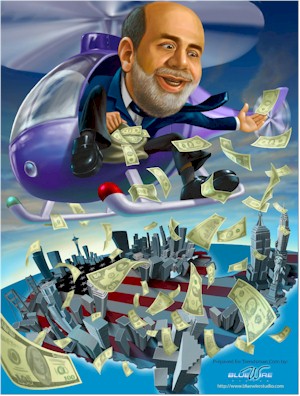

– Fire Bad! Free Money Good! Traders React to Global Central Bank Bailout (Yahoo News/The Daily Ticker, Sep. 15, 2011):

Stocks surged in the U.S. and Europe early Thursday while Treasury prices tumbled on news of a coordinated easing by global central banks.

“The Governing Council of the European Central Bank has decided, in coordination with the Federal Reserve, the Bank of England, the Bank of Japan and the Swiss National Bank, to conduct three US dollar liquidity-providing operations with a maturity of approximately three months covering the end of the year,” the ECB said in a statement.

Translation: The world’s central bankers will provide as much money as necessary until year-end to stem a brewing funding crisis among European banks. The move follows a report yesterday that two European banks were unable to get short-term dollar funding in private markets and were forced to tap the ECB for $575 million.

“The stress is still there as long as sovereign debt issues aren’t dealt with aggressively but this move eases short-term funding problems,” writes Miller Tabak strategist Peter Boockvar. “It’s a positive in that short-term relief is being given but a negative that we are at this state to begin with.”

Indeed, the initial euphoria had subsided about 1 hour into the New York session: In recent trading, the Dow was up 67 points to 11,314 after having eclipsed 11,400 earlier. (Update: As of 1:30 pm ET, the Dow was up 1.1% to 11,377.)

In hindsight, this action by global policymakers was predictable and was indeed predicted by Morgan Stanley’s global economics team last week, among others. Meanwhile, the Dow Transports had risen 10% and the Nasdaq was up 5% in the prior two day, leading some market participants to speculate “someone” knew this moving was coming. “Between the government taking these actions and a market that moves before the news, we are living inside a giant insider trading machine,” writes Scott Bleier of Create Capital.

The first big hint came two weeks ago when the Swiss National Bank pledged to support the euro vs. the Swiss franc with “the utmost determination.” (See:Turmoil in Europe Slams U.S. Stocks: Swiss Complicate ‘Safe Haven’ Trade)

Then yesterday, Treasury Secretary Tim Geithner assured CNBC’s Jim Cramer “there is no chance that the major countries of Europe will let their institutions be at risk in the eyes of the market. There is not a chance.”

In between, German chancellor Angela Merkel declared publicly “we are not going to have a Lehman Brothers” and has become more resolute about supporting Greece. Still, sovereign debt is a separate matter, as Boockvar notes, as is the arrest of a “rogue” trader at UBS, although that may have helped push up the timing of Thursday’s announcement.

In the end, the UBS trader story serves as yet another echo of the summer of 2008, when rogue trader Jerome Kerviel nearly brought Societe Generale to the brink of collapse. (See: 2008 Redo? History Doesn’t Repeat, But It Often Rhymes)

The coordinated response by policymakers shows they have learned some lessons from 2008 and are trying to preempt a funding crisis in the banking sector before it becomes systemic. Traders, meanwhile, seem to have absorbed only one lesson from 2008: Free money is good, regardless of the reason it’s being provided.

Stay tuned for additional coverage here and on Breakout, including our scheduled interview with PIMCO’s Neel Kashkari later today.