– A 918 Point Stock Market Crash In Japan And Deutsche Bank Denies That It Is About To Collapse:

On Tuesday junk bonds continued to crash, the price of oil briefly dipped below 28 dollars a barrel, Deutsche Bank was forced to deny that it is on the verge of collapse, but the biggest news was what happened in Japan. The Nikkei was down a staggering 918 points, but that stock crash made very few headlines in the western world. If the Dow had crashed 918 points today, that would have been the largest single day point crash in all of U.S. history. So what just happened in Japan is a really big deal. The Nikkei is now down 23.1 percent from the peak of the market, and that places it solidly in bear market territory. Overall, a total of 16.5 trillion dollars of global stock market wealth has been wiped out since the middle of 2015. As I stated yesterday, this is what a global financial crisis looks like.

Just as we saw during the last financial crisis, the big banks are playing a starring role, and this is definitely true in Japan. Right now, Japanese banking stocks are absolutely imploding, and this is what drove much of the panic last night. The following numbers come from Wolf Richter…

- Mitsubishi UFJ Financial Group plunged 8.7%, down 47% from June 2015.

- Mizuho Financial Group plunged 6.2%, down 38% since June 2015.

- Sumitomo Mitsui plunged 6.2%, down 26% since May 2015

- Nomura plunged a juicy 9.1%, down 42% since June 2015

A lot of analysts have been very focused on the downturn in China in recent months, but I think that it is much more important to watch Japan right now.

I have become fully convinced that the Japanese financial system is going to play a central role in the initial stages of this new global financial meltdown, and so I encourage everyone to keep a close eye on the Nikkei every single night.

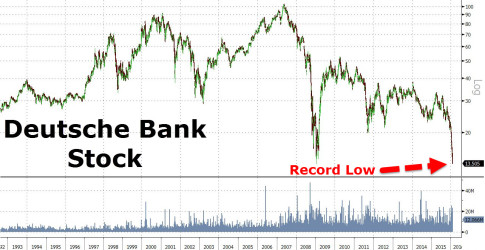

Meanwhile, the stock price of German banking giant Deutsche Bank crashed to a record low on Tuesday. If you will recall, Deutsche Bank reported a loss of 7.6 billion dollars in 2015, and I wrote quite a bit about their ongoing problems yesterday.

Things have gotten so bad that now Deutsche Bank has been forced to come out and publicly deny that they are in trouble…

Deutsche Bank co-CEO John Cryan moved to quell fears about the bank’s stability Tuesday with a surprise memo saying its balance sheet “remains absolutely rock-solid.”

The comments come as investors grow increasingly nervous about the health of European banks, which have taken a hit on the fall in energy prices and which face rising concerns over their cash levels.

Of course Lehman Brothers issued the same kind of denials just before they collapsed in 2008. Cryan’s comments did little to calm the markets, and even Jim Cramer saw right through them…

“You know, Deutsche Bank puts out a note saying, ‘listen, don’t worry, all good.’ Reminds me of JPMorgan saying if you have to say that you’re creditworthy then it’s already too late.”

Another thing that Lehman Brothers did just before they collapsed in 2008 was to lay off workers. We have seen a number of major banks do this lately, including Deutsche Bank…

Cryan, 55, has been seeking to boost capital buffers and profitability by cutting costs and eliminating thousands of jobs as volatile markets undermine revenue and outstanding regulatory probes raise the specter of fresh capital measures to help cover continued legal charges. The cost of protecting Deutsche Bank’s debt against default has more than doubled this year, while the shares have dropped about 42 percent.

The following chart comes from Zero Hedge. Nobody on the Internet does a better job with charts than Zero Hedge does. I would recommend visiting them right after you visit The Economic Collapse Blog each day (wink wink). This chart shows that Deutsche Bank stock has already fallen lower than it was during any point during the last financial crisis…

Deutsche Bank is the biggest and most important bank in the biggest and most important economy in the EU, and it has exposure to derivatives that is approximately 20 times Germany’s GDP.

If that doesn’t alarm you, I don’t know what will.

The biggest financial bubble in the history of the world has entered a terminal phase, and the parallels to the last financial crisis have become so apparent that just about anyone can see them at this point. Just consider some of the ominous warnings that we have seen recently…

Billionaire Carl Icahn, for example, recently raised a red flag on a national broadcast when he declared, “The public is walking into a trap again as they did in 2007.”

And the prophetic economist Andrew Smithers warns, “U.S. stocks are now about 80% overvalued.”

Smithers backs up his prediction using a ratio which proves that the only time in history stocks were this risky was 1929 and 1999. And we all know what happened next. Stocks fell by 89% and 50%, respectively.

Even the Royal Bank of Scotland says the markets are flashing stress alerts akin to the 2008 crisis. They told their clients to “Sell Everything” because “in a crowded hall, the exit doors are small.”

And let’s not forget that famous billionaire retail magnate Hugo Salinas Price has warned that the global economy “is going into a depression“.

The chaos that we have seen this week is simply a logical progression of the crisis that began during the second half of last year. If you were to create a checklist of all the things that you would expect to see during the initial stages of a new financial crisis, all of the boxes would be checked.

In the days ahead, keep your eyes on Germany and Japan.

Yes, the Italian banking system is completely collapsing right now, but I believe that what is happening in Germany is going to be the key to the meltdown of Europe, and I am convinced that Deutsche Bank is going to be the star of the show.

Meanwhile, don’t underestimate what is taking place in Japan.

The Japanese still have the third largest economy on the entire planet, and their financial system is essentially a Ponzi scheme built on top of a house of cards that has a rapidly aging population as the foundation.

As Japan falls, that will be a signal that financial Armageddon is now upon us.

And after last night, it appears that moment is a lot closer than a lot of us may have thought.

https://www.youtube.com/watch?v=fxWQbXt9A64