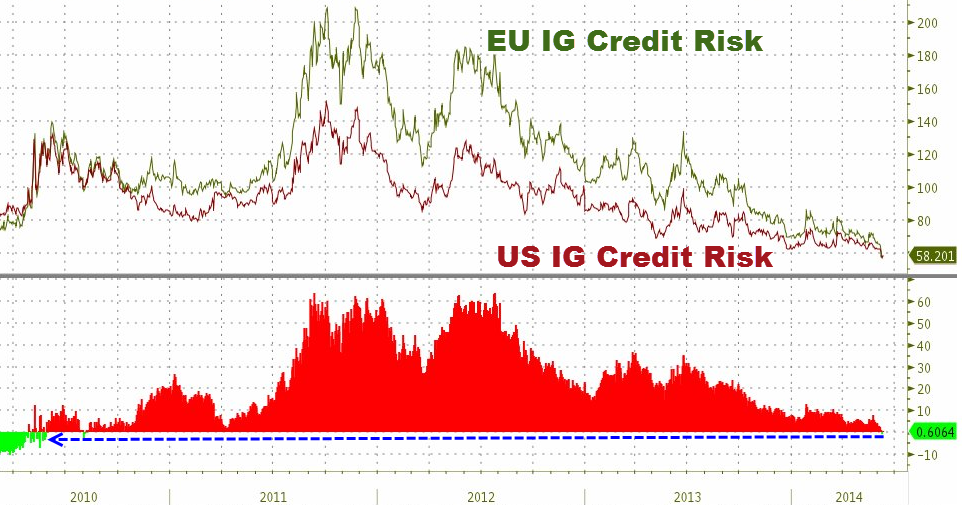

– US Riskier Than Europe For First Time Since 2010; BofA Admits ‘Good News Is Bad News’ (ZeroHedge, June 10, 2014):

For the first time since early 2010, the risk of European investment grade credit is lower than that of the US. As BofA notes, recall that the European sovereign crisis escalated in the first part of 2010, as Greece had to be bailed out for the first time, and concerns spread to other countries in the periphery. However, that European spreads have now recovered – after trading at times more than 60bps weaker than US spreads – reflects more on differential technicals (flows) than fundamentals (reality). Credit spreads are currently driven mainly by technicals; this is not to say that technicals in the US credit market are not strong – they are – only that European technicals are stronger. Furthermore, with now completely divergent central banks, BofAML believes that European technicals are going to remain stronger for longer. As they conclude, “relatively stronger US fundamentals lead to relatively weaker technicals,” – or put another way “good news is bad news” for US credit markets…

Furthermore, with now completely divergent central banks, BofAML believes that European technicals are going to remain stronger for longer. As they conclude, “relatively stronger US fundamentals lead to relatively weaker technicals,” – or put another way “good news is bad news” for US credit markets…

Sick.