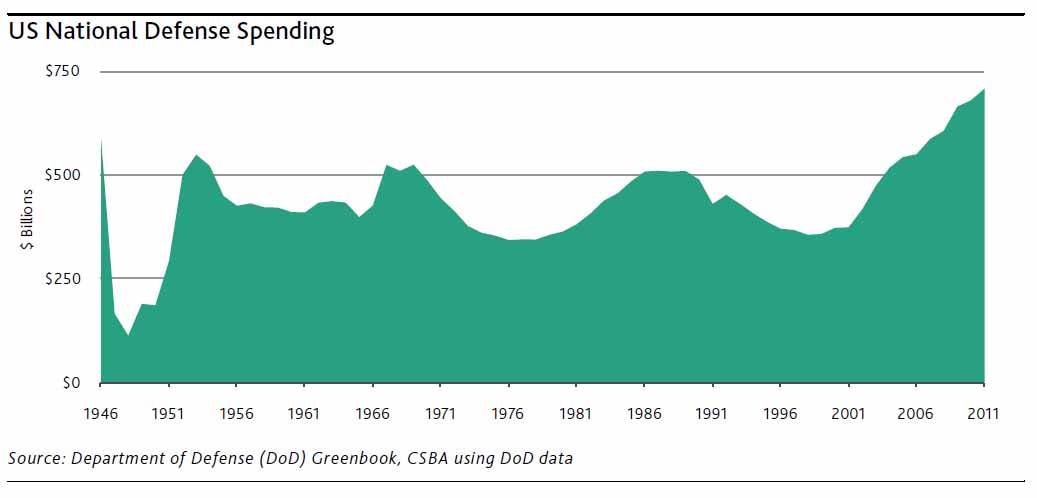

– Charting 60 Years Of Defense Spending, And Why The Mean Reversion Will Cost Millions Of Jobs (ZeroHedge, July 18, 2011):

Moody’s is out with a comprehensive chart of defense spending since 1946 which shows that while over the years the average yearly amount spent on defense by the US government has been around $400 billion, in the past decade this amount has surged to an all time high of just under $750 billion. And while one can debate the reasons for why America spends 20% of annual revenues on military (and debate even more why this number has continued to surge under a Nobel Peace Prize winning president), one thing is rather certain: this number will decline in the coming months and years as Washington has no choice but to cut the defense budget. And while this will likely be a multi-year process, it will have substantial implications for not only the defense companies identified, but for their respectively supply-chains, resulting in hundreds of thousands and possibly millions of layoffs over the next decade as government-sourced revenue plummets and yet another layer of overhead will have to be trimmed.

Per Moodys’

Last week’s escalating political rhetoric and ongoing debate about the US statutory debt ceiling and deficit spending lead us to expect deeper-than-anticipated budget cuts that will negatively affect defense contractors doing business with the US government.

At almost $700 billion and about 20% of total annual domestic outlays (and more than half of discretionary expenditures), the world’s largest defense budget by a factor of 6x (China ranks second) remains politically vulnerable to becoming at least a partial solution to the longstanding deficit problem. Whether or not a satisfactory solution to the growing deficit problem is reached near term and the debt ceiling is raised, there is little doubt that pressure to trim excessive spending will persist.

Affected companies include prime defense contractors Lockheed Martin (Baa1 stable), Northrop Grumman (Baa1 stable), Boeing (A2 negative), Raytheon (Baa1 stable) and General Dynamics (A2 stable); other big US government defense suppliers such as Science Applications International (A3 stable), ITT (Baa1 review for downgrade), L-3 Communications (Baa3 stable), BAE Systems (Baa2 stable) and United Technologies (A2 stable); and ultimately the full contingent of companies in the supply chain to these large defense contractors.For the past 10 years since the events of 9/11, the rapid build-up of arms and services, as seen in the exhibit below, made the defense business a good place to be, almost irrespective of specific program focus.

Now, with government budgetary pressures constituting a global phenomenon, defense spending is universally getting a broad reassessment after this period of very high growth, and defense contractors are consequently chasing fewer opportunities in a heightened competitive environment.Before leaving office, former Secretary of Defense Robert Gates had already identified and/or effected $400 billion of cost cutting from canceling certain weapons programs and identifying overhead and efficiency savings. However, more than $300 billion of that savings is slated to be reinvested in similar programs and/or higher military priorities, leaving only $78 billion available for deficit reduction. In his April budget proposal, President Obama asked for $400 billion of incremental defense spending cuts, roughly equal to 7% of the Department of Defense’s projected base budget (excluding supplemental wartime spending) over the coming 10 years. Still a somewhat modest figure in real dollar terms, we now expect agreement on a much larger deficit reduction plan, partially prompted by the desire and need to avert an outright payment default and downgrade of the country’s Aaa government bond rating, which we placed on review on 13 July.

For the defense industry, that may mean a call to reduce spending at a multiple of the original $400 billion target, particularly if held to its proportionate share of the total budget. As the just-approved Fiscal Year 2012 Department of Defense Appropriations bill from the House works its way through the Democratic-controlled Senate, particularly against the backdrop of broader deficit-reduction talks providing added political fodder, this historically largely untouched defense category may get hit with a double-digit percentage reduction in base funding levels over the next few years.

An accelerated withdrawal from Iraq and Afghanistan will jump-start the reduction in total defense outlays (including such wartime supplemental spending), and this alone will have a meaningful impact on many companies. Going forward, it will be increasingly important for defense contractors to be on the “right” programs. Exactly which programs those are remains to be seen, though, given the increasingly broad and growing list of potential and actual threats to US national security.

The offset to all of this is the sector’s overall current health and participants’ strong financial profiles. As well, such prospective spending cuts at any meaningful level will also likely take many years to play out, particularly given the long-dated nature of most defense contracts. Moreover, the daily news feed invariably serves as a constant reminder that the world is still a very dangerous place. The real issue is one of affordability. Demand (and need) for the sophisticated weaponry, programs and services on offer by defense contractors will largely mirror the threat level and therefore remain high, particularly for the US government. In this regard, the industry enjoys a somewhat unique but mutually beneficial relationship with its most important customer.

Think today’s layoff announcements by Cisco and Borders will be bad for the NFP? Just wait until the spending cuts start being priced in by various corporate treasury and CFO offices across the defense curve.

This is the clearest article on this subject I have been able to find. Thank you for a well-researched and straightforward report. Like your writer, I see more rough seas ahead.

I have sent the link to others.

Thanks,

Marilyn Gjerdrum

Interesting article. Just one correction – “Defence” spending runs at roughly 1 to 2%, 2 other categories, namely “Attack” and “Invade” make up the remaining 18 or so %.

As for those poor old defence contractors, I’m sure most of them will continue to find an avenue to the taxpayers dollars.