– Meanwhile In China, More Bubble Insanity:

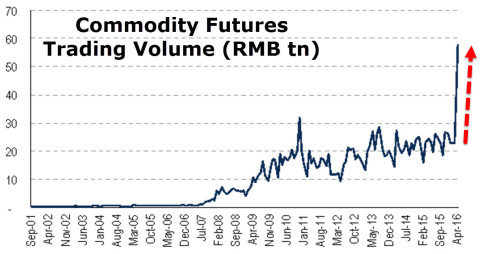

The credit-fueled speculative bubble in China’s commodity market, as we detailed previously, exploded this week as the mainstream slowly comes to realize that the gains in industrial metals are not a “sign of strength in China’s and the world’s economic recovery” but merely the next rotation of fast-money slooshing from Chinese equities to Chinese corporate bonds to Chinese real estate and now to Chinese commodity futures…

Trading in futures on everything from steel reinforcement bars and hot-rolled coils to cotton and polyvinyl chloride has soared this week, prompting exchanges in Shanghai, Dalian and Zhengzhou to boost fees or issue warnings to investors.

Deutsche Bank details the total crazinesss…

The onshore China commodity markets this week traded (conservatively) $350bn notional, a 17x increase on the $20bn notional that traded on Feb 1st 2016 i.e. a month ago(is it coincidence that the notional is about the same as at the peak of the equity frenzy?).

My calculations are pretty basic; I’ve trawled the screens and chosen 32 commodities in agri, metals and coke/coal and done a quick (contracts x value)/CNY for a dollar amount. I have not used the largest day’s volume either (e.g. Deformed Bar, RBTA has traded close to $100bn, but I used closer to $60bn). Cotton (VVA Comdty) has been trading $15bn, up from $500mm in Feb. In the US, the long established cotton contract (CT1 Comdty) trades $600mm. China listed Sugar (CBA Comdty) has traded $14bn versus the US listed sugar beet at $850mm.

This is what insanity looks like!!

The extreme measures China adopted to counter its stock market crash and unfolding crisis have now incited precarious speculative Bubbles in commodities. As CreditBubbleBulletin’s Doug Noland notes, this creates extraordinary uncertainties for China and the world.

A deepening Credit crisis would seem to ensure the usual cautious official measures to counter speculative excesses. So the world has of late been contemplating booming China: ongoing loose financial conditions with 2016 Credit growth in the neighborhood of $3.0 TN – providing extraordinary fuel for a rather destabilizing speculative blow-off.

Keep in mind that The Mighty World of Speculative Finance has been positioned long “defensive,” long “deflation,” long “duration” and long sold balance sheets. This world has been short commodities, energy, yields, cyclicals, financials and bad balance sheets. Moreover, many of these (Crowded) macro themes have been combined into leveraged portfolios (“risk parity”, etc.). China with $3.0 TN of Credit growth fueling unpredictable housing and commodities speculative Bubbles upsets the applecart.

…

At this point, China – as the “marginal source of global Credit and liquidity” – is exacerbating what had already evolved into a powerful central-bank induced short squeeze dynamic. Despite the collapse of Doha talks over the weekend, crude’s march higher ran unabated again this week. Industrial metal prices have been surging. Silver jumped 4.4% this week, with copper up 5.4%. The week saw nickel prices rise to a five-month high and aluminum to eight-month highs. Platinum, palladium, zinc and lead prices have all shot higher. Some iron ore prices have jumped to highs since early 2015.

The problem is that China’s newfound commodities speculation is underpinned by historic Credit growth – say, more than $3.0 TN annualized. Meanwhile, global short-squeeze dynamics are bolstered by $2.0 TN of annualized QE (ECB and BOJ). Moreover, there’s the massive pool of speculative finance – including a $3.0 TN hedge fund industry – with large leverage positions throughout global markets. In an extraordinary development, as scores of trades continue to unwind, a destabilizing global dynamic feeds on itself and gathers momentum. It’s monetary disorder on steroids.

The “marginal source of global Credit and liquidity” is short-term supportive of global risk markets. Yet its Credit system is self-destructing – and doing so rather conspicuously. If any other country employed a similar policy mix the world would be sprinting from that currency.

Thus far, Chinese officials have been determined to carefully manage China’s pegged currency regime. Yet current Credit and market dynamics are inconsistent with a stable currency. I would furthermore argue that breakneck Credit growth in the face of rapidly deteriorating underlying fundamentals is a proven recipe for a crisis of confidence. Global markets are in the midst of a destabilizing adjustment to China’s resurgent booms in Credit and speculation. This ensures real havoc when global markets are confronted with a Chinese Credit and/or currency dislocation.

How much impact is this having on global markets?

At first, very little. Many of the China listed futures started to bottom and rally in Nov and Dec last year, with very little relationship to global peers. This very crude chart below is a simple aggregation of all the prices of the 32 commods that I could find, but many of the underlying constituents are exactly the same. The performance looks inversely correlated with the performance of the underlying economy (and demand) but nicely related to the injection of credit.

But, in recent sessions, some of the US based commods have started to squeeze higher, presumably because the dog and the tail are changing places (clearly these are not apples-for-apples, as it were, in terms of contracts).

There is no correlation between the explosion in interest in Chinese commodity futures and any Chinese economic activity (and it should be a reminder to all who gaze lovingly at the commodity charts of the last decade that credit, rather than true demand, can be the most influential factor in financial markets). Volumes have increased 17 fold in a month. The economy has not. This is simply another speculative excess that will probably (already has) run way beyond fundamentals. It is probably creating a false picture of global demand for commodity stocks of all types, which themselves have rallied far beyond their earnings potential.

Eventually, the excesses will need to be curbed and maybe that starts a new phase of risk-off within China. We leave it to Tiger Shi, a managing partner at Bands Financial Ltd in Hong Kong to conclude:

“The market is moving so quickly, yesterday felt just like the stock market in June last year before the crash… I think how it goes up, that’s how it will come down.”

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP