– Brazil’s Economy Is On The Verge Of Total Collapse (ZeroHedge, Jan 30, 2015):

Back when the BRICs were the source of marginal global growth, the punditry couldn’t stop praising them. However, in the past year, now that China’s housing bubble has burst and its shadow banking system has imploded, those who remember what BRIC actually stood for are about as rare as those who recall what it means for the Fed to hike rates. Which is precisely why nobody in the mainstream financial media has commented on the absolutely abysmal economic update reported earlier today out Brazil.

We are happy to do so because today’s data follows up quite well to our article from a month ago “Brazil’s Economy Just Imploded” and as the earlier article on the crashing Brazilian Real hinted, things for the Brazilian economy how gone from imploding to, well, worse because not only did the twin fiscal and current account deficits rise even more, hitting a whopping 11% of GDP – the worst since August 1999, but its government debt soared to 63.4% in 2014, up from 56.7% a year ago, and the highest since at least 2006. In short – the entire economy is now on the verge of total collapse.

This is what happened in a few bullet points:

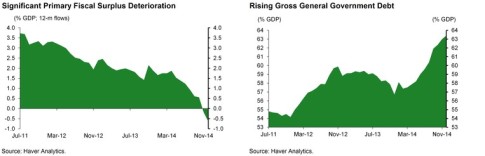

- The fiscal picture has deteriorated very sharply since 2011 at both the flow (fiscal deficit) and stock (gross public debt) levels. The primary and overall nominal fiscal surpluses at year-end 2014 were at levels last seen in the late 1990s.

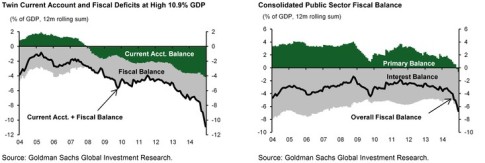

- The steady decline of the public sector savings rate is leading to a wider current account deficit despite weaker growth and low investment. In fact, the twin fiscal and current account deficits are now tracking at a combined, very troublesome 10.9% of GDP, the worst picture in 15 years (since August 1999). Repairing the severely unbalanced macro picture would require a deep, structural and permanent fiscal and quasi-fiscal adjustment and a significantly weaker BRL.

- The new economic team faces, among other things, the very significant challenge of repairing the severely deteriorated fiscal picture.

- The steady erosion of the fiscal stance pushed net and gross public debt up. Furthermore, fiscal and quasi-fiscal activism undermined the effectiveness of monetary policy, contributed to keep inflation very high and drove the current account deficit to a very high level despite weak growth.

More details from Goldman:

The overall public sector fiscal deficit widened to a very high 6.7% of GDP (from 3.25% of GDP in 2013 and the highest fiscal deficit since August 1999) given the very high 6.1% of GDP net interest bill and steady erosion of the primary fiscal surplus. Given the BRL depreciation during the month, the interest on the stock of Dollar swaps issued by the central bank reached R$17.0bn (adding to the R$8.7bn accrued in November).

Gross general government debt rose to 63.4% of GDP in 2014, up from 56.7% of GDP in 2013 and 53.4% of GDP in 2010 (the highest level since at least 2006).

The consolidated public sector posted a very large and worse-than-expected R$12.9bn deficit in December, driven by the unexpectedly large R$11.3bn deficit recorded by the States and Municipalities. The state-owned enterprises also posted a large deficit in December: R$2.3bn surplus.

Overall, the consolidated public sector posted a 0.63% of GDP primary deficit in 2014, down from surpluses of 1.9% of GDP in 2013, and 2.4% of GDP in 2012. This is the worst fiscal outturn in 16 years (since November 1998) and very significantly below the 1.9% of GDP primary surplus promised by former Finance Minister Mantega. The erosion of the primary surplus in recent years was driven chiefly by the weak fiscal numbers of the Central Government, whose primary balance declined from 1.55% of GDP in 2013, to a deficit of 0.40% of GDP in 2014.

However, the primary surplus of subnational government (States and Municipalities) has also been eroding, a reflection of the authorizations given by the Treasury since 2011 for increased borrowing by the States. For instance, the States and Municipalities posted a 0.15% of GDP deficit in 2014, down from 0.80% of GDP surplus in 2011.

In charts:

And the key numbers:

- The Consolidated Public Sector (CPS) posted a significantly worse-than-expected R$12.9bn primary deficit in December, driven by local governments and state-owned enterprises. The Central Government posted a R$755mn surplus but the States and Municipalities recorded a very large R$11.3bn deficit and the state-owned companies an also large R$2.3bn deficit.

- Overall, the primary balance of the CPS worsened to a 0.63% of GDP deficit in 2014 from a 1.9% of GDP surplus in 2012 and 2.4% of GDP surplus in 2012.

- The overall fiscal deficit (primary surplus minus interest payments) deteriorated further: to a very high 6.7% of GDP given the large 6.1% of GDP net interest bill. This is the largest overall fiscal deficit since August 1999.

- Net public debt worsened to 36.7% of GDP in 2014, up from 33.6% in 2013. Gross general government debt rose to a high 63.4% of GDP in December, up from 56.7% of GDP in 2013.

Good luck Brazil.