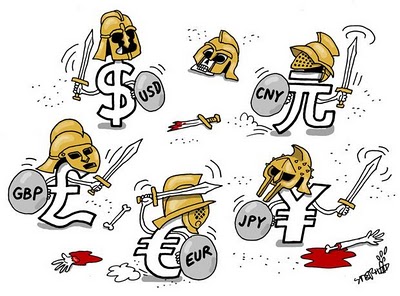

– Currency Wars Are Trade Wars (Azizonomics, Feb 16, 2013):

Paul Krugman is all for currency wars, but not trade wars:

First of all, what people think they know about past currency wars isn’t actually true. Everyone uses some combination phrase like “protectionism and competitive devaluation” to describe the supposed vicious circle of the 1930s, but as Barry Eichengreen has pointed out many times, these really don’t go together. If country A and country B engage in a tit-for-tat of tariffs, the end result is restricted trade; if they each try to push their currency down, the end result is at worst to leave everyone back where they started.

And in reality the stuff that’s now being called “currency wars” is almost surely a net plus for the world economy. In the 1930s this was because countries threw off their golden fetters — they left the gold standard and this freed them to pursue expansionary monetary policies. Today that’s not the issue; but what Japan, the US, and the UK are doing is in fact trying to pursue expansionary monetary policy, with currency depreciation as a byproduct.

There is a serious intellectual error here, typical of much of the recent discussion of this issue. A currency war is by definition a low-level form of a trade war because currencies are internationally traded commodities. The intent (and there is much circumstantial evidence to suggest that Japan at least is acting with mercantilist intent, but that is another story for another day) is not relevant — currency depreciation is currency depreciation and still has the same effects on creditors and trade partners, whatever the claimed intent.

Krugman cites Barry Eichengreen as evidence that competitive devaluation does not necessarily mean a trade war, but Eichengreen does not address the issue of a trade war directly, much less denying the possibility of one. Indeed, while broadly supportive of competitive devaluation Eichengreen notes that the process was “disorderly and disruptive”.

And the risks of disorder and disruption are still very real today.

While the positive effects a currency war produced in the 1930s are unlikely to reappear, there is a chance of large negative effects such as a simultaneous trade war or the breakdown of the international monetary system, so let’s hope a currency war can be avoided.

The mechanism here is very simple. Some countries — those with a lower domestic rate of inflation, like Japan — have a natural advantage in a currency war against countries with a higher domestic rate of inflation like Brazil and China. If one side runs out of leverage to debase their currency because of heightened domestic inflation, their next recourse is to resort to direction trade measures like quotas and tariffs.

China and Russia and Brazil have all recently expressed deep unease at America’s can-kicking and money-printing mentality. This is partly because American money printing has exported inflation to the world, as a result of the dollar’s role as the global reserve currency, and partly because these states already own a lot of American debt, and do not want to be paid off in hugely-debased money.

Since I made that statement, there has been a great lot of debasement without any great spiral of damaging trade measures. But with the world locked into ever greater monetary and trade interdependency, and with fiery trade rhetoric continuing to spew forth from the BRIC nations, who by-and-large seem to continue to believe that American money-printing is damaging their interests — who in the past two years have put together a new global reserve currency framework — it would be deeply complacent to believe that the risks of a severe trade war have gone away.

(Unfortunately, Krugman and Eichengreen both seem to discount the reality that Okun’s law has broken down, and that monetary expansion today is supporting crony industries, and exacerbating income inequality, but those are another story for another day)

1 thought on “Currency Wars Are Trade Wars”