– Citi Predicts Greek Hyperinflation Breaks Out In Two Years (ZeroHedge, July 21, 2015):

Earlier, we showed that according to Citigroup (among many) for Greece to have any hope of surviving, it needs a masive debt haircut: the bigger, the better, with Citi tossing out numbers as high as €130 billion. Still, even if Greece does get debt relief, as long as it remains in the Eurozone, its economy has nothing but hell to look forward to.

Here is how Citi previews the next few years:

From an economic and financial sector angle, the success or failure of a third programme will depend on i) the strength of a possible economic recovery in coming quarters, following an overhaul of the Greek banking system, and on ii) whether debt re-profiling discussions look likely and take place as envisaged. On the first item, the degree of fiscal austerity and outright reforms to be implemented in a short period of time is likely to result in a prolongation of economic recession in coming quarters. And we need to factor in the economic costs from the (very likely) persistence of stringent capital controls and the lack of liquidity in the economy. We recently updated our real GDP growth forecasts and now expect the Greek economy to contract by at least 2.4% YY in 2015 (compared with -0.2% YY projected in June), with the economy likely to remain in recession at least until Q1 2016. Such a poor performance in terms of economic activity would mean a higher risk that Greek economic and fiscal performance would undershoot its programme targets, which could likely challenge its membership in the Eurozone. In addition, debt re-profiling is likely to be deferred, conditional and tranched, and is unlikely to boost the government’s fiscal space for public spending increases or tax cuts. Failure by the Greek authorities to lift capital controls in a meaningful way and a further increase in unemployment (we forecast that the jobless rate will rise from 27% in 2015 to 29% in 2016) could also increase social tensions, in our view.

In the near term, the government probably will face a continued cash shortage, given the likelihood that bank liquidity will remain heavily restricted, that tax payments will be delayed (or not made), and that financing assistance will be kept to a minimum. As a result, we continue to see significant near term risks (before a third programme begins) that the government will have to slash spending further, accumulate further arrears and even – as a last resort – to issue scrip.

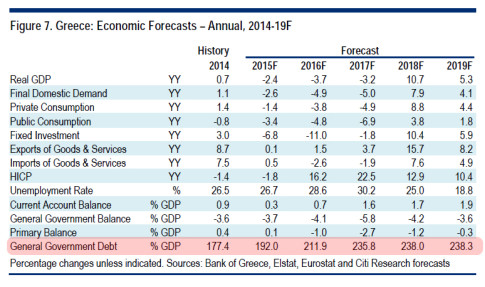

And while the one line item everyone traditionally looks for in every Greek economic forecast is what its debt will be now that reality is finally allowed to creep in, a number that Citi now expects to hit 238% by 2018 as highlighted in the row below…

… it was another number that caught our attention: Citi’s estimate for Greek HICP (inflation) in 2017.

- 22.5%

In other words, Citi predicts that by 2017 Greece will have hyperinflation even if it remains in the Eurozone.

But… but… the whole point of not reverting to Drachme was to have a “stable” currency and to avoid the country’s collapse into a hyperinflationary abyss.

It appears that what Tsipras has done is gotten the worst of all possible worlds: not only will Greece somehow have an imploding economy (with 30% unemployment) and hyperinflation, but it will also remain forever a vassal state of Germany, which will be able to purchase trophy Greek assets at even cheaper prices once the entire economy finally locks up permanently some time in the next two years.

But at least it will have the Euro.