So much for exiting the market. According to Goldman’s estimates, China spent CNY600 billion propping up the stock market in the month of August alone. Meanwhile, MNI reports that in the wake of the yuan devaluation, SAFE began “‘urging’ [companies to] actively take measures to limit foreign exchange purchase for advance payment under imports… and postpone forex purchases.

– China Loses All Control, Spends 600 Billion Yuan On Plunge Protection In August, Tightens Capital Controls (ZeroHedge, Sep 8, 2015):

Back on July 20, Caijing reporter Wang Xiaolu suggested that China Securities Finance – the state-owned plunge protection vehicle – may be set to exit the market. That sent futures plunging and ultimately led to Mr. Wang’s arrest late last month. Under duress, Wang would later “admit” that he “shouldn’t have released a report with a major negative impact on the market at such a sensitive time.”

Of course Wang wasn’t the last person to speculate about how long China would be willing to spend billions propping up the market, and indeed it certainly seems as though Beijing tried to scale back the manipulation two weeks ago only to see the SHCOMP crash 8%, a move which promptly triggered a global rout of epic proportions. One additional 8% decline and a dual policy rate cut later, and CSF was back in the market desperately trying to arrest the inexorable slide ahead of Xi Jinping’s lavish military parade on September 3.

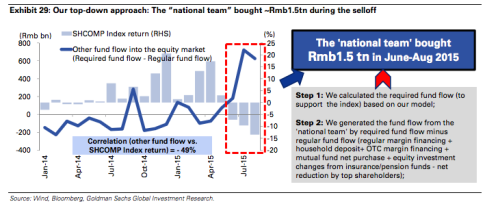

So in case anyone still harbored any doubts about the degree to which China most certainly has not wound down the plunge protection effort, Goldman has updated its analysis on the “national team’s” efforts on the way to concluding that China spent an additional CNY600 billion propping up the market in August.

Here’s Goldman:

In our note: China musings: How much has the government bought in the market? (Aug 5), we estimated potential government purchases in the stock market based on: (1) our top-down liquidity model; and (2) bottom-up analysis on fund flow changes in key investment channels based on public information released by relevant media sources. Our last estimate published in early Aug (based on July month-end data of 5 liquidity factors) was Rmb900bn, largely consistent with the July monetary data release which showed Rmb900bn of non-bank financial institutions lending and we suspect a majority of which went to China Securities Finance Corp (CSFC) which has been directly supporting the market during the correction. Using our top-down model and refreshing inputs based on Aug month-end data, we estimate that the “national team” has spent another Rmb600bn in August, raising the potential aggregate amount of buying to Rmb1.5tn, representing 3.5% and 9.2% of current total and free-float market cap.

And based on history (and probably also based on what we know about China’s unwillingness to relinquish control), the effort isn’t likely to end any time soon:

Overall, we reiterate our view that the lingering market concern over the Chinese government’s potential exit from its market support is probably overdone based on cross-country experiences, including the intervention from HKMA in Aug 1998 and the Quantitative Easing in the US since March 2008.

Speaking of futile attempts on the part of Beijing to manage expectations and get control of a potentially disastrous situation, MNI is out reporting that in the wake of the August 11 deval, SAFE began “urging” Chinese companies to “actively take measures to limit foreign exchange purchase for advance payment under imports… and postpone forex purchases.”

Although MNI does note that this represents more of a tightening of existing measures than it does the imposition of new capital controls, the writing on the wall is clear. That is, it’s all about capital controls at this point (as we tipped last week) as China desperately needs to stem the outward flow if it wants to limit costly interventions to stabilize the yuan, interventions which, as we learned on Monday, led directly to the liquidation of $94 billion in FX reserves during the month of August alone. “SAFE said the focus is outbound direct investment and remitting money overseas. It ordered branches and banks to check whether such investment is genuine, including the source of the money and where the money is being invested,” MNI adds.

As we said earlier this month, “while China is doing everything in its power to not give the impression that it is panicking, the truth is that it is one viral capital outflow report away from an outright scramble to enforce the most draconian capital controls in its history, which – as every Cypriot and Greek knows by now – is a self-defeating exercise and assures an ever accelerating decline in the currency, which authorities are trying to both keep stable while also devaluing at a pace of their choosing. Said pace never quite works out.”

And the same goes for the stock market. The more authorities have to intervene, the more readily apparent it becomes that the market can’t stand on its own which only serves to undermine investor confidence leading to more selling pressure, necessitating still more intervention, until finally, Beijing will either be a majority owner of every mainland listed company or else will simply halt the entire market until such a time as the Politburo believes people’s “malicious” propensity to sell has subsided.