Japan is doomed on so many levels.

– Abenomics Disaster: Japan Regular Wages Fall For 19 Consecutive Months; Real Wages Drop To 16 Year Low (ZeroHedge, Feb 5, 2014):

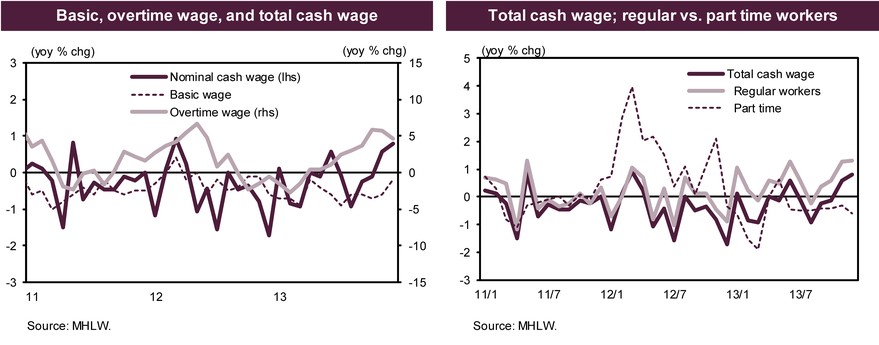

For the past year Abenomics has gotten the “get out of a jail free” card because while the plunging yen was crushing Japanese purchasing power, and sending nominal regular wages ever lower, at least the stock market was higher so (some of the) locals could delude themselves they are getting richer, if only on paper. However, following the most recent 10% correction in the Nikkei which may soon become an all out rout if the 101 level in the USDJPY doesn’t hold (and then 100, and so on), all Japan suddenly has left, is the shock of soaring food and energy prices, and the hangover of declining wages that refuse to drop droppoing. Case in point, last night the Japan labor ministry reported that monthly wages excluding overtime and bonus payments fell 0.2 percent in December from a year earlier to 241,525 yen on average per worker, a series of declines which has now stretched to 19 consecutive months.

The silver lining – overall wages rose 0.8 percent from a year earlier to 544,836 yen, helped by a 1.4 percent climb in winter bonuses and increased overtime pay. However, as Goldman ends, this bonus offset is set to end soon: “We think much of the increase in overtime pay—chiefly in the manufacturing sector—reflects companies accommodating rush demand ahead of the consumption tax hike, and we expect this trend to continue for the next few months. That said, we think overtime hours/wages could drop off sharply after the tax hike, exerting downward pressure on overall wages. We expect the wage boost from overtime pay to drop out from April, and we will be focusing on the extent to which spring wage negotiations are reflected in basic wages at the macro level, including SMEs and nonpermanent employees. ”

Furthermore, while bonuses benefit some, just like the rising stock market, most do not get any bonus benefits – in Japan basic wages accounts for around 80% of overall wages and has a big impact on consumer sentiment and future expected income.” Alas, terrified corporations now eyeing the Nikkei’s recent plunge will hardly do much if anything to jeopardize their botom line just as a market plunge may be imminent, leading to all sorts of unpredictable consequences for the country.

Some more perspectives from Bloomberg:

Japan’s base wages adjusted for inflation last year matched a 16-year low in 2009 when the world was gripped by recession, posing a risk to consumer spending as the nation girds for a higher consumption tax.

Pay excluding bonuses and overtime payments dropped to 98.9 in 2013 on a labor ministry index released today that takes price changes into account, equaling the level four years earlier. The gauge is based at 100 in 2010 in data back to 1990.

Prime Minister Shinzo Abe is calling on firms to boost wages to sustain a reflationary effort so far driven by stimulus and the yen’s 18 percent drop against the dollar last year. Amid a backdrop of market turbulence, business and union leaders met today to start annual pay talks — due to end in March, a month before a 3-percentage-point increase in the sales levy.

…

Nobuaki Koga, head of Rengo, or the Japanese Trade Union Confederation, said last month it would seek overall base-salary increases of more than 1 percent in spring labor negotiations, and 2 percent for workers at small- and medium-sized companies and non-regular workers.

“Base salaries may not rise as much as Rengo has requested” as executives may not be confident enough of Japan’s economic recovery to raise wages, said Yoshiyuki Suimon, an economist at Nomura Securities Co. in Tokyo.

…

Inflation will accelerate five times faster than wage gains in the year starting April, according to Bloomberg News surveys. Higher prices, coupled with the sales-tax rise, threaten to erode household spending power.

Having injected monetary and fiscal stimulus into the economy, Abe’s next challenge is make advances in stripping away regulations to encourage business investment.

“Wages might rise a little bit this year, but it won’t be sustainable unless the government pushes through policies to improve productivity,” said Koya Miyamae, a Tokyo-based economist at SMBC Nikko Securities Inc. “It’s easy to boost prices, but it’s much more difficult to have companies raise wages.”

In other words, it appears Abe has at most another 3-4 months before it all unravels. It may be time to corner the Imodium market: recall that the last time the prime minister quit in disgrace as a result of his failed policies he blamed it on explosive diarrhea. Whatever will he blame this time?

If they told the truth, that many of their products are returned due to radioactivity, it is no surprise. Also, the globalists want to run wages down around the world, but Japan is in deeper trouble than even the globalists can cause.