It’s not a story that’s likely to appear on the evening news, but it certainly should.

Deutsche Bank has announced that it will create more shares, selling them at a 35% discount. Existing shareholders have not been pleased and, in the first four days since the offer was announced, the value of existing shares dropped by 13% as shareholders began dumping them.

So why on earth would Germany’s foremost bank do something so rash? Well, in recent years, the bank has been involved in many arbitrations, litigations, and regulatory proceedings as a result of fraudulent activities, including the manipulation of markets. Having been found guilty, they presently owe $7.2 billion to the US Department of Justice and are now facing an additional $10 billion litigation bill. Unfortunately, the bank is already broke and, should Deutsche actually be able to sell the new shares, the $8.6 billion they hope to receive will still not save them from bankruptcy.

Business has also not been so good. They’ve lost nearly $2 billion in the last two years, instituted a hiring freeze, cut bonuses by 80%, and are facing a $2.5 million civil penalty to pay to the Commodity Futures Trading Commission for failure to report transactions and, not surprisingly, have been downgraded.

The German government has stated that they will not bail out Deutsche and, indeed, under the EU agreement, they cannot do so. It’s safe to say that Germany’s largest bank will soon go the way of the dodo.

For those who don’t live in Europe, this may not seem all that significant. However, Deutsche is the bank that funds the euro system, which they can now no longer do. Further, Deutsche is ten times larger than Lehman Brothers, an American bank that famously went down in 2008, heralding in that year’s economic crash. (Ninety percent of Deutsche’s revenue has been from derivative trading, which is what brought down Lehman.)

Upon the collapse of Deutsche Bank, four major US banks would be expected to become insolvent in a matter of days. The ripples would then continue to spread outward into the economic system as a whole.

Now for the Bad News

For many years, I’ve made repeated reference to the fact that the Western powers have been headed south economically, repeatedly relying on strategies that would provide short-term gain but would ultimately create long-term pain. They’ve been remarkably consistent and steadfast in this trend and, at this point, Deutsche is merely the latest trigger that may bring down the system. The other potential triggers are as serious as they are diverse.

- Recently, foreign governments have been selling US Treasuries back into the US market at the fastest rate in history (indicating their belief in a future devaluation of the dollar).

- The Dodd-Frank Act of 2010 was intended to legally end the possibility of quantitative easing. It did, however legalise the bail-in, authorizing banks to confiscate (steal) deposits. In other countries where a bail-in has been introduced, governments additionally seized pension funds, retirements, etc., often paying for them either with stocks in a failing bank or a bond, then defaulting on the bond.

- The stock market is in a larger bubble than in 2008 and is overdue for a crash.

- Bonds are in their largest bubble in history and are also overdue for a crash.

- Derivatives, which triggered the last major crash, are now at a higher level than in 2007, indicating yet another overdue trigger.

- Much of the world is moving away from the petrodollar, which is significantly responsible for the continued hegemony of the US dollar internationally. Many countries now routinely effect payment for fuel in other currencies.

- Russia has recently announced the creation of its own SWIFT system (as did China not long ago), making it possible for them to effect international payments without the need to go through SWIFT in Brussels, which is largely controlled by the US.

- On 15th March, the US hit its debt ceiling and can no longer legally continue to borrow money. It’s estimated that the money remaining in the Treasury will be exhausted on 1st June. After that point, if major money transfusions do not take place, the US government ceases to fund itself, its many agencies, and its entitlements. (There apparently is no plan in place that could provide sufficient funding.)

These are just a few select high points, and there are quite a few other triggers out there, any of which, if pulled, would serve to collapse the economy very quickly. And the list keeps growing.

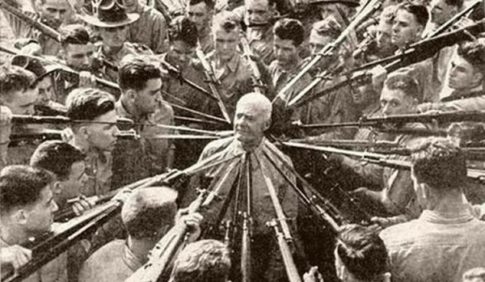

The question is not “if” but “when.” In the end, it will matter little which trigger it will be, as, like a string of firecrackers, when one explodes, a chain reaction is set off. Therefore, anyone who is dependent in a significant way upon the government, financial institutions, and/or markets of any of the major Western powers is likely to understandably feel like the fellow in the photo above.

H/t reader squodgy:

“Good summary.”

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP