Related article: Eliot Spitzer: Federal Reserve is a Ponzi scheme, an inside job:

The Federal Reserve – the quasi-autonomous body that controls the US’s money supply – is a “Ponzi scheme” that created “bubble after bubble” in the US economy and needs to be held accountable for its actions, says Eliot Spitzer, the former governor and attorney-general of New York.

Is a political scandal brewing in New York? A year and a half after taking over for a disgraced Spitzer, Paterson is now at war with everyone, but most notable the New York State Budget, and now, the President.

Reports the New York Times:

President Obama has sent a request to Gov. David A. Paterson that he withdraw from the New York governor’s race, fearing that Mr. Paterson cannot recover from his dismal political standing, according to two senior administration officials and a New York Democratic operative with direct knowledge of the situation.

The decision to ask Mr. Paterson to step aside was proposed by political advisers to Mr. Obama, but approved by the president himself, one of the administration officials said.

“Is there concern about the situation in New York? Absolutely,” the second administration official said Saturday evening. “Has that concern been conveyed to the governor? Yes.”

The president’s request was conveyed to the Mr. Paterson by Representative Gregory W. Meeks, a Queens Democrat, who has developed a strong relationship with the Obama administration, they said.

Yet Paterson seems unwilling to pull a Perella-Weinberg just yet:

“The message the White House wanted to send – that it wants Paterson to step aside – was delivered,” said the Democratic operative,, who spoke on condition of anonymity because the discussions were intended to be confidential. “He is resistant.”

What is the reason for this escalation? Simple – Bank Of America, and SEC-gate. Throw in some potential race issues, and you have one clusterfuck of a situation about to develop:

Now, Mr. Cuomo effectively has the blessing of the nation’s first black president to run against New York’s first black governor. That will probably neutralize any criticism he may face among the governor’s prominent black allies, including Representative Charles B. Rangel of Harlem, who warned this year that the party would become racially polarized if Mr. Cuomo took on Mr. Paterson.

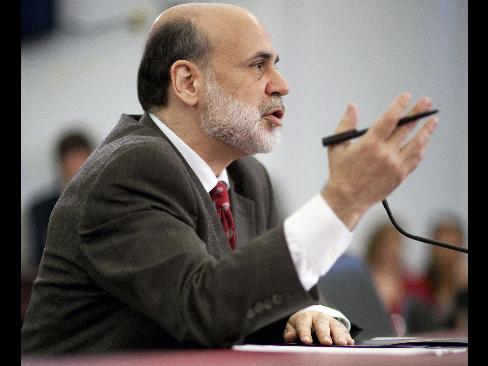

With Andrew Cuomo now elbow deep in the Merrill bonus investigation, and likely about to file criminal charges against Ken Lewis any minute, what better way to shut him up than to promote him immediately to the post he will obtain sooner or later anyway. If in the meantime, the Faustian bargain between Lewis and Paulson/Bernanke can be retained without Lewis actually going to jail for folding like a lawn chair to threats about his job security by the Chairman, so much the better. As for the simple matter of how and why the President can so blatantly interfere in State affairs, and specifically nudging the direction of popular elections, which ultimately are the domain purely of US citizens, it is likely that nobody will care.

Submitted by Tyler Durden on 09/19/2009

Source: ZeroHedge