This is the ‘Greatest Depression’.

– Shhhh…It’s Even Worse Than The Great Depression (ZeroHedge, Aug 20, 2012):

According to Wikipedia, Narcissistic personality disorder (NPD) affects one percent of the population and has little to do with looking at yourself in the mirror. It has a lot to do with unrealistic fantasies of success, power and intelligence. Some NPD sufferers become cult leaders or mass murderers, the rest become economists and policy-makers. Despite having a highly elevated sense of self-worth, narcissists have fragile self-esteem and handle criticism unpredictably, so let’s keep this to ourselves….

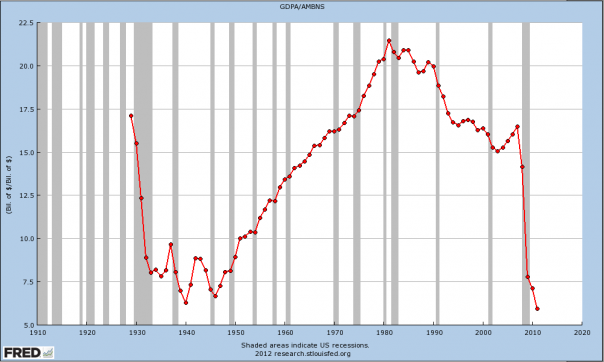

Velocity of money is the frequency with which a unit of money is spent on new goods and services. It is a far better indicator of economic activity than GDP, consumer prices, the stock market, or sales of men’s underwear (which Greenspan was fond of ogling). In a healthy economy, the same dollar is collected as payment and subsequently spent many times over. In a depression, the velocity of money goes catatonic. Velocity of money is calculated by simply dividing GDP by a given money supply. This VoM chart using monetary base should end any discussion of what ”this” is and whether or not anybody should be using the word “recovery” with a straight face:

In just four short years, our “enlightened” policy-makers have slowed money velocity to depths never seen in the Great Depression. Hard to believe, but the guy who made a career out of Monday-morning quarterbacking the Great Depression has already proven himself a bigger idiot than all of his predecessors (and in less than half the time!!). During the Great Depression, monetary base was expanded in response to slowing economic activity, in other words it was reactive (here’s a graph) . They waited until the forest was ablaze before breaking out the hoses, and for that they’ve been rightly criticized. Our “proactive” Fed elected to hose down a forest that wasn’t actually on fire, with gasoline, and the results speak for themselves. With the IMF recently lowering its 2012 US GDP growth forecast to 2%, while the monetary base is expanding at about a 5% clip, know that velocity of money is grinding lower every time you breathe.

The Fed’s refusal to recognize the importance of velocity of money quickly goes from idiotic to insidious. Here’s a question: If I give you 50¢ and as a result of that transaction, you owe me $1.00, what interest rate have I charged you? Obviously, I’ve charged you 100% interest and I don’t give a rat’s ass about you or your kids. I’m pure evil and you’re pure stupid. But believe it or not, this kind of master-slave arrangement isn’t enough to satisfy a true narcissist. The narcissist needs to be exalted for his actions, no matter how unjust.

He likes to be thought of as “accommodative.”

In 2011, every dollar of GDP growth created $2.08 in debt. In real life, that’s 108% interest plus the nominal rate, and our twisted leaders want you say, “Thank you sir, may I have another!”

2011 wasn’t an anomaly either; it’s the new normal. Since the Bush deficit increases (to call a spade a spade) went into effect, the rise in debt has exceeded the rise in GDP 6 of the last 10 years (the four years of positive GDP-minus-Debt can be directly attributed to the housing bubble). That never happened in the U.S. during Great Depression/WWII era. One place where it did happen was in the Weimar Republic (which shortly thereafter became known as Nazi Germany) . No one’s ever done a better job of explaining how quickly things unraveled there than Art Cashin (this is an absolute MUST read):

In 1920, a loaf of bread soared to $1.20, and then in 1921 it hit $1.35. By the middle of 1922 it was $3.50. At the start of 1923 it rocketed to $700 a loaf. Five months later a loaf went for $1200. By September it was $2 million. A month later it was $670 million (wide spread rioting broke out). The next month it hit $3 billion. By mid month it was $100 billion. Then it all collapsed.

….In 1913, the total currency of Germany was a grand total of 6 billion marks. In November of 1923 that loaf of bread we just talked about cost 428 billion marks.

So I’ve got a whole bag of “Fuck You!” for anyone who still thinks nothing could be worse than another Great Depression. The path we’re on ends with mountains of corpses when the great experiment fails.

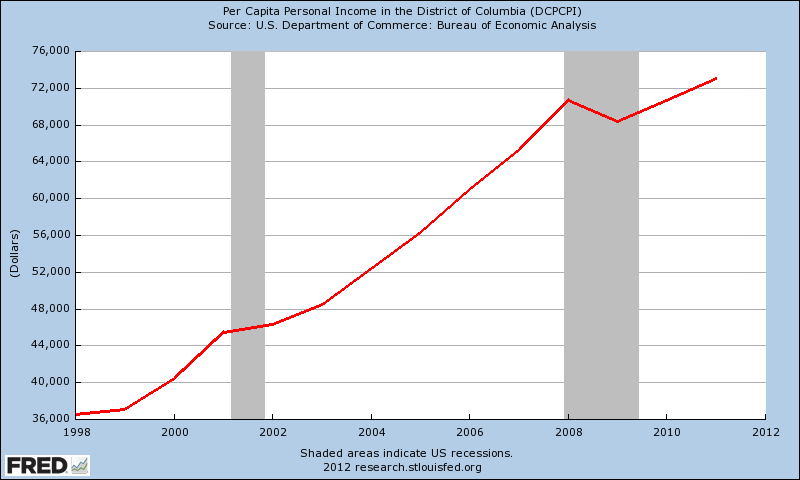

America’s most prestigious education institutions have become grooming salons for malignant narcissists. Men and women high on their own self-important sense of entitlement, but short on any sense of honor or duty (like passing a budget or arresting someone who stole a billion dollars) and devoid of any real insight or achievement. So far it’s working out quite nicely for them:

Fun fact: Washington DC now boasts, by far, the highest and fastest growing income per capita in America.

No matter what color Kool-aid you prefer, a Harvard Law School graduate who wipes his ass with the constitution will occupy the White House until 2016. Any flavor difference you think you detect is artificial. Neither party has any intention of balancing the budget or stopping the generational rape of America. They exist only to give you the illusion of choice.

There’s another reason nobody wants you thinking about velocity of money and triple-digit principle-based interest rates. When you get comfortable with the idea that the same dollar gets spent over and over in the economy, you’ll begin to reconcile that notion with the fact that total government spending (Federal, State and Local) accounted for over 40% of GDP in 2011. Then it becomes clear that you are already living in on of those countries where the government controls everything (call it whatever -ism you want). Next thing you know, you’ll start connecting the dots between the nation’s skyrocketing public debt and the private fortunes amassed by a select few, and no one who’s in on the fix wants that.

Better than one in seven Americans are now on food stamps thanks to Washington’s disastrous policies, but narcissists refuse to recognize the consequences of their own actions. That’s how they sleep at night. They see themselves as saviours, feeding the inferior huddled masses too stupid to fend for themselves, so of course they deserve more money. The only thing they learn from shitty results is that they need more power, more control and more money.

The so-called “fiscal cliff” represents nothing more than a return to policies proven far less dysfunctional than the current ones, but Washington doesn’t see it that way. Instead they want you to beg them to save you from this horrific monster and adore them when they double down on policies that serve to increase your dependency on them.

By any and all reasonable measures, it’s worse than the Great Depression, and still deteriorating. Just remember that truth is the narcissist natural enemy before you speak.

Great article. It is much worse than the great depression of the 1930s for some very simple and easy to understand reasons.

1. In 1929, we were the world’s largest lending nation.

2. Our currency was backed with gold.

3. We were an emerging world mfg power with a growing middle class economic base.

A person could take $100.00 and open a brokerage account and purchase $190.00 worth of stock by using a margin account. 9:1 rato.

Today, we are the world’s largest debtor nation, our currency has nothing behind it but debt, our mfg base has been gutted, and the emerging middle class has been destroyed.

The standard operating procedure is to take $100 million and leverage it into $100 billion, that is 1000:1 rato.

The entire world GDP……money earned in the whole world….averages between $50-65 trillion a year.

LIBOR affects $800 trillion a DAY in money borrowed and loaned.

The numbers are way out of wack.

The only growth over the past 12+ years has been debt, most of it based on money that never existed in the first place.

Damn right it is worse……much worse.