– Alarm bells toll for human civilization as world’s 12th largest mega-city to run out of water in just 60 days (Natural News):

The city of Sao Paulo is home to 20 million Brazilians, making it the 12th largest mega-city on a planet dominated by shortsighted humans. Shockingly, it has only 60 days of water supply remaining. The city “has about two months of guaranteed water supply remaining as it taps into the second of three emergency reserves,” reports Reuters. [1]

Technical reserves have already been released, and as the city enters the heavy water use holiday season, its 20 million residents are riding on a fast-track collision course with severe water rationing and devastating disruptions.

…

– Accident at largest nuclear power plant in Europe revealed by Ukraine PM (RT):

There has been an accident at a nuclear plant in the southeast of Ukraine, Prime Minister Arseny Yatsenyuk has revealed during the first session of his new Cabinet.

A minor accident occurred at Zaporozhskaya nuclear plant, the largest in Europe, last Friday, according to the facility’s website. A reactor was switched off and put to maintenance as a result.

…

– CNN: Urgent – Emergency repairs reported at largest nuclear power plant in Europe — Prime Minister: I know that a nuclear accident has occurred (VIDEO) (ENENews)

CNN, Dec 3, 2014: URGENT – Ukraine Nuclear Plant Repairs — Emergency repairs began earlier this week… Details about what caused the problem, which the ministry first reported Tuesday, weren’t immediately available.

…

– Ferguson 2.0? Grand Jury Fails To Indict White NYPD Cop In Fatal-Chokehold Case; Press Conference – Live Feed (ZeroHedge):

UPDATE: Charlie Rangel opines “This is not a black problem, this is a problem we have in our great country.”

Protests planned: 430, Grand Central; 7:00 Rockefeller Christmas Tree

A Staten Island grand jury has decided not to indict white NYPD officer Daniel Panateleo, according to NY1, who allegedly used a banned chokehold and killed Eric Garner, a 400lb black man, who was stopped on suspicion of selling loose cigarettes. Police in New York are preparing for potential protests, There are at least two different demonstrations planned in lower Manhattan Wednesday.

…

– Flight fright: Russian MiG-31 jet pulls midair maneuver on Norwegian F-16 (VIDEO) (RT):

Two top guns came into very close contact when a Russian MiG-31 aircraft overtook a Norwegian F-16 fighter and cut practically in front of it, forcing the NATO pilot to veer away sharply.

The Russian jet passed the F-16 within a mere 20 meters, causing the Norwegian pilot to exclaim, “What the hell!” before darting away hastily.

…

– This Is The Body Camera That All NYPD Officers Will Soon Wear (ZeroHedge):

As part of the final solution to inner city social unrest across America, President Obama has put forward recommendations that all police offers wear body cameras… this is what the ‘eyes-are-always-on-you’ NYPD police camera will look like. What ever happened to Google Glass privacy concerns?

…

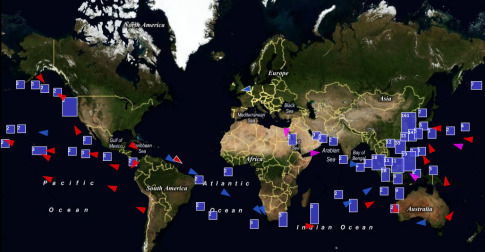

– Pentagon says Iran bombs ISIS in Iraq, Tehran ‘cannot confirm’ (RT):

Iran has launched airstrikes against Islamic State militants in eastern Iraq in recent days, the Pentagon confirms. According to spokesperson Rear Adm. John Kirby, the strikes were not co-ordinated with the US military and may be the first of their kind.

“We have indications that they did indeed fly airstrikes with F-4 Phantoms in the past several days,” Kirby told AFP.

It may be the first time Tehran has launched manned aircraft from inside Iran to strike Islamic State (IS, formerly ISIS/ISIL) targets in Iraq, Kirby told AP.

…

– US Army Sends 100 Tanks To Eastern Europe To “Deter Russian Aggression” (ZeroHedge):

The ink on Barack Obama’s Chuck Hagel termination letter hasn’t dried yet but already the US president’s new, and seemingly far more hawkish advisors, are having their warmongering presence felt. Case in point: the Eastern European theater of (Cold) war, where Military.com reports that the new Army commander in Europe plans to bolster the U.S. armored presence in Poland and the Baltic states and keep rotations of U.S. troops there through next year and possibly beyond to counter Russia. Lt. Gen. Frederick “Ben” Hodges, who replaced Lt. Gen. Donald M. Campbell earlier this month as commander of U.S. Army Europe, said the Army was looking to add about 100 Abrams tanks and Bradley Fighting Vehicles to the forces in Eastern Europe.

…

– Fracking ban goes into effect in its birthplace (RT):

An unprecedented ban on fracking went into effect Tuesday in Denton, Texas, a town of 123,000 located on top of the natural-gas goldmine that is the Barnett shale formation, the birthplace of the much-maligned oil and gas extraction method.

Denton voters approved the ban last month, making it the first city or county to do so in the energy-rich, fracking-heavy state of Texas.

Shortly after the Nov. 4 vote, the Texas Oil & Gas Association, an energy industry group, and the Texas General Land Office filed a lawsuit seeking to reverse the ban.

…

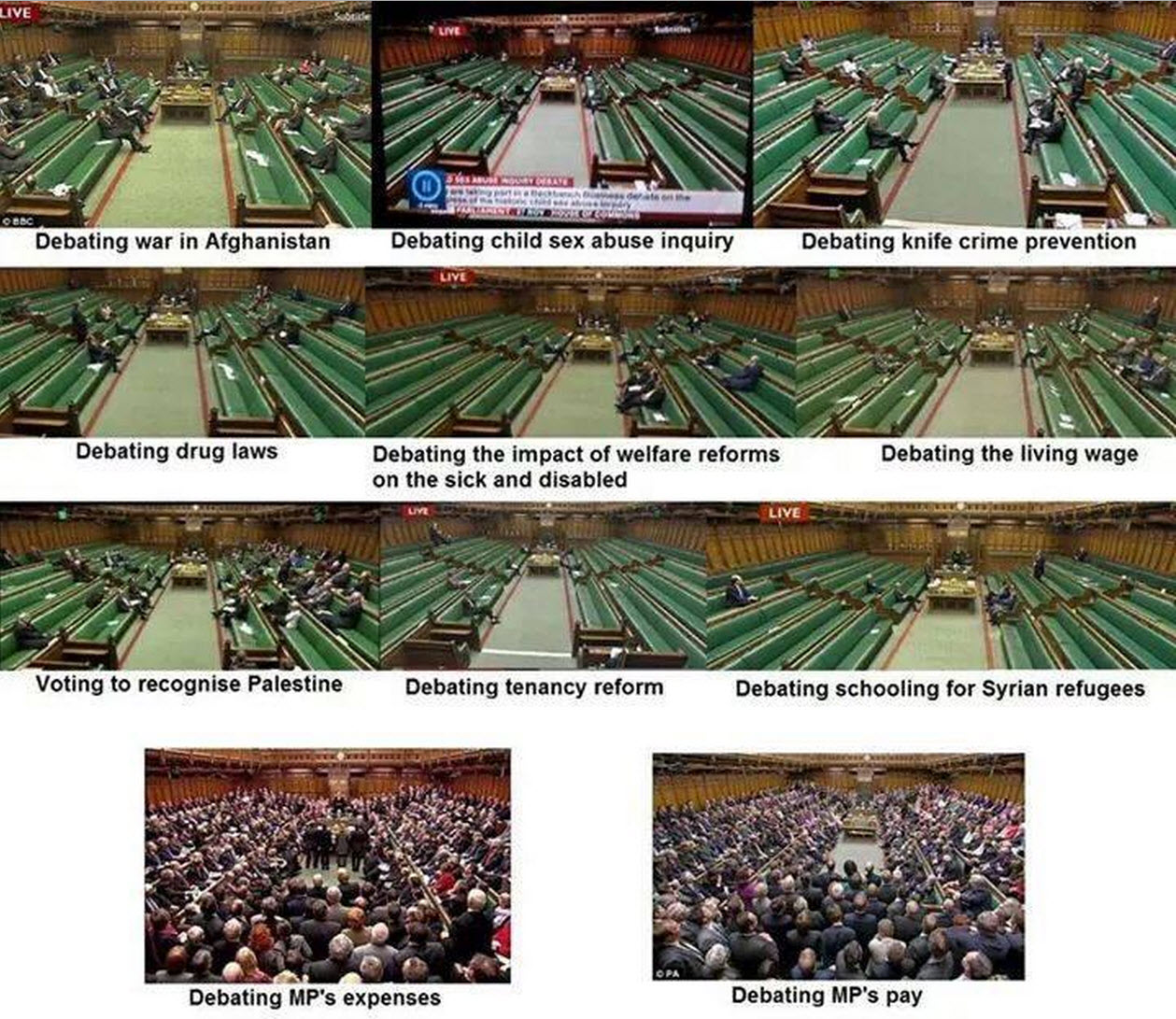

– $178 Billion In Government Kickbacks: Meet The World’s Biggest Organized Crime Syndicate (ZeroHedge):

Once upon a time it was the Sicilian, or Russian, or Japanese, or Chinese mob that were some of the biggest sources of funding for corrupt government officials (incidentally, most of them). After all, the government is smart enough to realize that it is more lucrative to “cooperate” with the world’s biggest criminal syndicates than to wipe them out and cut off a major source of funding (of course, when it comes to populist optics and reelection, there is always an easy low-level perp walk every week or so to keep the peasants in place… and Diebold).

…

– ?Anonymous take down Ft. Lauderdale’s site for anti-homeless laws (RT):

The hacktivist group Anonymous is no fan of Fort Lauderdale’s new laws targeting the Florida city’s homeless population, and they took down multiple city websites to prove it.

…

…

– Another Government Scam – Small Business Administration (SBA) is Exposed as Corporate Welfare to Big Businesses (Liberty Blitzkrieg):

Many people have noted that the more insidious or corrupt a law or agency, the more positive sounding its name. The most egregious example during my lifetime, was naming legislation that stripped Americans of most of their civil liberties the “Patriot” Act.

In a similar vein, which red-blooded American could ever be opposed to something called the Small Business Administration (SBA). We all love small businesses and the entrepreneurial spirit, and even those who abhor big government have a hard time siding against an agency that supports the little guy. As such, the SBA is the perfect vehicle for cronyism, corruption and corporate welfare, which indeed appears to be its primary reason for existence.

My friends at Open the Books have published a key study on the SBA, and the results are ugly. The full report can be found here, but what follows is some analysis of the report by Stephen Moore at Investors Business Daily:

…

– Chicago – Coldest Year in 110 Years (Ice Age Now):

Not just the day, not just the week, not just the month, we’re talking the entire year.

…

– Iraqi army ‘had 50,000 ghost troops’ on payroll (BBC):

An investigation into corruption in the Iraqi army has revealed that there were 50,000 false names on its payroll.

Known in the military as “ghost soldiers”, they either did not exist or no longer reported for duty, however their salaries were still paid

…

– UN: Israeli trade control causes $310 MILLION loss for Palestinian Authority (Al Akhbar):

The Palestinian Authority lost at least $310 million in customs and sales tax in 2011 as a result of importing from or through Israeli-occupied territories, the UN said Wednesday, urging a radical change to the system.

The lost revenue, worth 250 million euros, was equivalent to 3.6 percent of gross domestic product (GDP) and 18 percent of the tax revenue of the authority, the UN Conference on Trade and Development (UNCTAD) said.

…

– 100,000 Czech travelers stranded due to freezing arctic weather (Ice Age Now):

People forced to spend the night in cold trains and railway stations when temperatures dropped to minus 7.3 C (19.4 F).

…

– Made in the USA – How the Ukrainian Government is Giving Away Citizenships so Foreigners Can Run the Country (Liberty Blitzkrieg):

…

Claims that the new government in Ukraine is nothing more than a Western puppet Parliament have been swirling around consistently since February. Nevertheless, I think it’s very significant that the takeover is now overt, undeniable and completely out in the open. Nothing proves this fact more clearly than the recent and sudden granting of citizenship to three foreigners so that they can take top posts in the government.

…

– Forget Stocks, This is the REAL Crisis That’s Coming (ZeroHedge):

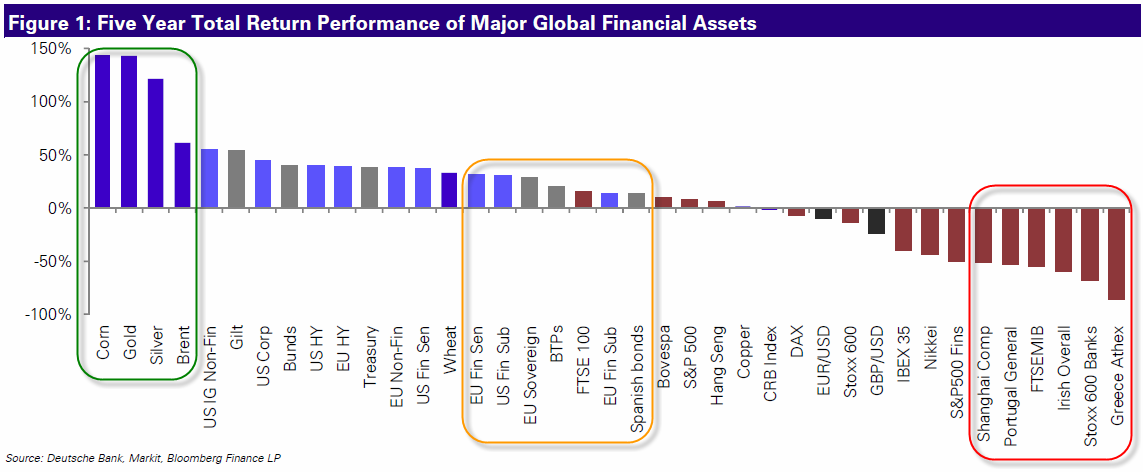

The 2008 crash was a warm up.

Many investors think that we could never have a crash again. The 2008 melt-down was a one in 100 years episode, they think.

They are wrong.

The 2008 Crisis was a stock and investment bank crisis. But it was not THE Crisis.

THE Crisis concerns the biggest bubble in financial history: the epic Bond bubble… which as it stands is north of $100 trillion… although if you include the derivatives that trade based on bonds it’s more like $500 TRILLION.

The Fed likes to act as though it’s concerned about stocks… but the real story is in bonds. Indeed, when you look at the Fed’s actions from the perspective of the bond market, everything suddenly becomes clear.

…

– Budapest – Freezing rain leaves 40,000 homes powerless (Ice Age Now)

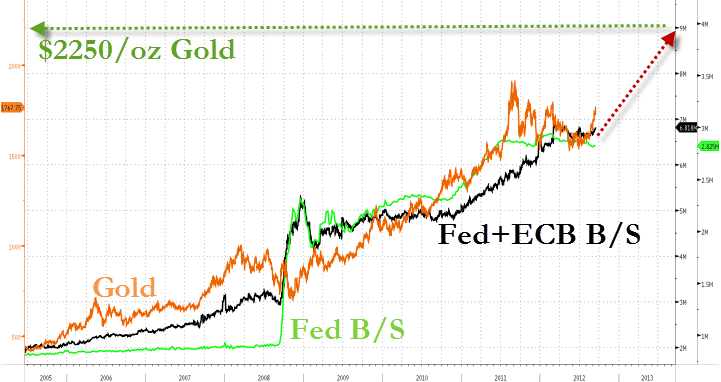

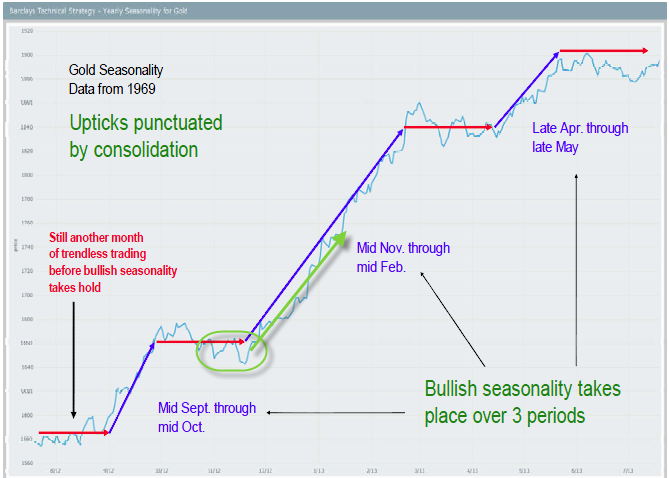

– Central Bank Buying Of S&P 500 Futures Extended Until End Of 2015 (ZeroHedge):

We have some bad news. According to a modification of the Central Bank Incentive Program, central bank rigging of, well, everything and certainly the E-mini S&P future, will go on for a much longer time, with the revised deadline now going through December 31, 2015.

…

– Romania – More than 1,000 people stuck in snow (Ice Age Now)

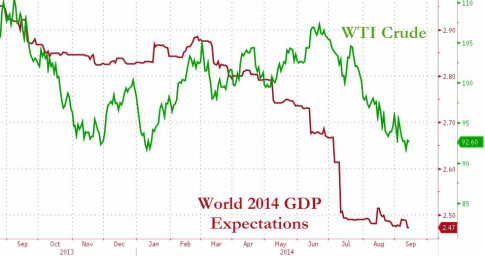

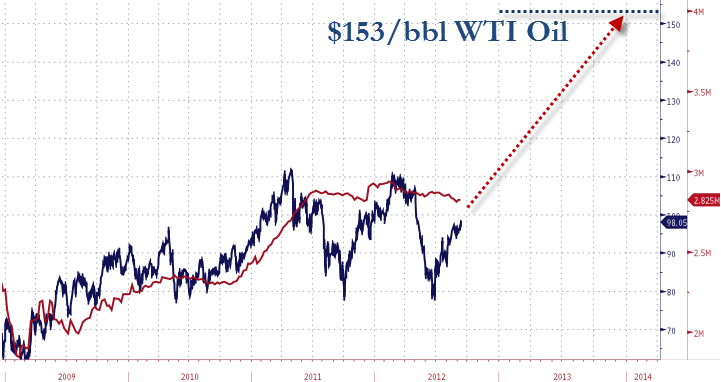

– Plummeting Oil Prices Could Destroy The Banks That Are Holding Trillions In Commodity Derivatives (Economic Collapse):

Could rapidly falling oil prices trigger a nightmare scenario for the commodity derivatives market? The big Wall Street banks did not expect plunging home prices to cause a mortgage-backed securities implosion back in 2008, and their models did not anticipate a decline in the price of oil by more than 40 dollars in less than six months this time either. If the price of oil stays at this level or goes down even more, someone out there is going to have to absorb some absolutely massive losses. In some cases, the losses will be absorbed by oil producers, but many of the big players in the industry have already locked in high prices for their oil next year through derivatives contracts. The companies enter into these derivatives contracts for a couple of reasons. Number one, many lenders do not want to give them any money unless they can show that they have locked in a price for their oil that is higher than the cost of production. Secondly, derivatives contracts protect the profits of oil producers from dramatic swings in the marketplace. These dramatic swings rarely happen, but when they do they can be absolutely crippling. So the oil companies that have locked in high prices for their oil in 2015 and 2016 are feeling pretty good right about now. But who is on the other end of those contracts? In many cases, it is the big Wall Street banks, and if the price of oil does not rebound substantially they could be facing absolutely colossal losses.

It has been estimated that the six largest “too big to fail” banks control $3.9 trillion in commodity derivatives contracts. And a very large chunk of that amount is made up of oil derivatives.

…

– Austria – Rare ice storm hits Waldviertel (Ice Age Now):

Some trees 3 ft (1 m) in diameter – Few in the fire service could recall so many ice-damaged trees. Trees breaking like matchsticks.

…

H/t reader squodgy:

“Jeeeeeeeeeeezuss!”

H/t reader squodgy:

“WOW!!!….of course….the last resort measure to trigger the war they so desperately need to smokescreen their escape from blame for this entire BANK CREATED MESS.”

– Falling Oil Prices Could Cripple ‘Vulnerable’ Russia, Trigger World War III (The Daily Sheeple):

The Cold War 2.0 is going hot, and while it may someday be fought with planes, tanks, guns and bombs, the first front is being fought with oil and shale gas.

The U.S. and European sanctions against Russia will become more severe and crippling in the face of drastically falling oil prices – prices which are falling drastically because of the unprecedented boom of shale gas fracking both domestically in the U.S. and abroad in Ukraine and other locales. The oil & gas giants like Chevron and Exxon Mobil have created revolutionary conditions with now direct consequences on U.S. foreign policy and global war for dominance. Via Bloomberg:

…

– New US Oil Well Permits Collapse 40% In November, Fed Still “Not Worried”? (ZeroHedge):

Houston, we have a problem-er. With a third of S&P 500 capital expenditure due from the imploding energy sector (and with over 20% of the high-yield market dominated by these names), paying attention to any inflection point in the US oil-producers is critical as they have been gung-ho “unequivocally good” expanders even as oil prices began to fall. So, when Reuters reports a drop of almost 40 percent in new well permits issued across the United States in November, even The Fed’s Stan Fischer might start to question his lower oil prices are “a phenomenon that’s making everybody better off,” may warrant a rethink. New permits, which indicate what drilling rigs will be doing 60-90 days in the future, showed steep declines for the first time this year across the top three U.S. onshore fields: the Permian Basin and Eagle Ford in Texas and North Dakota’s Bakken shale.

…

H/t reader squodgy:

“At this rate there won’t be any good ones left.”

How ironic can life be? Officer Jeremy Henwood survived several tours of duty in Iraq and Afghanistan as a US Marine only to be killed practically at his doorstep. McDonald’s security cameras caught his final act of kindness on tape, just moments before he was shot. Watch what he did when a small 10 year old boy couldn’t afford his meal.

As trivial as it may seem to some, it’s these little things that make a good man. It’s only appropriate that Officer Henwood’s final moments reflect the life he had, the one of a true American hero.

– How Did Christmas Become A Festival Of Greed? (Economic Collapse):

For most people, Christmas is all about the presents. But how did such a supposedly sacred holiday become a festival of greed? Not many people know the history behind Christmas gift giving, and it will probably shock you. This year, Americans will spend somewhere in the neighborhood of 600 billion dollars on Christmas, but most people have no coherent explanation for why they are buying all of these gifts. Those that are Christian will tell you that they are doing it to celebrate the birth of Christ, but as you will see below, gift giving on this holiday originated long before Christ was born. Others will tell you that they are just following tradition, but most of them have absolutely no idea where the tradition of Christmas gift giving originally came from. And the truth is that most people simply don’t care about the history. They are just excited about all of the stuff that they are going to get on December 25th. But if you are curious to learn how Christmas became a festival of greed, just keep reading…

…

– London Property Bubble Primed To Burst – Consequences For UK Economy and Sterling (ZeroHedge):

The ongoing slump in oil prices looks set to take their toll on London’s “super prime” property markets with attendant consequences for the rest of the London property market. Foreign money that had been flooding into the UK from a whole array of international sources and parking in London real estate is drying up.

…

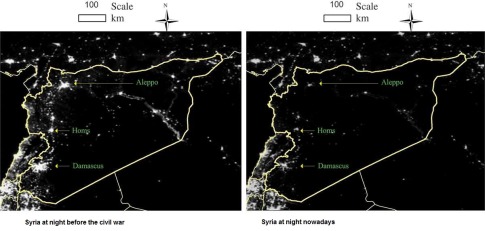

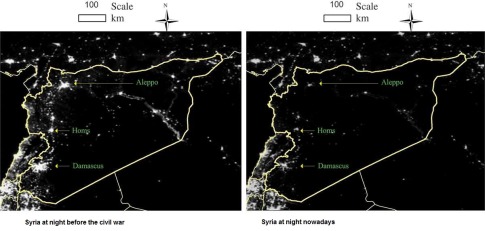

– Syria Goes Dark (Acting Man):

Syria Then and Now

“Arab Spring” situations have an inexorable tendency to go pear-shaped (Tunisia, the first country to experience one is the lone exception, but even there the “old guard” is reportedly making a comeback, so the whole thing was essentially for nothing in the end). In Egypt, the revolution went from bringing an Islamist to power whose economic policies were either useless or were sabotaged by the organization that actually owns Egypt (the army controls 40% of the economy), back to someone who suspiciously looks like the old boss, with the only difference that he’s even worse. Nothing about the situation even remotely resembles democracy at this juncture. Getting jailed and tortured in Egypt and getting sentenced to death in mass show trials is once again par for the course.

…