– The ECB Is Considering A Parallel Greek Currency (ZeroHedge, April 17, 2015):

As we first reported yesterday, one of the proposed measures to be implemented in Greece just before, or during its default and/or exit from the Eurozone, in addition to pervasive capital controls of course, is the implementation of a parallel “currency”, or as explained yesterday, a government paying its citizens with IOUs.

This is what we said less than 24 hours ago:

Greece might resort to IOUs and/or capital controls to avoid a disorderly default and keep the banks afloat for now. But such measures would offer a temporary solution at best and could be the first steps towards a euro-zone exit.

Assuming that a deal is not reached next week, there are a couple of routes that the Greek Government might take to avert disaster in the short term. First, it could issue IOUs to pay public sector workers and pensioners and free up money to repay its debts. But this could cause economic chaos if fears that the IOUs would never be paid sparked riots or public sector employees simply refused to work.

Even if Greek people accepted IOUs, they could only function for a very short period. Before long, those receiving incomes in IOUs could only afford to pay their taxes through the same medium. And given that the Government’s international creditors would not accept IOUs as repayment, this would still lead to a debt default. Effectively, the IOUs would become a parallel currency whose value was deemed lower than that of a normal euro. This would be akin to a euro-zone exit.

Today, to our dismay, we find that the ECB has not only considered a “parallel currency” alternative but for Greece this may be a reality before long. According to Reuters, the ECB “has analyzed a scenario in which Greece runs out of money and starts paying civil servants with IOUs, creating a virtual second currency within the euro bloc, people with knowledge of the exercise told Reuters.”

“The fact is we are not seeing any progress… So we have to look at these scenarios,” said one person with knowledge of the matter.

A spokesman for the ECB said it “does not engage in speculation about how specific scenarios regarding Greece could unfold.”

One Greek government official, who declined to be named, said there was no need to examine such a scenario because Athens was optimistic it would reach a deal with its international lenders by the end of the month.

Not surprisingly, “experts at the ECB have concluded that using IOUs to pay public sector wages would probably fail to avert a full-blown crisis and could even threaten Greece’s future in the 19-country euro zone.”

This is precisely what we warned about yesterday when we further noted that “Greece is already issuing the rough equivalent of those in the form of Greek T-bills which are sitting on the books of the very same Greek banks which, in the event the IOU solution is pursued, will be besieged by the very same citizens to whom the IOUs are issued.”

What is most surprising is how eager the ECB is to instill a banking sector panic and a self-fulfilling prophecy of a terminal bank run. In fact, as we noted first back in February, based on the rhetoric out of the Eurozone the eurocrats are practically desperate to crush the Greek financial system (perhaps in order to teach the Syriza government a lesson) where it is a miracle there are still any deposits left.

What is disturbing is the lack of vision on behalf of the ECB about what will surely happen to every peripheral European country’s deposits once it is revealed that what was, according to Draghi, an “unbreakable” union is quite fragile and where the safety of one’s lifetime savings is entirely contingent on not electing a government which the Troika deems unworthy.

Back to the ECB and its calculations:

Those officials believe that up to 30 percent of Greeks would end up receiving such government IOUs rather than payment in euros, which would only put further pressure on Greek banks because those workers were likely then to plunder their savings.

The banks would then be forced to tap increasing amounts of emergency liquidity funding or boost their capital base.

But the banks could not use the IOUs as security for drawing down the emergency credit because the ECB would not accept them.

“The IOUs, I just don’t think it can work,” said the first person who spoke to Reuters. “That could effectively be it, they would be out (of the euro).”

Those fears were voiced by others familiar with ECB thinking.

“With a parallel currency … you are getting to something so tailored that you are almost in Grexit,” said a second person. “It is something that is outside the institutional set-up.“

Perhaps the only question at this point is whether Bloomberg (which today showed beyond a reasonable doubt it is as systematically important as any financial institution when 2 hours of downtime led to a worldwide panic), will show the XGD first…

or the XIOU?

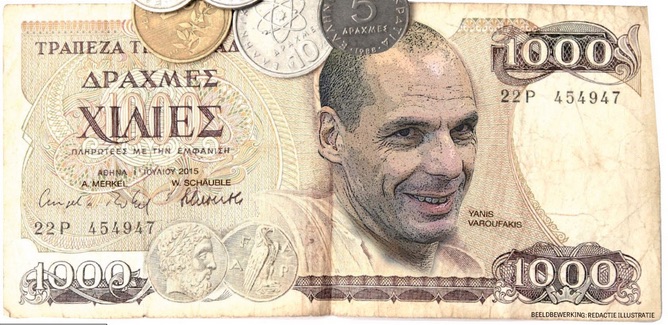

In any event, it is only a matter of time before the Drachma, which may or may not look as rendered below, is now officially back.