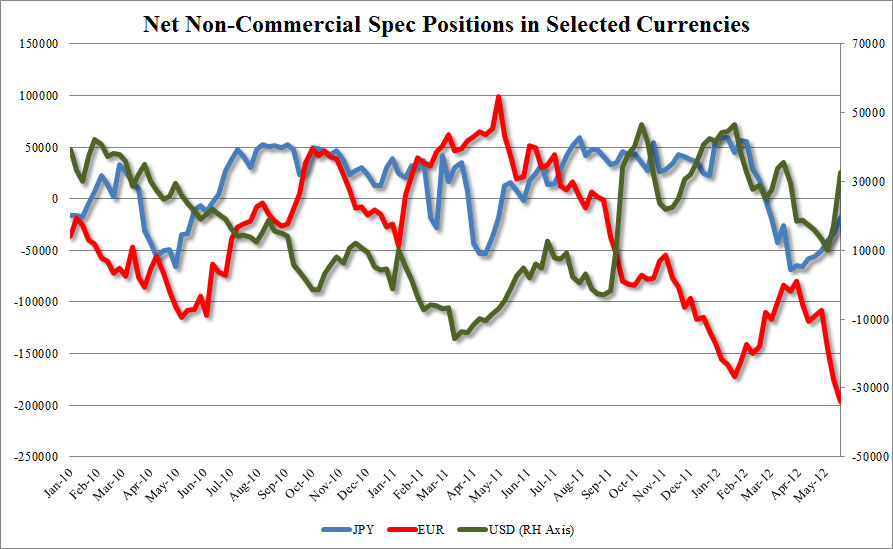

– EUR Shorts Hit New Record (ZeroHedge, May 28, 2012):

Last week, when we reported on the then brand new record number of EUR non-commercial short contracts as reported by the CFTC, we said: “with such a massive surge in shorts in a short period of time, this means that the likelihood of major short squeezes is substantial on even the most innocuous of news, such as a G8 summit which promises much but delivers nothing, or China once again saying it will gladly focus on growth (as opposed to what? non-growth?), or some DieBold-inspired leadership change in the Greek pro/anti-bailout polls. Our advice to FX trading readers: be very careful with EURUSD stops: it is very likely that in their pursuit of short covering squeezes, (BIS) algos will take the pair substantially into the offer-side stop limit buffer just to force short hands out, which in turn may initiate short-term covering ramps.” As of last Friday, the record number of net short contracts (-173.9K), just rose to a new all time high of -195.4K. The result: something as worthless and meaningless as uber-volatile Greek political polls (which had Syriza with a 4 point lead last Friday, which somehow dissolved and is now in second place about 24 hours later), was enough to send the EUR higher nearly by 100 pips overnight. Obviously, with ever more record shorts in the currency, expect the desperate continent to come up with nothing but more flashing red headlines in attempts to spook weak hands and incite even more very transitory short covering.

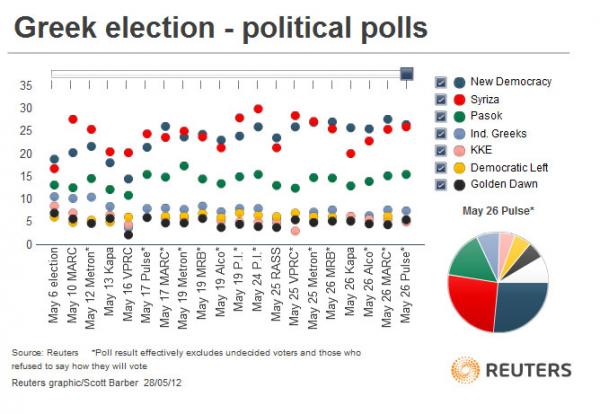

Below is the random number generator on which the fate of capital markets rests: