– Great Depression Redux: First Currency War, Now US Unleashes Trade War With China:

Given the vicious downward spiral of competitive devaluation that is washing around the world’s economic bathtub, it appears – just as we saw during The Great Depression – that currency wars have given way to mal-investment-fueled protectionism as US launches the first missile in the trade wars with a massive 266% tariff on imports of cold-rolled steel. “There’ll be a short-term benefit,“ said John Packard of Steel Market Update. ”However, in the long run, the U.S. mills are always going to want more tariffs, and it’s questionable how much more [protection] they can get.”

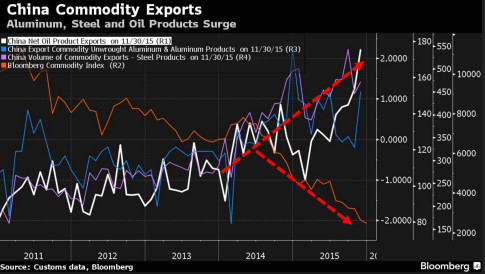

In December, we warned of China’s flooding the world with its unwanted commodities – all created and warehoused in the biggest credit-bubble-fueled mass mal-investment “boom” in human history…as Bloomberg notes, shipments of steel, oil products and aluminum are reaching for new highs, according to trade data from the General Administration of Customs.

That’s because mills, smelters and refiners are producing more than they need amid slowing domestic demand, and shipping the excess overseas.

The flood is compounding a worldwide surplus of commodities that’s driven returns from raw materials to the lowest since 1999, threatening producers from India to Pennsylvania and aggravating trade disputes. While companies such as India’s JSW Steel Ltd. decry cheap exports as unfair, China says the overcapacity is a global problem.

The flood of Chinese supplies is roiling manufacturers around the world and exacerbating trade frictions. The steel market is being overwhelmed with metal from China’s government-owned and state-supported producers, a collection of industry associations have said. The nine groups, including Eurofer and the American Iron and Steel Institute, said there is almost 700 million tons of excess capacity around the world, with the Asian nation contributing as much as 425 million tons.

Low-cost supply from China in Europe prompted producer ArcelorMittal to reduce its profit forecast and suspend its dividend. India’s government has signaled it’s planning more curbs on steel imports while regulators in the U.S. are planning to lift levies on shipments from some Chinese companies.

And then, as we explained, the dramatic over-production is exporting deflationary pressures all over the world, especially US Steel mills…

Logically, the less domestic demand for steel, and the greater China’s steel exports, the lower the price continues to tumble, now at a 10 year low.

That’s because mills, smelters and refiners are producing more than they need amid slowing domestic demand, and shipping the excess overseas.

The flood of Chinese supplies is roiling manufacturers around the world and exacerbating trade frictions. The steel market is being overwhelmed with metal from China’s government-owned and state-supported producers, a collection of industry associations have said. The nine groups, including Eurofer and the American Iron and Steel Institute, said there is almost 700 million tons of excess capacity around the world, with the Asian nation contributing as much as 425 million tons.

And now, as The Wall Street Journal reports, The Department of Commerce Tuesday imposed preliminary duties on imports of cold-rolled steel, used to make auto parts, appliances and shipping containers, from seven countries including China, whose steelmakers were slapped with a massive tariff.

The duties, set at 265.79% for Chinese steelmakers, will be imposed within the next week but must still be confirmed in a final determination scheduled for this summer. They are meant to punish dumping, or selling below cost. to improperly gain market share. Chinese officials have denied the practice.

After enduring one of their worst downturns ever, American steelmakers are now counting on tariff protection to help ride out a weak market. A slowdown in the steel-heavy oil-and-gas industries combined with a boom in Chinese exports has deflated steel prices around the world.

But can tariffs really save the American steel industry?

Analysts say trade protection will prop up prices, but can’t be expected to save beleaguered companies or improve market demand, especially in the oil and gas segment.

“There’ll be a short-term benefit,“ said John Packard of Steel Market Update. ”However, in the long run, the U.S. mills are always going to want more tariffs, and it’s questionable how much more [protection] they can get.” The U.S. already has anti-dumping duties in place on 19 categories of Chinese steel. And the U.S. needs some imports because U.S. demand—regularly over 110 million tons—is far higher than the U.S.’s annual production of around 80 million tons.

Although China is only the seventh biggest exporter of steel to the U.S., behind Canada, Brazil, Russia, Mexico, South Korea and Turkey, Chinese steelmakers have received the most attention because they have the ability to disrupt the U.S. market. Their prices tend to be 20% to 50% lower than anybody else’s, say steel traders. And because the volumes of its exports are so massive, Chinese steel is ending up everywhere. China last year exported more steel—100.4 million tons—than any other country except Japan produced.

Besides the fates of the individual companies, the tariff debate is landing in a campaign season where trade looms as a potentially major issue as we wonder what a President Trump will do… 1000% tariff?

Finally, as The Automatic Earth’s Raul Ilargi Meijer notes, there’s another side to this, one that not a soul talks about, and it has Washington, London and Brussels very worried. Here goes:

These large mining -including oil- corporations most often operate in regions in the world that are remote and located in countries with at best questionable governments (the corporations like it like that, it’s how they know who to bribe to be able to rape and pillage).

The corporations de facto form a large part of the US/UK/EU political/military control system of these areas. They work in tandem with the CIA, MI5, the US and UK military, to keep the areas ‘friendly’ to western industries and regime.

This has caused unimaginable misery across the globe, in for instance (a good example) the Congo, one of the world’s richest regions when it comes to minerals ‘we’ want, but one of the poorest areas on the planet. No coincidence there.

Untold millions have died as a result. ‘We’ have done a lot more damage there than we are presently doing in Syria, if you can imagine. And many more millions are forced to live out their lives in miserable circumstances on top of the world’s richest riches. But that will now change.

Thing is, with the major miners going belly up, ‘our’ control of these places will also fade. Because it’s all been about money all along, and the US won’t be able to afford the -political and military- control of these places if there are no profits to be made.

They’ll be sinkholes for military budgets, and those will be stretched already ‘protecting’ other places. The demise of commodities is a harbinger of a dramatically changing US position in the world. Washington will be forced to focus on protecting it own soil, and move away from expansionist policies.

Because it can’t afford those without the grotesque profits its corporations have squeezed out of the populations in these ‘forgotten’ lands. That’s going to change global politics a lot.

And it’s not as if China will step in. They can’t afford to take over a losing proposition; the Chinese economy is not only growing at a slower pace, it may well be actually shrinking. Beijing’s new reality is that imports and exports both are falling quite considerably (no matter the ‘official’ numbers), and the cost of a huge expansion into global mining territory makes little sense right now.

With the yuan now part of the IMF ‘basket‘m Beijing can no longer print at will. China must focus on what happens at home. So must the US. They have no choice. Other than going to war.

And, granted, given that choice, they all probably will. But the mining companies will still be mere shells of their former selves by then. There’s no profit left to be made.

This is not going to end well. Not for anybody. Other than the arms lobby. What it will do is change geopolitics forever, and a lot.

* * *

As we concluded, now that the US has fired the first trade war shot, it will be up to China to retaliate. It will do so either by further devaluing its currency or by reciprocating with its own protectionist measures against the US, or perhaps by accelerating the selling of US Treasurys. To be sure, it has several choices, clearly none of which are optimal from a game theory perspective, but now that the US has openly “defected” from the “prisoner’s dilemma” game, all bets are off.

Chinese steel? Why would I want it after seeing everything else from there and the quality? Of course we pay welfare to our workers, and that should be added directly to these imports.