– Ukraine Has Only 4 Months Of Gas Stocks Without Russia (ZeroHedge, March 3, 2014):

Having explained the Ukraine “situation” in one map, it appears the inter-connectedness of Ukraine and Russia is becoming any increasingly problematic part of the current crisis. As Reuters reports, absent Russian gas, Ukraine’s natural gas stocks can meet just 4 months of demand. The modest silver-lining is that the stocks are generally in the west of the country (away from potential Russian intervention) but it bears noting that Ukraine meets around half its gas demand through Russian imports (and Russia has cut supplies in the past). The situatio is not just energy though as Bloomberg notes, that Ukraine relies on Russia for about 30 percent of its global trade activity, compared with Russia’s 6 percent dependency on Ukraine.

Sadly, everything you need to know about the crisis in Ukraine in one worrisome map which summarizes all the relevant “red lines.”

To prepare for a potential disruption, Ukraine’s gas transit monopoly Ukrtransgas has been increasing its gas imports from Russia in recent days, increasing its stocks which now stand at four months worth of supplies, several industry sources said.

Of Ukraine’s 33 billion cubic metres (bcm) storage capacity, Gas Infrastructure Europe (GiE) data shows that around 80 percent is in its far west, so even in the case of a Russian intervention in Ukraine’s predominantly Russian east, most storage assets would likely remain safe from seizure.

Analysts also say that a continuation of gas supplies was in the interest of all parties.

“Until a real war, I think that all sides (Russia, Europe and all parties in Ukraine) have a vested interest in flowing gas from Russia to Europe,” said Thierry Bros, senior gas analyst at French bank Societe General.

“Russia needs the money from gas sales, Europe is 26 percent dependant on Russia for its gas consumption, and Ukraine need the money from the transit fees,” he added.

Ukraine’s Reliance on Russia goes far beyond just energy…

A conflict between Russia and Ukraine would have a more substantial impact on Ukraine in terms of trade dependency. Trade-flow data show that Ukraine relies on Russia for about 30 percent of its global trade activity, compared with Russia’s 6 percent dependency on Ukraine. The European Union overtook Russia as the larger destination for Ukraine’s exports in January 2013 on a 12-month rolling basis.

Still, more than a quarter of Ukraine’s exports are still consumed by Russia. Ukraine depends on Russia for about a third of its total imports. Russia’s reliance on Ukraine is much less, with 6 percent of the country’s exports being consumed by Ukraine and about 5 percent of Russia’s imports coming from Ukraine.

The chart illustrates how trade dependencies between Ukraine and Russia have changed during the past 10 years.

And it’s not just Ukraine that faces a problem…

In western Europe, a mild winter and improved infrastructure mean Europe is less reliant on Russian natural gas pumped through Ukraine than in past years, easing worries that the escalating crisis in Ukraine could hurt supplies.

Despite the improved situation, analysts warned that a renewed disruption would hit Europe hard.

“Risks for Europe exist always, that is why it should pursue even more diversification projects further and develop liquefied natural gas (LNG) markets and new connectors in central and southeastern European regions,” said Anna Bulakh of the International Centre for Defence Studies.

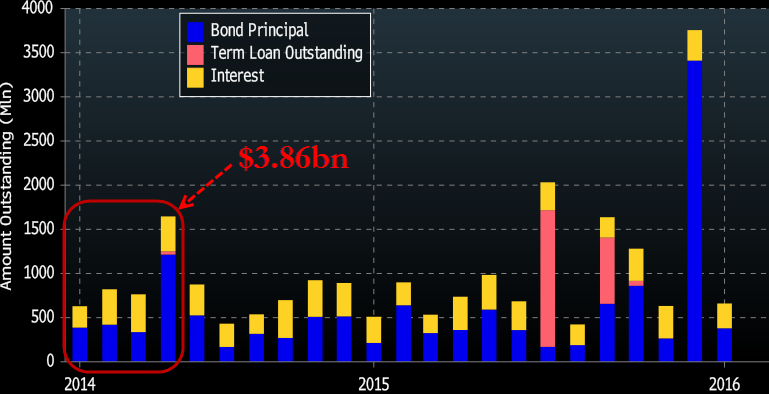

However, Ukraine has another big problem – while it would like $3bn in IMF loans, that will not even cover interest and principal payments through June…

What is perhaps most ironic is the mainstream media’s attention to a 12% drop in the Russian stock market. If this occurred in the US, it would be the end of the status quo… Putin does not care about Russian stocks… all he cares about is the price of oil. Sanctions would merely raise oil prices as supply would be cut… raising the value of Russia’s resources – and we are sure the Chinese would be more than happy to buy (in Yuan-terms) crude direct from Russia as the rest of the world shuns them (and faces crushing energy costs).

Source: Bloomberg