– It Will Now Cost You 0.75% To Save Money In Denmark: Danish Central Bank Cuts Rates For FOURTH Time In Three Weeks (ZeroHedge, Feb 5, 2015):

It has become a weekly thing now. In its desperation to preserve the EURDKK peg, the Danish central banks has cut rates into negative, then cut them again, then again last week, and moments ago, just cut its deposit rate to negative one more time, pushing NIRP from -0.5% to -0.75%, its fourth “surprise” rate cut in the past 3 weeks!

From the press release:

Effective from 6 February 2015, Danmarks Nationalbank’s interest rate on certificates of deposit is reduced by 0.25 percentage points to -0.75 per cent. The lending rate, the discount rate and the current account rate remain unchanged at 0.05 per cent, 0.0 per cent and 0.0 per cent, respectively.

The interest rate reduction follows Danmarks Nationalbank’s purchase of foreign exchange in the market.

Following the decision by the Swiss National Bank to discontinue the minimum exchange rate and the decision by the European Central Bank to launch an expanded asset purchase programme, there has been a considerable inflow of foreign currency.

The traditional monetary policy instruments of the fixed exchange rate policy are interventions in the foreign exchange market and influencing the interest rate spread relative to the euro area. Danmarks Nationalbank’s interventions in the foreign exchange market amounted to kr. 106.3 billion in January and the rate on certificates of deposit has been lowered several times. Additionally, the Ministry of Finance has decided to suspend the issuance of domestic and foreign bonds until further notice, based upon the recommendation of Danmarks Nationalbank. These measures have been taken with the intention to inhibit the inflow of foreign exchange.

“The fixed exchange rate policy is an indispensable element of economic policy in Denmark – and has been so since 1982. Danmarks Nationalbank has the necessary instruments to defend the fixed exchange rate policy for as long as it takes”, says Lars Rohde.

Lars Rohde continues: “There is no upper limit to the size of the foreign exchange reserve. The sole purpose of the monetary policy instruments is maintaining a stable krone exchange rate against the euro. The revenue of Danmarks Nationalbank is positively affected by the increase of the foreign exchange reserves.”

And all this even after Denmark launched bizarro QE when instead of adding to Treasury demand, Denmark decided to boost prices of long-dated bonds by cutting all supply indefinitely. Looks like that strategy failed less than a week after its launch.

The good news is that all those who still haven’t gotten the epic deal of getting paid to take out a Danish mortgage, are one step closer. And the other news is that with every passing rate cut, Denmark essentially admits it is one step closer to pulling an SNB, facing reality and admitting it can no longer peg to the EUR.

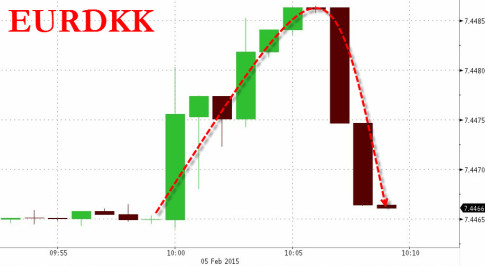

The kneejerk reaction in the EURDKK is higher…

… but we doubt it will last more than a few minutes.

Update (30 seconds later)

It wasn’t “a few minutes” – it was “seconds.”