– The Sovereign Debt Bubble Will Continue To Expand Until – BANG – The System Implodes (Economic Collapse, Jan 20, 2013):

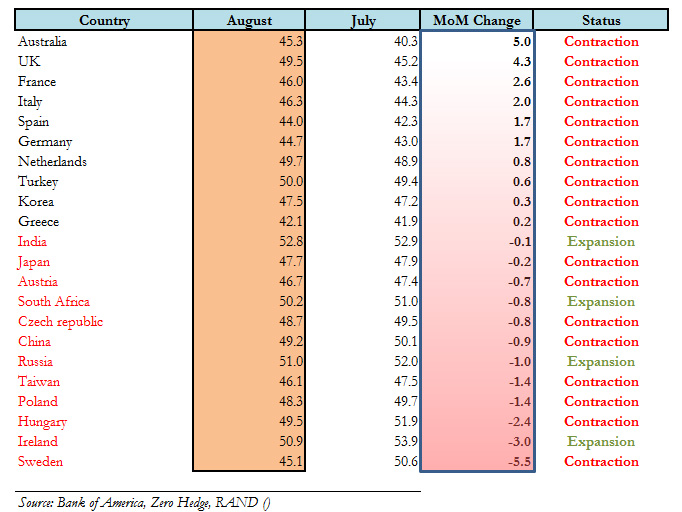

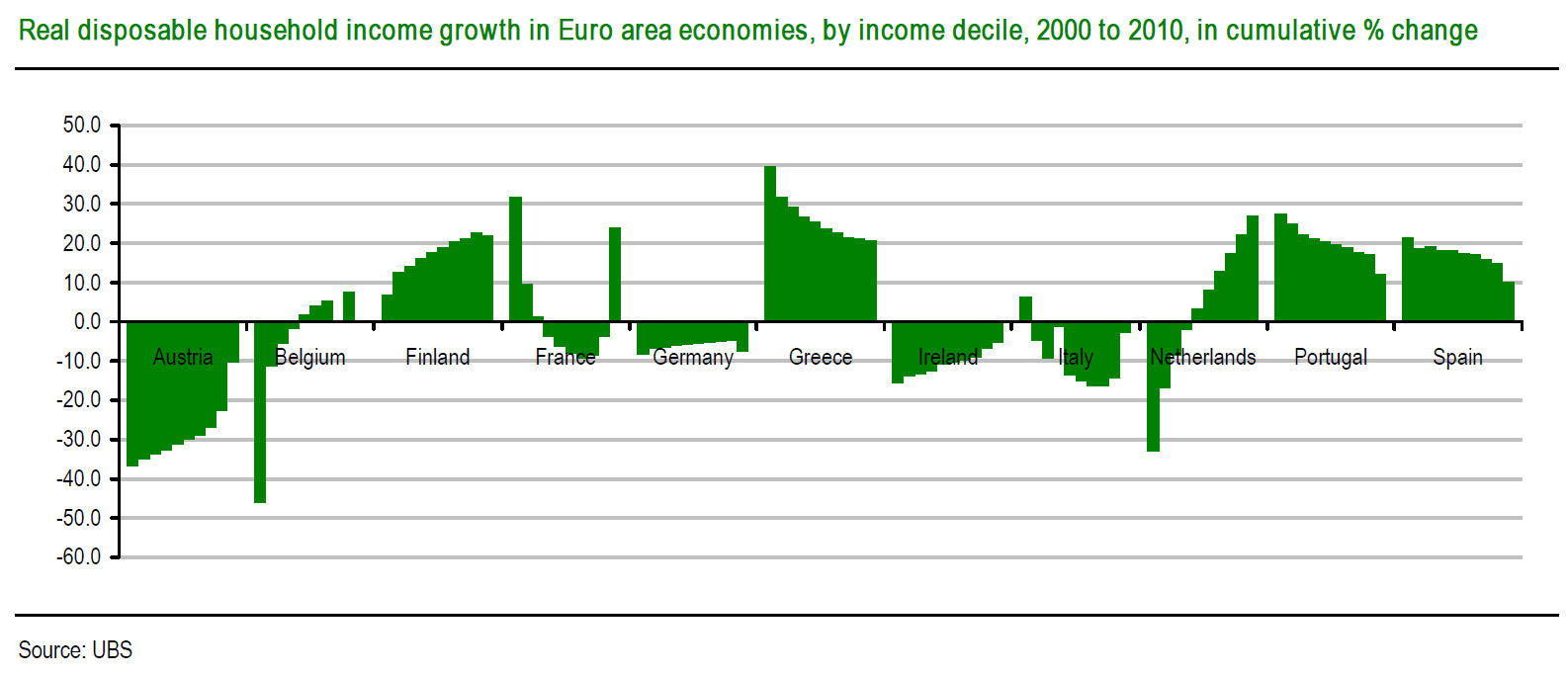

Why are so many politicians around the world declaring that the debt crisis is “over” when debt to GDP ratios all over the planet continue to skyrocket? The global economy has never seen anything like the sovereign debt bubble that we are experiencing today. The United States, Japan, and nearly every major nation in Europe are absolutely drowning in debt. We have heard a lot about “austerity” over in Europe in recent years, but debt to GDP ratios continue to rise in Greece, Spain, Italy, Ireland and Portugal. In general, most economists consider a debt to GDP ratio of 100% to be a “danger level”, and most of the economies of the western world have either already surpassed that level or are rapidly approaching it. Of course the biggest debt offender of all in many ways is the United States. The U.S. debt to GDP ratio has risen from 66.6 percent to 103 percent since 2007, and the U.S. government accumulated more new debt during Barack Obama’s first term than it did under the first 42 U.S. presidents combined. This insane sovereign debt bubble will continue to expand until a day of reckoning arrives and the system implodes. Nobody knows exactly when that moment will be reached, but without a doubt it is coming.

Read moreThe Sovereign Debt Bubble Will Continue To Expand Until – BANG – The System Implodes