– “Cornering The Earth” – How The Rothschilds “Controlled At Least One Third Of Global Wealth” Over 100 Years Ago (ZeroHedge, June 14, 2015):

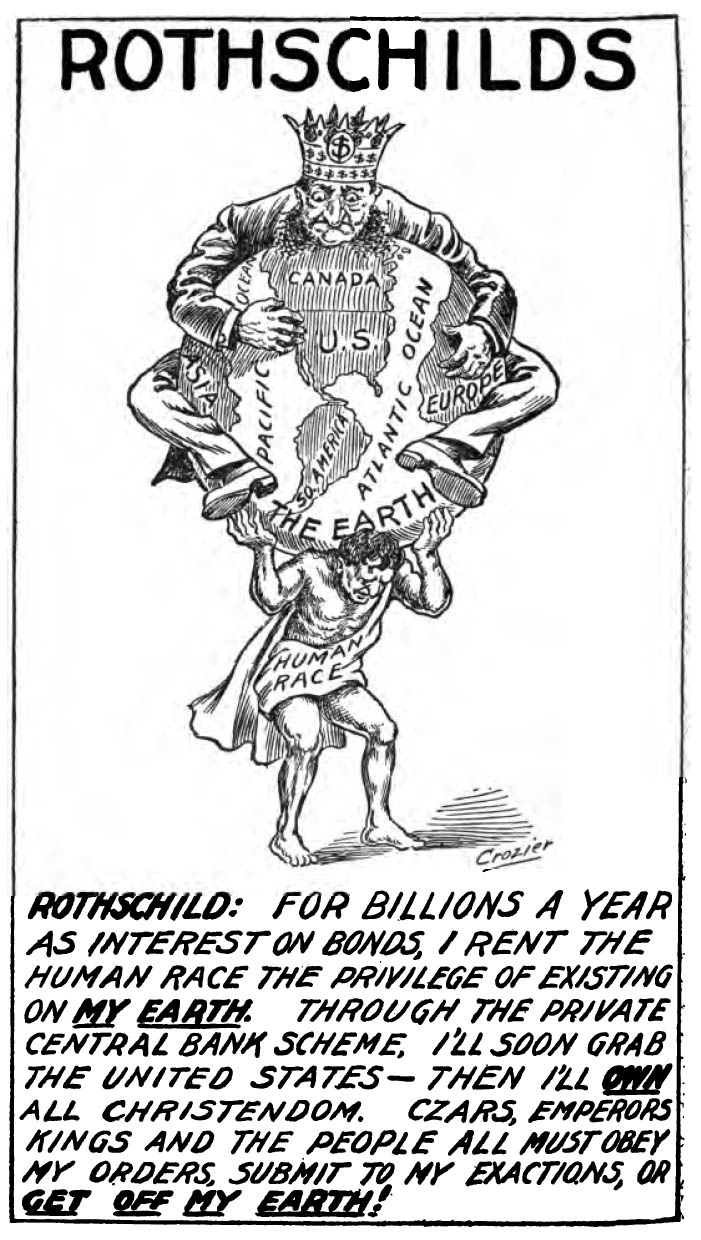

One week ago we presented the prophetic work of Alfred Owen Crozier who in 1912 penned “U.S. Money vs Corporation Currency” in which, together with 30 illustrations that captured Wall Street precisely as it would turn out some 103 later year, he explained why the the “Aldrich Plan” proposal, infamously crafted in secrecy by a small group of bankers and their bought politicians on Jekyll Island to establish a National Reserve Association, a money printing-predecessor to the Federal Reserve, would lead to untold pain, suffering ans war.

The Aldrich Plan was defeated only to bring the Federal Reserve Act of 1913, and the most deadly 30-year period of warfare in human history.

And while we urge everyone to read the Crozier’s book for its profound insight, and its painful reminder that even in the “New Normal” there is absolutely nothing new, as everything that has happened was foretold over a century ago, we wish to bring readers’ attention on one segment in the book.

A segment dealing with the Rothschild family.

Below are select excerpts of a text written precisely 103 years ago by Alfred Owen Crozier, in “U.S. Money vs Corporation Currency.”

* * *

[The Rothschild] descendants comprise the four great banking houses of that name in Europe—in London, Paris, Berlin and Vienna. In 1863 the wealth of this one family was conservatively estimated at $3,200,000,000, over three billions of dollars. This huge total compounded during the past fifty years and increased by incidental investments in mines, timber and many other things, may now amount to fifty or one hundred billions. No one outside knows the amount. With alliances controlled by this family it surely directly or indirectly controls a large portion of all government bonds and at least one-third of the world’s estimated total wealth of $377,000,000,000.

But suppose the Rothschilds themselves only own $39,000,000,000, an amount equal to the bonded debt of all the governments of the world, with an annual income of $2,300,000.000 or two-thirds what their total wealth was in 1863. Any change either way in these figures will be a variation only in degree. In no way does it materially change the acknowledged potent fact that in all great national and international monetary and financial affairs the Rothschilds always play the ruling hand. They possess masterful genius and financial intellect. But it is the sheer weight of liquid or ready wealth held in such large quantity that all the nations of the world must go to the Rothschilds for financial assistance in time of peace, or before they can go to war whatever the provocation or emergency, that gives them supreme power in the world’s affairs. No war can be waged without money, and no large nation can get adequate money to finance a war from anyone but the Rothschilds. Therefore it is reasonable to assume that whenever any war is begun the Rothschilds have consented thereto. They may finance both sides, because it is immaterial whether the interest profits they crave come from one or both countries. In fact the war furnishes an excuse recognized as legitimate for charging both nations higher interest rates not only on the new debts but on old obligations maturing and being refunded. Increase to 4 per cent from 3 per cent is a 25 per cent increase in the total income and in the value of bonds, measured by their earning power.

It is known, of course, that after the nations have fought for a while and murdered tens of thousands and wounded and permanently maimed hundreds of thousands of human beings on both sides, pressure exerted by other governments instigated by the financiers will force a quick compromise, leaving the nations both in approximately the same condition as before except that each has vastly increased its debt and the annual interest burden on its people while the financiers have gotten rid of accumulated capital in exchange for high interest gold bonds that can not be paid for perhaps thirty or fifty years. This surely is the result if not the deliberate plan.

Then again, the debt of the principal European countries has been doubled or vastly increased during the long period of “armed peace.”

Frequent rumors of war or warlike preparations each year have been ping-ponged back and forth between the countries in the public press. These have tended to excite popular fear, hate and patriotism and cause the people to consent and even to urge the governments to swell vastly the mortgage burden upon the peoples for funds to increase and equip still larger standing armies and to build greater and more expensive navies. By withdrawing millions of men. into armies and idleness it reduces production and the earning power of the people, increases the burden on those employed, and makes it more certain that existing bonds will not be paid but will be refunded and increased. Why not have bigger armies, navies, forts, guns, idleness of millions of soldiers, rumors of war or even occasional war, when such things are so fruitful, so necessary to cause the issuance of more bonds to provide profitable investment for the $5,000,000,000 of excess income derived yearly from interest paid on existing issues of gold bonds?

These conditions explain at least a substantial portion of the bonded debt and yearly interest of these countries.

Peaceful and quiet little Netherlands (the home of the dove of peace, the Hague) and Belgium together have a larger debt than the United States, although their aggregate wealth is but $13,000,000,000, as against $125,000,000,000 for this country. Belgium has 7,074,910 population and a debt of $93.77 per capita. Evidently they have been frightened into hopeless, permanent debt by the menacing actions of their neighbors towards each other. Poor exploited Congo, whose ignorant natives do not know a bond from a hole in the ground or interest and the gold standard from the milky way and the Aurora Borealis, has been given a hot dose of the “blessings of Christian civilization” by being saddled with a debt of $20,000,000 on which annually they must pay $1,260,306 interest profits to the exploiters. Unwelcome British rule has imposed upon India a yoke of mortgage debt 40 per cent larger than the total bonded debt of the United States.

Portugal with $2,500,000,000 wealth has a government debt of $864,561,212, or 35 per cent. No wonder it tired of royalty and sought relief as a republic. The tombs of Pharaohs of Egypt now groan under a public debt half that of the United States. China may be the next debt victim.

Is hopeless debt and perpetual interest slavery forever to be the price of Christian civilization and civil liberty?

Large portions of most of these vast bond issues are in the strong boxes of the Rothschilds. No doubt they are satisfied with their clever work in Europe, their manipulation of Governmental policies, their control of state and private finances through great private central banks dominated by them in the principal countries, and their mastery, through the purse, over kings, czars and emperors. They have seen the average government debt of European nations grow until it has become about equal to one-tenth of the entire wealth of those countries.

But they must be sorely disappointed and dissatisfied with the work and progress of their direct personal representatives in the United States. Here we have the richest and most substantial country, the best security, on the globe and the financiers have succeeded in keeping it in debt only about three-fourths of 1 per cent of its $125,000,000,000 of wealth. And worse than that, the Government has kept control of its monetary system and currency supply and so conducted its finances that most of the bonds bear only 2 per cent interest, or 40 to 60 per cent less interest annually than is paid by other governments that have turned monetary control over to the same private interests that buy and own the bonds issued by themselves for the Government to themselves for their individual profit.

Then no doubt they have been worried over another serious problem. Their financial ascendency and control over governments and maintenance of relatively high interest rates is possible only so long as they own or at least control all large loanable funds seeking such investments; only while there is no important competition.

The wonderful natural resources of the United States and the boundless energy of its people has greatly increased the liquid capital of the country. Hundreds of millions of American debts to European investors have been paid off or bought up by Americans. This has tended to increase the supply of idle capital in Europe. And now the United States has invaded Rothschild’s exclusive melon patch by bidding for large issues of the new or of refunding bonds of various governments. This is a serious situation. If this competition goes on it is certain to lower the rates of interest not only on new issues but ultimately on the entire 39 billion dollars of present bonds, to say nothing of state, county, city, district and corporation bonds. Genuine competition, such as the United States could furnish with the available investment capital it now commands or soon will have, might easily lower the average bond interest of other governments to the 2 per cent basis enjoyed by our Government. This would cut down by one-half the annual income of the owners of the fixed income or bond wealth of the world. They would lose thereby $2,500,000,000 annually. This in effect would be the equivalent of a direct shrinkage of so per cent in the value of the 39 billions of bonds, an immediate loss of nearly 20 billion dollars, for the value of bonds is measured by their rate of interest, the annual income they yield, their earning power.

And we now see the stealthy hand of these foreign bond-holders in one of the most clever and far-reaching schemes ever devised by the mind of man, driving American sentiment and politics rapidly toward the adoption of a plan that will instantly remove the one menace to the supremacy and profits of the Rothschilds, viz.: competition for bonds.

It is believed that the scheme now called “Aldrich plan” was originally conceived and worked out in Europe by the Rothschild interests, and that it was put out here or pushed by Jacob H. Schiff and Paul M. Warburg of the firm of Kuhn, Loeb & Co., said to represent here or do business with the Rothschilds of Europe. It is at least certain that Mr. Schiff of that firm was actively advocating a central bank as far back as 1906, when the New York Chamber of Commerce on October 4, 1906, officially adopted the plan after sending its representatives to Europe for several months to meet and personally discuss the matter with the big financiers of Europe.

The official records of the Chamber, printed elsewhere in this volume, show these facts.

Since then Mr. Warburg has been the most active of the Wall Street financiers in promoting the central bank or National Reserve Association plan by way of articles, speeches, conferences, and in persuading bankers and the American Bankers’ Association to join in promoting the scheme through Congress, and in thereafter participating in its benefits. He has been greatly aided from the outset by the Standard Oil interests, officials of the National Bank of Commerce and National City Bank of New York (Mr. Schiff being a director of both of these banks), and affiliated banks in that and other cities and by many of the powerful financiers of Wall Street. We show elsewhere conclusive documentary proof that the Aldrich plan is identical with what we could call the Rothschilds’ plan, but have named “New York Chamber of Commerce’s first plan,” adopted in 1906, except that the original plan at least made a pretense of Government control, while the Aldrich plan is strictly for a private corporation.

At the currency conference of the National Civic Federation in New York on December 16, 1907, Mr. Spyer presided, and Mr. Seligman introduced the prepared resolutions. Both are Hebrew Wall Street international bankers said to do business for or with the great financiers of Europe. August Belmont, who then was president of the National Civic Federation, is said also to represent or do business with the Rothschilds.

Jacob H. Schiff seems to have led the movement that has caused the abrogation of the commercial treaty with Russia. The action taken was right, for obedience to the provisions of all treaties must be enforced. But we wonder if the only object was to punish Russia for denying passports to a mere handful of American Jews?

Was there back of it in Europe a Rothschild scheme to embroil the two nations so that each would increase its bonded debt, sell more bonds, to be prepared for possible complications if not actual hostilities? [ZH: all this is written 2 years before World War I erupted]

Several attempts looking to a vast increase of the bonded debt of the United States have been made, other attempts will be made. But this Government should pay every dollar of its bonded debt and then stay out of debt. It would be a wholesome example to the world. It would show to all nations the advantages of self-government and human liberty.

With the Standard Oil, the Morgan and the Kuhn, Loeb & Co. groups linked by ties of mutual interest and profit with the Rothschilds and their affiliations abroad, there would be complete harmony and co-operation and practically no competition between America and Europe for big government loans. All danger of lowering interest rates has been removed and an effective plan adopted that will enable substantial increases from time to time in the bond interest rate the world over. There will be no adequate market for such bonds except with this international money combine. Truly, the United States proposes to become a “financial world power” by this merger, but it will be controlled from the other side because Europe, the Rothschilds, will furnish 90 per cent of the cash. Wall Street seems to be willing to play second fiddle and permanently sell out the interests of the United States and the welfare of all the people for the mere hope that by thus getting near the money throne of the Rothschilds some crumbs from their table will fall within the reach of our high financiers.

This Rothschild scheme if adopted will ultimately plunge the United States into the slavery of debt like the European nations. They do not want 2 per cent bonds. So it is proposed to increase the interest 30 to 50 per cent, make the rate 3 per cent, refund the present United States debt and make it payable in fifty years. That is the Aldrich plan, the provisions of the pending bill. Then it will be proposed to so change the tariff and increase expenditures that each year will show a deficit that can be converted into long time bonds. No doubt it is expected that in time the mort-gage debt of this country will be increased to $2,000,000,000, or even more, which with interest at 3 per cent instead of 2 per cent would- be the equivalent of a bonded debt of $3,000,000,000 so far as the yearly interest burden is concerned.

The only way the human race can get the benefit, or its due because of the rapid increase of the world’s wealth, is to have free and unrestricted competition for loans maintained, so that as wealth increases the rate of interest will decrease.

A billion of public currency now is to be taken away from the Government and given outright and free to a private corporation owned by the banks, and ultimately the National Reserve Association is to control the entire three billions of money heretofore issued by the United States Government. The association will gather up the United States money, hold it as a “reserve” and issue thereon two or three times its amount in corporation currency. Then by contraction and expansion of the money supply it will rule every bank and manipulate the supply of $20,000,000,000 of business credit and all prices and dominate everything in America for the profit of the world-wide money trust of which the National Reserve Association will be the American branch. This is the game, the program. If it succeeds the republic and all its people will find themselves permanently enslaved by the bondage of debt, chained helplessly to a system that takes everything and gives nothing, the victims of a soulless and sordid conspiracy that is moral if not legal treason against the welfare and perhaps the life of the nation.

* * *

A few notes:

- As noted previously, this text was written in 1912.

- The Aldrich Plan in its proposed form was rejected, only for the bankers behind it to refine it and present it as the Federal Reserve Act which subsequently passed in 1913, months before the start of World War I. The premise behind the Act was that the US nation, and not commercial banks, that decides the fate of US money. As the events of 2008 showed, this is completely false, and the US Federal Reserve is nothing more than the US Central Bank, working on behalf – and printing at the bidding – of a few major banks.

- The Rothschild name is far less prominent these days; instead the family which has kept a very low profile since the two world wars, has remained active in determining policy through the control of financial interests in the prominent commercial banks of the day, either in Europe, the US or, most recently, Asia.

- Contrary to 1912, US debt is no longer paltry, in fact quite the opposite. Depending on one’s definition of debt, total US debt is anywhere between 100% of GDP to many times that if one accounts for underfunded entitlements and public sector liabilities.

- Unlike in 1912 when the rate of interest on debt is what mattered, under a ZIRP and then NIRP regime, the mere issuance of debt is what is critical now that virtually zero-cost debt is the functional equivalent of preferred (or even common) equity. Upon an event of default, the transfer of equity ownership falls in the hands of the debt holder which means the last decade has been nothing but a preparation for the biggest debt for equity exchange in the history of the human race, with the new equity holders of virtually all global assets set to be a select group of financial oligarchs.

- The enslavement through debt bondage of the American people turned out just as the author had predicted.

* * *

“Let us control the money of a nation, and we care not who makes its laws”

– the maxim of the house of Rothschild and is the foundation principle of European banks (source).