From the article:

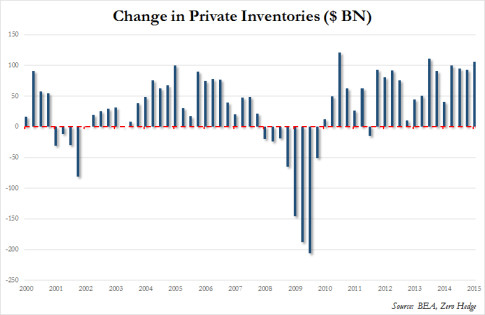

What is disturbing is that as noted before, inventories contributed the biggest component of Q1 GDP growth, adding $106 billion in nominal “growth.” Without that contribution, annualized GDP would have been worse than -3%!

…

In short: welcome to the recession, which however will soon be double seasonally adjusted into another flourishing, of only stiatistically, “recovery.”

– “Welcome To The Contraction”: Q1 GDP Drops By 0.7%, Corporate Profits Crash (ZeroHedge, May 29, 2015):

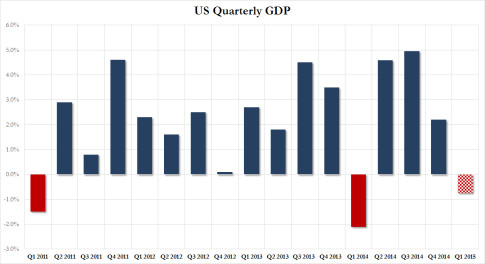

And you thought the preliminary 0.2% Q1 GDP print from last month was bad. Moments ago, just as we warned, the BEA released its latest, first, revision of Q1 GDP (pre second-seasonal adjustments of course), and we just got confirmation that for the third time in the past four years, the US economy suffered a quarterly contraction, with the Q1 GDP revised drastically from a 0.2% growth to a drop of -0.7%: the worst print since snow struck, so very unexpectedly, last winter.

Incidentally, there has not been a US “expansion” with three negative quarters in it in the past 60 years.

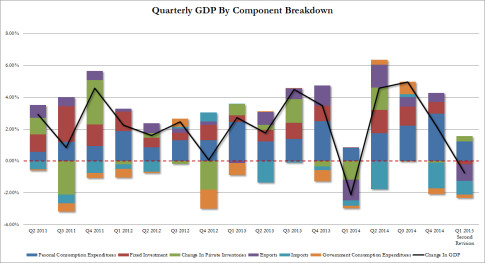

Worse, the breakdown shows that far from being a non-core slowdown, consumption rose just 1.8%, below the 2.0% expected, and contributed just 1.23% of the bottom line GDP number. This was the worst Personal Spending contribution since Q1 of last year, when revised GDP dropped by -2.11%.

What is disturbing is that as noted before, inventories contributed the biggest component of Q1 GDP growth, adding $106 billion in nominal “growth.” Without that contribution, annualized GDP would have been worse than -3%!

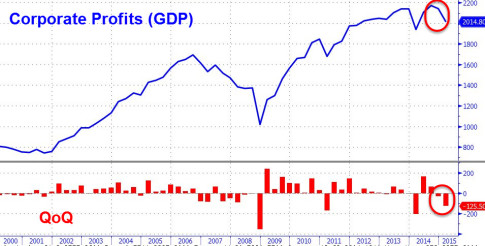

And worst of all, was the plunge in corporate profits. According to the report:

Profits from current production (corporate profits with inventory valuation adjustment (IVA) and

capital consumption adjustment (CCAdj)) decreased $125.5 billion in the first quarter, compared with a

decrease of $30.4 billion in the fourth.Profits of domestic financial corporations decreased $2.6 billion in the first quarter, compared with a decrease of $12.5 billion in the fourth. Profits of domestic nonfinancial corporations decreased $100.4 billion, in contrast to an increase of $18.1 billion. The rest-of-the-world component of profits decreased $22.4 billion, compared with a decrease of $36.1 billion. This measure is calculated as the difference between receipts from the rest of the world and payments to the rest of the world. In the first quarter, receipts decreased $28.9 billion, and payments decreased $6.5 billion

Or visually, here was the third largest corporate profit crash since the financial crisis:

In short: welcome to the recession, which however will soon be double seasonally adjusted into another flourishing, of only stiatistically, “recovery.”

We have been in recession/depression since before the 2008 crash.

Anyone in business knows that.

We try to survive the obvious but it is increasingly difficult.

Sales are down, profits decimated, future investment jeopardised.

We’ve been there four times since WWll, but never as long term as this.

All we have now is existence, and we’ll have to wait & see.

Friend Stanley:

You are correct this recession (depression) started before 2008. The real crash, where my family lost much of its fortune was in 2001-02. That was the real crash.

They covered it up with a real estate bubble, and we invested in properties to regain our losses. By the time we thought we were out of the woods, the second bubble broke…………and most of us (except for a couple who stole) lost our shirts.

This has been going on for over 15 years…………and it is far worse than anything we have seen in the era of modern economics. In the Crash of 1929, our currency was still backed with gold, we were still the largest lending nation in the world, and we started a number of infrastructure projects to put America back to work. WW 2 came along and finished the job for us.

Today, it is the opposite. We no longer lend money, we borrow it. 10% of our national debt is held by foreign nations, the other 90% is underwritten by the taxpayer protecting the TBTF banks and other outright crooks. This money can never be repaid……………

We are sinking like a stone, the entire western economy with us…………….

I see no return to the great wealth we used to enjoy………………

Our economy, and our republic have been hijacked by the Vandals Within, as Lincoln called them. Lincoln said we would not be destroyed by invading armies, but by the Vandals Within. Truer words were never spoken.