The Cathedral of St. John the Divine

The Symbols

The impressive exterior of the cathedral provokes a humbling sensation at whom gazes at it. But what are you humbling yourself to? We’ll examine the details of the artwork.

The Apocalyptic Pillar

On the western facade of the building, stonemasons have sculpted numerous scenes that seem oddly out of place for a Cathedral. The most striking one is the chilling depiction of the destruction of New York city and its landmarks.

(Not only the) Twin towers collapsing.

The scene above was done in 1997, four years before the destruction of the Twin Towers. Other recognizable skyscrapers are the Chrysler Building and the Citigroup center.

Apocalyptic New York

The scene above might be unsettling for New York residents. We see the Brooklyn bridge crumbling with cars and buses falling into agitated waters. At the right is the Statue of Liberty, which seems to be sinking in the water. Beneath this horrifying prophecy is the New York Stock Exchange, with people trading goods around it.

So, what is the purpose of this weird carving? Well, the first thing that needs to be mentioned is the actual St. John the Divine is credited for writing the Book of Revelation in the Bible, which describes in symbolic imagery the events of the apocalypse. Occultists believe that the Book of Revelation has been hermetically coded to reveal its true meaning to the initiates of esoteric teachings. This scene, carved on the west entrance of the cathedral, depicts New York as being “Babylon the Great”, the city who gets completely destroyed by the wrath of God. The Book of Revelation mentions:

“Fallen! Fallen is Babylon the Great!

She has become a home for demons

and a haunt for every evil spirit,

a haunt for every unclean and detestable bird.

For all the nations have drunk

the maddening wine of her adulteries.

The kings of the earth committed adultery with her,

and the merchants of the earth grew rich from her excessive luxuries.”

-Book of Revelation 18

The artists might be on to something because there is indeed numerous similarities between the actual New York city and the description of Babylon the Great in the Bible. The Book of Revelation mentions:

- A “Great Prostitute” who sits on many waters – peoples, multitudes, nations and languages – holding a golden cup. She rules over the kings of the Earth. = The Statue of Liberty

- Merchants of the Earth who grew rich of her “excessive luxuries”, weeping because nobody buys their goods anymore = New York Stock Exchange

“The merchants who sold these things and gained their wealth from her will stand far off, terrified at her torment. They will weep and mourn and cry out:

” ‘Woe! Woe, O great city,

dressed in fine linen, purple and scarlet,

and glittering with gold, precious stones and pearls!

In one hour such great wealth has been brought to ruin!’

– Book of Revelation, 18

Knowing that, still today, over 70% of the world’s capital goes through the NYSE, we understand why the building was depicted on the apocalyptic pillar. It represents the “financial” aspect of the Book of Revelation, where it repeatedly refers to rich merchants and trading goods.

So, a landmark of NYC, the St. John the Divine Cathedral, predicts in vivid detail the destruction of its home city. Pretty unusual. Under the rendering of the NYSE, we a skeleton and strange creatures, who seem to represent death and destruction. Is this some sort of prophecy?

………………..

Background and History of the Cathedral

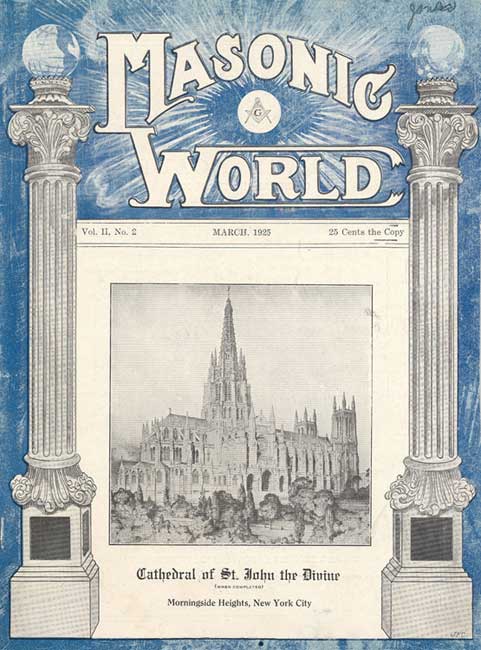

This unfinished building has been claimed as being the world’s largest cathedral. It is realistic to maintain such high aspirations when your sources of funding include tycoons like JP Morgan and prominent figures like the Grand Master of the Masons of the state of New York. The completion of the cathedral was such a prized accomplishment for the Freemasons that it was featured on the front page of “Masonic World” of March 1925.

The article states:

“It is particularly fitting that the Masons, who were the principal builders of cathedrals and churches during the greatest cathedral-building period, should now have a prominent part in the movement to build America’s greatest cathedral (…) Little need be added to the story of Freemasonry during the cathedral-building period; its monuments are its best history, alike of its genius, its faith and its symbols.”

The article openly admits that masonic cathedrals represent the best legacy of the Brotherhood and the symbolism is prominently showcased. The masses are however too ignorant to recognize the meanings behind the art, so they just stare at them, thinking “it’s pretty nice”.

Illuminati Pyramid and All-Seeing Eye on the Cathedral of St. John the Divine

Illuminati Pyramid and All-Seeing Eye

The Manhattan Project: Current and Future Security Measures for New York’s Financial District

The Manhattan Project: Current and Future Security Measures for New York’s Financial District