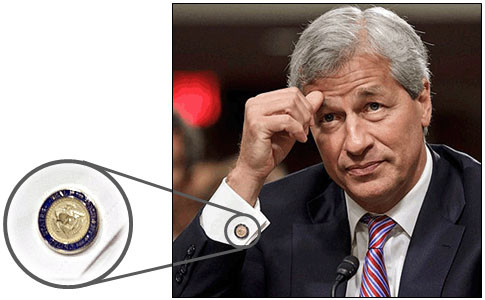

On February 12, Jamie Dimon made headlines when he bought 500,000 shares, or some $26 million worth of JPM stock which coming one day after the market hit its lowest point in the recent selloff, has become known as the “Dimon Bottom.” Was it just good timing or was there something more to the purchase some wondered. As it turns out the purchase may have been nothing more than Jamie frontrunning his own company’s multi-billion buyback, because as JPM announced moments ago, the company of which he is a CEO, just authorized the repurchase of an additional $1.9 billion in stock over the next three months, thereby assuring CEO Jamie of an even great profits on his recent acquisition.

From the release:

JPMorgan Chase & Co. (NYSE: JPM) (“JPMorgan Chase” or the “Firm”) today announced that the Firm’s Board of Directors has authorized the repurchase of up to an additional $1.88 billion of common equity through the end of the second quarter of 2016 as part of the Firm’s current equity repurchase program. This amount is in addition to the $6.4 billion of common equity authorized for repurchase by the Board last year. The Firm has received a non-objection from the Board of Governors of the Federal Reserve System to this increase in the amount of common equity that may be repurchased under the Firm’s 2015 capital plan.

The timing and exact amount of purchases of common equity by JPMorgan Chase under its equity repurchase program will depend on various factors, including market conditions, the Firm’s capital position, internal capital generation, alternative investment opportunities, and legal and regulatory considerations; the Firm’s repurchase program does not include specific price targets or timetables, and may be executed through open market purchases or privately negotiated transactions, including the use of Rule 10b5-1 programs, and may be suspended at any time.

And now the legal question: did Dimon have knowledge that JPMorgan would conduct this buyback just one month ago when he purchased JPM stock in the open market to make a “statement.” We doubt any regulators will ask this obvious question as even if he did, it will surely be chalked up to merely just another “tempest in a teacup.”

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP