– The ECB Suddenly Has A Huge Headache On Its Hands (ZeroHedge, June 28, 2015):

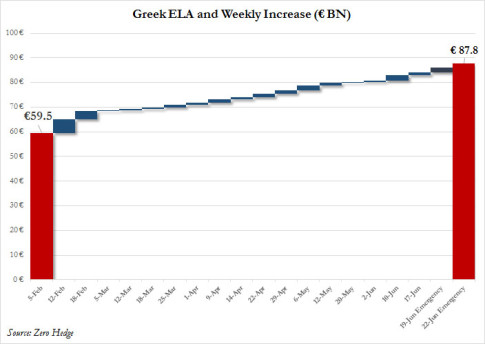

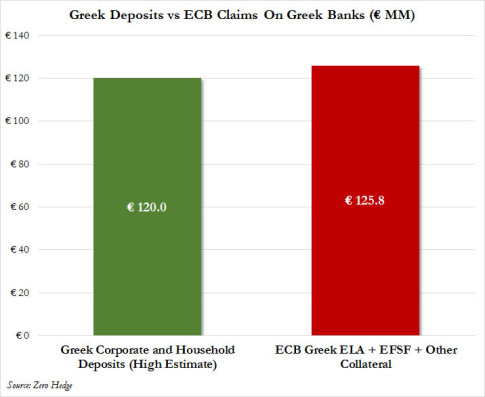

Last week we reported that as a result of the relentless surge in the Greek deposit flight, which may finally end tonight if, as now appears almost certain, the Greek government imposes capital controls, the ECB’s claims on the Greek banking system have now surpassed the total amount of Greek deposits…

… when one factors in some €38 billion in collateralized EFSF bonds and other collateral usage.

We previously explained that on the surface, this is terrible news for Greece as it implies that the moment the last linkage between the ECB and Greece is severed, Greek deposits will have to undergo a massive haircut as without ECB liquidity backstop funding the banks at ridiculously small haircuts on what is essentially worthless collateral, the Cyprus “Plan B” will be immediately imposed.

However, a quick glance at a different balance sheet reveals that a full-blown Grexit with all bridges burned between Greece and its former “irreversible monetary union” implies someone else may have an even greater headache on their hands. The balance sheet in question: that of the Eurosystem in general, and the ECB – which is the anchor behind the Eurosystem and the Eurozone’s official monetary authority – in particular.

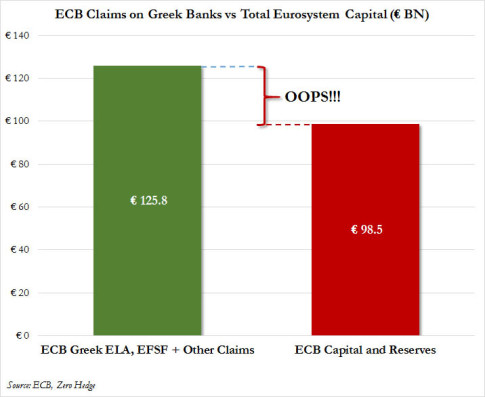

The chart below compares total ECB claims to Greek banks (excluding SMP purchases of Greek bonds) side by side with the latest total Capital and Reserves of the Eurosystem as of June 19.

Incidentally the chart above is why earlier today Varoufakis said that “if ECB were to stop support for the Greek banking system would mean that Europe has failed.” Because if indeed the ECB were to pull the carpet from under Greece as it hinted it would do on Tuesday when the Greek program runs out, when it froze the Greek ELA despite the ongoing Greek bank run, it would promptly set off a chain of events that would not only crush the Greek banking system but destroy any credibility Greek sovereign collateral had as a state, impairing all Greek national and corporate collateral, including bonds and loans currently held by the ECB, to zero.

It would also mean that as that €126 billion or so of total ECB/Eurosystem claims on Greek banks were “charged off” in case of a terminal Greek “event” then the entire ECB capital buffer would also be wiped out, leaving the ECB with negative equity. Translated: dear Eurosystem members: we need more cash.

And yes, while in theory the ECB can always print more money (and it will, in fact as we first showed Goldman’s entire play has been that the ECB wants a Greek default precisely so it can boost its QE, and print stocks to new highs), an event such as this may well crush what little confidence the ECB has left: if not so much with Germany, whose commercial banks are well capitalized, but with the rest of the periphery, leading to a slow at first, then quite dramatic bank run across Italy, Spain, Portugal, Ireland and so on, in other words all those countries who have yet to address their €2 trillion bad debt problem, which the ECB eagerly brushes under the rug with every single stress test.

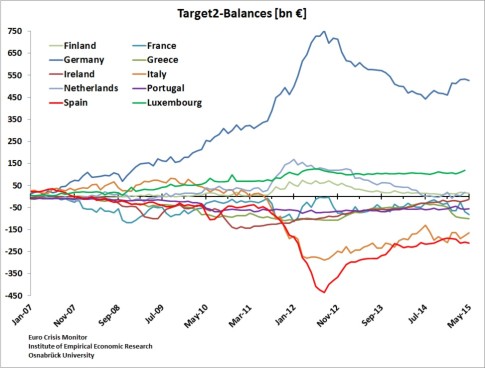

Finally, keep an eye on that old favorite, Europe’s TARGET2 balances: if indeed Greece is kicked out, watch as the imbalance promptly blows through all time high levels, and Germany is suddenly left on the hook for perpetuating an “irreversible” monetary system which just became very much reversible.

Germany, France, Italy and Spain hold over 98% of all Greek debt.

If Greece goes, it will be much more than a headache for the ECB, the entire Euro and US markets would be decimated.

Germany and France, like every other Euro nation has debt to GDP in excess of 100%. What that means is that every cent of income is already owed elsewhere. There is no chance of any growth in the real economy, especially when nations have well in excess of 100% as all of them do.

The Euro, just like the US is mired in debt. Does anyone else remember Spain and Italy nearly collapsed in the last 24 months? France has their difficulties & Germany in trying to get the Euro up, advanced lots of money, creating a load of debt for their nation.

If one looks at the markets, the major product is only debt…..it is insane. During the last boom years, standard business practice was to take $100 million and leverage it out to $100 billion, 1000:1 ratio.

After things got bad, and zero growth became the normal state of economic affairs for the US and Euro nations, a couple of years ago, they decided to leverage the leveraged funds…..I will let those of you who can do the math figure out the ratio of debt now……I give up when we hit quadrillions. What shocks me is that I can understand how much that is……..

If this were allowed to happen, (I doubt it, because Greece has the future of the Euro in their hands) the economic weakness in the four nations carrying 98% of all the Greek debt would be exposed. This would do more than weaken ECB credibility, it would destroy the so-called Strong Four who have underwritten Greek debt. If those four are the strongest, the Euro is on life support.

I have followed the Euro since its inception because it adopted Napoleon’s Continental system concept, the idea of a single currency for the continent. But, his would have been gold backed currency, and one government (his) running all. This fool idea of joining all these nations only removed their ability to control their own currency. Nothing behind any of these nations but words and paper. Switzerland had the sense to say no.

When the Euro was formed, each country applying for membership submitted their financials. Most of them practiced Enron Accounting, inflating their claims of income and value, while hiding their debt under different names. When the truth came out with Greece, Italy and Spain, ETC it was too late.

Greece knows the truth, and their PM is playing Chicken with the greedy guts. The results of a fallout would cause a huge economic crash, there is nothing behind the ECB or the lending nations but smoke and mirrors.

Hell, we’ve been chewing on the bone of Euro collapse for at least ten years, and all the eurocrat BANKSTERS have done in all that time is look after themselves while they plan their escape into Switzerland, while fudging the situation by kicking the ball down the road giving we sheeple the line that all is well.

Now we know the end is coming fast and anyone who has had confidence in the system should be thinking hard and start asking questions of their financial advisers.

The fist domino is falling, and the ECB, like a rabbit in headlights, haven’t a clue what to do.