The Fed and the ECB know exactly that it is totally insane what they are doing, unless you want to destroy the middle class and the entire financial system, which is exactly what they are doing and deliberately so.

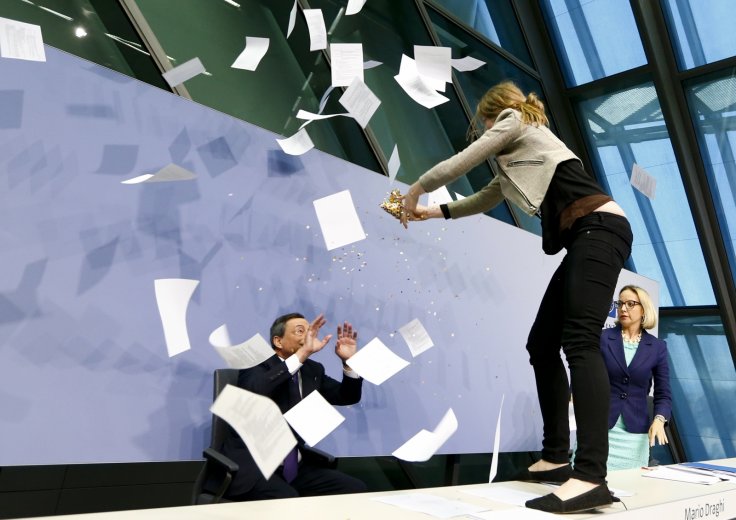

– The ECB’s Lunatic Full Monty Treatment (Acting Man, March 6, 2015):

…

In short, the entire citizenry of the euro area has already become poorer due to the efforts of the ECB. The explicit goal of the central bank is now to make them even more so. What is the point of such a policy?

There is of course a point to this seeming lunacy: it is all done to support the profligate governments of Europe’s welfare states and keep the formation of the socialistic super-state in Europe on track. Whether this is seen as good or bad by the average citizen is not even up for debate: it is simply what the political and bureaucratic elites have long ago decided is good for the citizenry, since they think they know best. One might say that it is up to said citizens to elect someone who would do things differently, but that runs into the practical problem that many, even most, of the political groups offering an alternative are even bigger etatistes than the current elite. Whether they are of the socialist or the nationalist (more precisely, national socialist) variety matters little in this context. One would have to expect them to implement even more central economic planning.

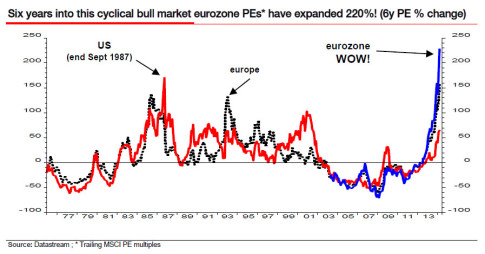

Conclusion:

The ECB may succeed in increasing economic activity and prices in Europe (especially the latter) by stepping up the pace of monetary pumping even more. However, this will not create any new wealth and will ultimately only sow the seeds of the next crisis. Since many economic regions in Europe are already very poor structural shape, it is also possible that that not even the illusion of economic growth can be created anymore. Bondholders should however be happy, as they can now unload the debt of governments that are up to their eyebrows in debt that will never be repaid in real terms on a buyer with unlimited buying power.