This is the Greatest Depression.

The US workforce shrank by 652,000 in June, one of the sharpest contractions ever. The rate of hourly earnings fell 0.1pc. Wages are flirting with deflation.

People queue for a job fair in New York. The share of the US working-age population with jobs in June fell from 58.7pc to 58.5pc. The ratio was 63pc three years ago. Photo: EPA

“The economy is still in the gravitational pull of the Great Recession,” said Robert Reich, former US labour secretary. “All the booster rockets for getting us beyond it are failing.”

“Home sales are down. Retail sales are down. Factory orders in May suffered their biggest tumble since March of last year. So what are we doing about it? Less than nothing,” he said.

California is tightening faster than Greece. State workers have seen a 14pc fall in earnings this year due to forced furloughs. Governor Arnold Schwarzenegger is cutting pay for 200,000 state workers to the minimum wage of $7.25 an hour to cover his $19bn (£15bn) deficit.

Can Illinois be far behind? The state has a deficit of $12bn and is $5bn in arrears to schools, nursing homes, child care centres, and prisons. “It is getting worse every single day,” said state comptroller Daniel Hynes. “We are not paying bills for absolutely essential services. That is obscene.”

Roughly a million Americans have dropped out of the jobs market altogether over the past two months. That is the only reason why the headline unemployment rate is not exploding to a post-war high.

Let us be honest. The US is still trapped in depression a full 18 months into zero interest rates, quantitative easing (QE), and fiscal stimulus that has pushed the budget deficit above 10pc of GDP.

The share of the US working-age population with jobs in June actually fell from 58.7pc to 58.5pc. This is the real stress indicator. The ratio was 63pc three years ago. Eight million jobs have been lost.

The average time needed to find a job has risen to a record 35.2 weeks. Nothing like this has been seen before in the post-war era. Jeff Weninger, of Harris Private Bank, said this compares with a peak of 21.2 weeks in the Volcker recession of the early 1980s.

“Legions of individuals have been left with stale skills, and little prospect of finding meaningful work, and benefits that are being exhausted. By our math the crop of people who are unemployed but not receiving a check amounts to 9.2m.”

Republicans on Capitol Hill are filibustering a bill to extend the dole for up to 1.2m jobless facing an imminent cut-off. Dean Heller from Vermont called them “hobos”. This really is starting to feel like 1932.

Washington’s fiscal stimulus is draining away. It peaked in the first quarter, yet even then the economy eked out a growth rate of just 2.7pc. This compares with 5.1pc, 9.3pc, 8.1pc and 8.5pc in the four quarters coming off recession in the early 1980s.

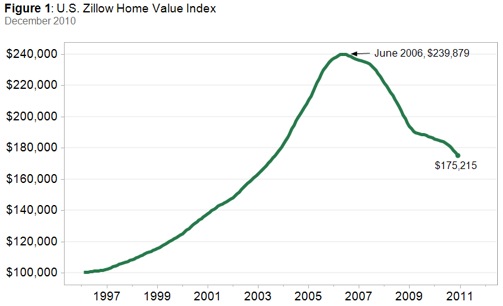

The housing market is already crumbling as government props are pulled away. The expiry of homebuyers’ tax credit led to a 30pc fall in the number of buyers signing contracts in May. “It is cataclysmic,” said David Bloom from HSBC.

Read moreWith The US Still Trapped in Depression, This Really Is Starting to Feel Like 1932