– Recessionspotting: “You Are Here” (ZeroHedge, Aug 13, 2011):

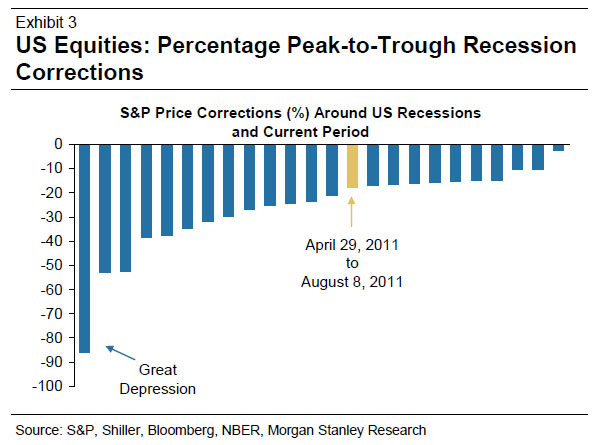

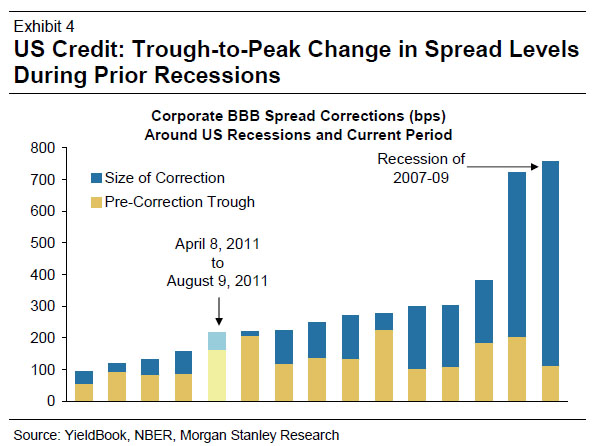

Now that even the likes of Joe LaSagna are starting to throw out the R-word about as casually as they did a 4% 2011 GDP target as recently as 2 months ago, it is becoming increasingly clear that the market is pricing in the fact that post a few more historical BEA revisions, the prior two real GDP reads will end up having been, shockingly enough, negative, i.e., your garden variety recession. So where does that put us on a market performance continuum, for those wishing to extrapolate how much further stocks and, yes, bonds (because credit is and always has been a far better indicator of objective market reality) have to drop before we hit the proverbial floor. Well, according to Morgan Stanley, quite a bit lower: “Despite the recent decline in risk assets, we do not believe that recession is in the price. Exhibits 3 and 4 show the typical declines in developed market risk assets in recession. Compared to corrections in past recessions, S&P prices and corporate credit spreads would have more to go, though spreads are starting from a higher level than typically precedes recessions.” What is startling is that should central planners lose all control (and with central bank intervention upon intervention, one can argue that should all artificial props be removed, the market really ought to plunge in a Great Depression-style tailspin), the drop from the April 29 peak to the bottom will be roughly 4 times greater… which means the S&P would hit the proverbial “S&P 400” which is the long-term target of the likes of some more popular skeptics such as Albert Edwards and Russell Napier. As for credit: watch out below.

Equities:

and Credit:

And completing the pain, again from Morgan Stanley:

Arguably if there were a recession next year the decline in risk assets would be larger than usual. Investors may be unsettled by two related factors. First, the limited policy options for policymakers. Conventional policy tools are near-exhausted in major developed economies. Moreover, there seems to be political, institutional and market obstacles to aggressive use of unconventional policy tools. Ultimately they may come – the bigger the crisis, the bigger the response – but they may only come after there are very significant asset market losses.

Second, a recession next year would increase deflation risks in developed economies. This is partly a matter of inadequate policy response. But the more important point is that the developed economies would enter recession with the lowest nominal GDP growth rate seen entering recession, so nominal GDP contraction would be a larger-than-usual threat. Falling nominal GDP with elevated debt levels is the deadly debt-deflation combination of the 1930s. We are not forecasting such an outcome, but it is a significant tail risk, and one that could lead to a larger-than-usual setback in risk assets.

Translation: we are on the verge of the biggest deflationary market collapse since the 1930s, which will, inevitably, be followed by the most powerful (read fiat dilutive) central bank response in history.

All those gloating that hyperinflation has not set in yet… give it a year.