-subsidized cash REO-to-rent trades, the sad truth is that jobs (and the GDP-enhancing multiplier effect that they create) are just not coming. Even Bob Shiller prefers the potential for 4% gains in stocks over housing risk in the medium-term as he points out that – inflation-adjusted – house prices are back at levels first seen in 1894… now that is a long-term investor.

Source: Goldman Sachs