Commentary:

‘Tough as Teflon’? How stupid can they get?

There is some truth here, in regards to Teflon:

– Teflon Is Forever (Mother Jones):

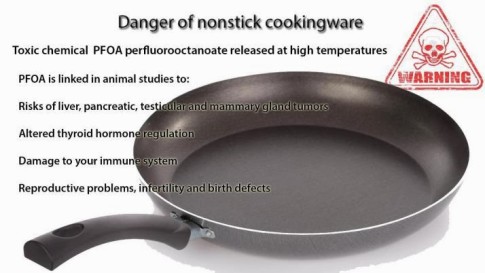

Teflon, it turns out, gets its nonstick properties from a toxic, nearly indestructible chemical called pfoa, or perfluorooctanoic acid. Used in thousands of products from cookware to kids’ pajamas to takeout coffee cups, pfoa is a likely human carcinogen, according to a science panel commissioned by the Environmental Protection Agency.

– THE DANGERS OF TEFLON PANS:

In two to five minutes on a conventional stovetop, cookware coated with Teflon and other non-stick surfaces can exceed temperatures at which the coating breaks apart and emits toxic particles and gases linked to hundreds, perhaps thousands, of pet bird deaths and an unknown number of human illnesses each year, according to tests commissioned by Environmental Working Group (EWG).

…

DuPont claims that its coating remains intact indefinitely at 500°F. Experiences of consumers whose birds have died from fumes generated at lower temperatures show that this is not the case. In one case researchers at the University of Missouri documented the death of about 1,000 broiler chicks exposed to offgas products from coated heat lamps at 396°F.

Teflon is toxic and destroys your health.

And investing into this toxic BS market will eventually destroy your financial health.

– The Barron’s “Cover” Is Back (ZeroHedge, Sep 1, 2012):

Just when all hope was gone that the market has lost all connection with newsflow, discounting, or fundamentals, and all that mattered was how loudly this or that head of printing could jaw(or finger)bone stocks up, here comes that patron saint of all contrarian indicators, the Barron’s cover, and “Tough as Teflon.” Or at least this was before central planning. Nowadays, every downtick is a catalyst to buy, as it has become a well known fact that even a 0.1% drop in the market is not only a catalyst for widespread panic, but also grounds for immediate promises of endless easing by any and all Goldman affiliated central banks (that would be all of them).

Source: Barrons