“When a country embarks on deficit financing and inflationism (=quantitative easing) you wipe out the middle class and wealth is transferred from the middle class and the poor to the rich.”

– Ron Paul

Quantitative easing = printing money = creating money out of thin air = increasing the money supply = inflation = hidden tax on monetary assets = theft!!!

“By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.”

– John Maynard Keynes“In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. … This is the shabby secret of the welfare statists’ tirades against gold. Deficit spending is simply a scheme for the confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists’ antagonism toward the gold standard.”

– Alan Greenspan

– Oops! Philly Fed Admits QE widens inequality (Not Quant, June 10, 2015):

Once again, the Federal Reserve proves that it’s the last one to know everything that we knew already. Today’s stunning announcement: The Philadelphia Fed admits they (“may have”) made the wealthy wealthier and Main Street poorer.

Oops. Sorry America.

The Philly Fed insists that “redistributing wealth” to the wealthy isn’t the main idea, but just a potential side effect of stimulus that they can’t do much about.

“Monetary policy currently implemented by the Federal Reserve and other major central banks is not intended to benefit one segment of the population at the expense of another by redistributing income and wealth,” …

“However, it is probably impossible to avoid the redistributive consequences of monetary policy”.

We’re shocked. Shocked, we tell you. It turns out that handing out free money, buying worthless assets at face value and allowing a small cabal of private banks the sole right to access your magic free-money window, “may” have given some financial advantages to “one segment of the population”. But that’s just a side effect of saving the “economy”.

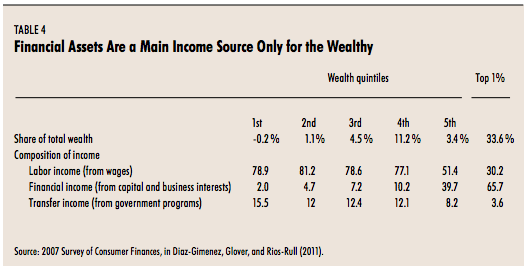

Of course, it’s not just the bankers. The 1% also happen to hold vastly more financial assets than the lower 99% — so they may directly benefit from financial asset-inflating monetary policy.

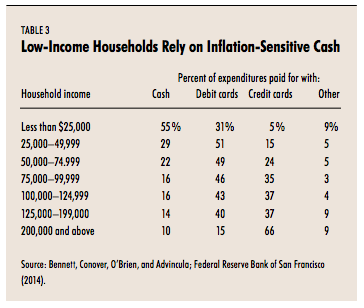

And low income households which live paycheck-to-paycheck are far more exposed to “inflation-sensitive cash”.

It’s great to see the Federal Reserve finally state this possibility publicly, unfortunately it doesn’t mean they’re about to change their minds. In the eyes of the Fed, the ends justify the means. If society as a whole is “better off” then it’s apparently “okay” that the poor are poorer and the rich are richer:

It might be also true that the gain to society’s well-being from stabilizing the overall economy is greater than the loss coming from associated redistributive effects, in which case we could safely focus on the overall effects and ignore the redistributive effects.

How convenient: Focus on the winners, not the losers. Or something like that.

But the rose-colored glasses have only just been donned:

One could also argue that, in the long run, the redistributive consequences of monetary policy might average out. In other words, if the same type of households that tend to gain from monetary policy during economic expansions also tend to lose from monetary policy during recessions, then over time the average effect could be a wash.

Got that? The Fed is suggesting that while the rich “may” get richer during boom times, recessions equalize wealth inequality. So in a perfect world it might all even out.

First, let’s take a moment to note that the Fed just admitted that deflationary forces are wealth equalizers and inflationary forces benefit the rich. That’s noteworthy.

But let’s also note that the Fed’s money printing creates endless artificial booms, and limits recessions. Ergo, the Fed reduces the possibility of equalization and creates a continuous money transfer mechanism from poor to rich – as they note:

…There is a good chance that the redistributive effects do not average out because business cycles are known to be asymmetric —expansions tend to be long and moderate, while recessions tend to be short and sharp.

Exactly. And why are recessions so short? Recessions “tend to be short and sharp” because the entire modus operandi of Federal Reserve policy is to shorten recessions and lengthen expansions.

In other words, the Fed is admitting that it’s core policy thesis which is inherently inflationary makes the rich richer and the middle-class poorer.

But as long as the “economy” is doing better, it’s all good. Right?