And what could possibly go wrong?

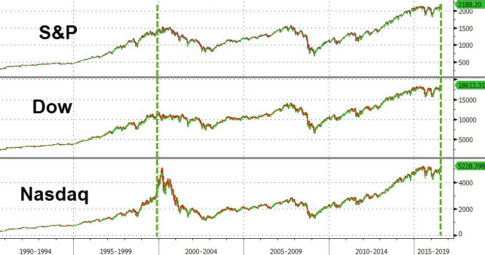

– S&P 500 Earnings Stuck at 2011 Levels, Stocks up 87% Since

*****

H/t reader squodgy:

“Of course, he’s right. We all know it, we’ve watched the manipulations.

We’ve seen the Shipping Activity Index (BDI) sat in the gutter.

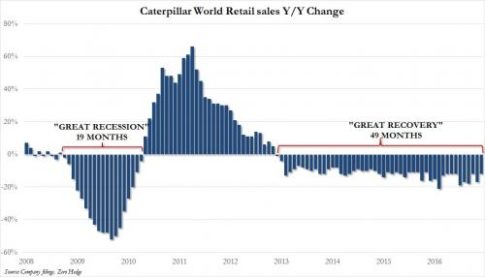

We’ve seen Caterpillar report 5 consecutive years of continuous order book drops.

We’ve watched the food stamps grow to one third of the population.All these show total disconnect from Wall St & the Fed bullshit manipulation

Stocks prices continuously rise as a result of false purchases by the banks and buy backs by the Companies…..but activity, earnings and returns are rubbish.Now the truth outs. We are slap bang in a depression & Trump has been set up to take the fall for it.

Yet, being an astute businessman, he knew all this already, and his crowing is equally false. He knew he was going to be the scape goat.”

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP