The Obama administration is pure Wall Street, Federal Reserve, CFR and Trilateral Commission. There is no change. The banksters have free reign in America.

Related information:

– The US Government: Bought and Paid For

– Treasury Secretary Geithner’s Closest Aides Reaped Millions Working for Banks, Hedge Funds

– Goldman Sachs Banksters Set to Pay Record £14 Billion in Bonuses

– Government Watchdog: Treasury and Federal Reserve Knew Bailed-Out Banks Were Not Healthy, Lying to Americans

– Goldman Sachs to be paid $1bn if CIT fails, while US taxpayers would lose $2.3bn

– US: Utah approved a $27.3 million incentive package to keep Goldman Sachs, bringing the total amount to $47.3 million

– Congresswoman Marcy Kaptur: There Has Been a Financial Coup D’Etat

Mike Shedlock:

“I am outraged that the Obama Administration promised change and did not deliver. “Yes We Can” was a lie. The reality is “It’s Business As Usual, Only Worse, With Higher Deficits”.”

“I am outraged there is not enough outrage over this.”

“Where the hell is the outrage?”

The number of articles and opinions on Goldman Sachs earnings, bonuses, and influence peddling over the past several days is quite stunning.

Many have pointed out the problems; few have expressed outrage over what is happening in general, not just at Goldman Sachs. Let’s take a look.

My take is at the end.

Letting The Dice Roll

Rolfe Winkler at Contingent Capital is writing Letting Goldman Roll The Dice.

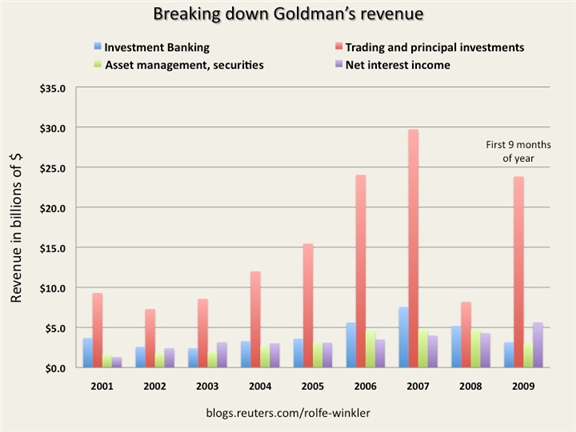

Is Goldman really such an indispensable financial intermediary? One look at the firm’s revenue breakdown shows that it’s more casino than anything else, and some of the markets it makes still put the economy in danger.

Goldman, in other words, generates most of its revenue trading its own money and earning vigorish on customer transactions. It’s a hybrid hedge fund and bookie, with an investment bank and asset management business thrown in for good measure.

With that in mind, one is left to wonder whether Goldman was really worth saving last year. What have taxpayers received for the $50 billion worth of cash and guarantees, for giving Goldman access to the Federal Reserve as its lender of last resort?

Saving Goldman was largely about saving the derivatives market, which is so big and unstable that the death of one counterparty could mean the death of all. With big commercial banks like JPMorgan Chase in deep, saving the derivatives business was as much about protecting depositors and maintaining the integrity of the payment system as it was derivatives themselves.

Read moreThe Goldman Sachs Bankster Casino – Where The Hell Is The Outrage?