The US should have been downgraded a ‘looong’ time ago:

– The Greatest Economic Collapse Is Coming:

“To give you an idea of how big a problem these deficits are, consider that the US government could tax its citizens 100% of their earnings and NOT have a balanced budget.” (!)

– Richard Fisher, president of the Dallas Federal Reserve Bank:

The“very big hole” in unfunded pension and health-care liabilities is over $99 trillion.

(Full article: Here)

– Glenn Beck: United States Debt Obligations Exceed World GDP

– Federal obligations exceed world GDP

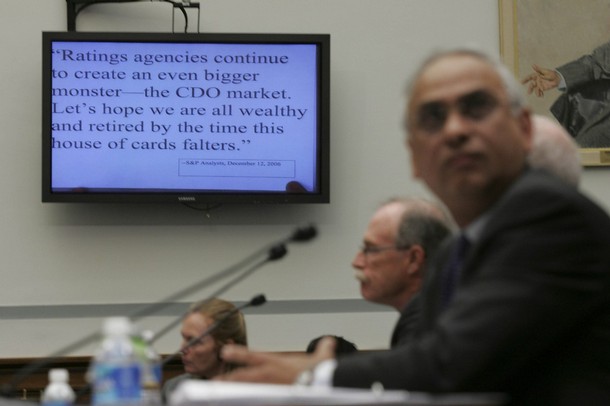

S&P like the Obama administration is controlled by the elite behind the scenes.

The sovereign debt of Latvia and Estonia have been downgraded as the brutal slump plays havoc with public finances and tests commitment to euro currency pegs across the Baltic states.

Tallinn in Estonia, where sovereign debt has been downgraded |

Standard & Poor’s, the credit-rating agency, cut Latvia’s rating to “BB” and warned that its economy will contract by a further 16pc this year. The public debt will vault from 19pc of GDP last year to 80pc by 2011. “This very fast increase in debt is unprecedented,” said Moritz Kraemer, S&P’s head of sovereign ratings.

S&P said the country is facing a “struggle” to find a path back to growth while also maintaining its currency peg, but the agency stopped short of advising whether devaluation would help.

There is an intense debate in the Baltics over whether the euro pegs are themselves causing an unnecessarily harsh adjustment, entailing salary cuts of up to 20pc. The International Monetary Fund had privately suggested a devaluation in Latvia to help cushion the blow, but this was overruled by the European Union on grounds that most of the country’s corporate and mortgage debt is in foreign currencies.

GDP has fallen 20pc in Latvia and 22pc in Lithuania over the past year – more concentrated falls than anything seen in the Great Depression. Both countries expect unemployment to peak at almost a quarter of the workforce.

Read moreStandard & Poor’s downgrades Baltic states’ debt ratings