What health?

– The Health Of This Market Is Fading Fast (ZeroHedge, Feb 3, 2015):

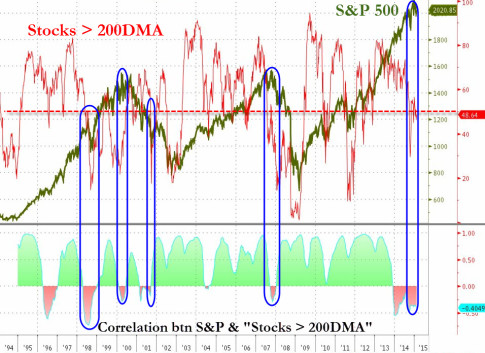

Less than 50% of stocks are trading below their 200-day-moving-average and the correlation between the S&P 500 and its internals is remarkably negative. The last 4 times this ‘setup’ has occurred in the last 20 years, the broad equity market indices eventually gave up the divergence (including 2000’s market top and 2007’s market top). Simply put – the health of the market is fading fast…

The Blue ovals show periods when less than 50% of stocks traded above their 200DMA and internals were anti-correlated (52-week rolling) with equity exuberance. In each case things did not end well…

Any market that gyrates a trillion dollars a week is close to collapse. The crooked games are obvious to anyone with sense.