From the article:

As I write this, a lot of investors whom I know personally—who are sophisticated, wealthy, and not at all the paranoid type—are quietly pulling their money out of all brokerage firms, all banks, all equity firms. They are quietly trading out of their paper assets and going into the actual, physical asset.

Note that they’re not trading into the asset—they’re simply exchanging their paper-asset for the real thing.

Sounds familiar, doesn’t it?

Prepare for collapse.

– A Run On The Global Banking System—How Close Are We? (Gonzalo Lira, Dec. 27, 2011):

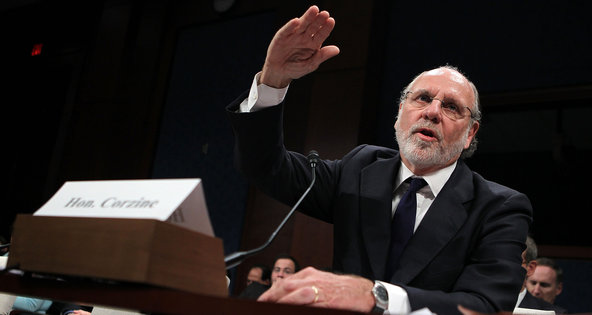

Nine weeks after its bankruptcy, the general public still hasn’t quite realized the implications of the MF Global scandal.

Once he looks down, then he’ll begin to fall. My own sense is, this is the first tremor of the earthquake that’s coming to the global financial system. And how the central banks and financial regulators treated the “Systemically Important Financial Institutions” that had exposure to MF Global—to the detriment of the ordinary, blameless customer who got royally ripped off in its bankruptcy—is both the template of how the next financial crisis will be handled, and an accelerator that will make the next crisis happen that much sooner.

So first off, what happened with MF Global?

Read moreA Run On The Global Banking System – How Close Are We?