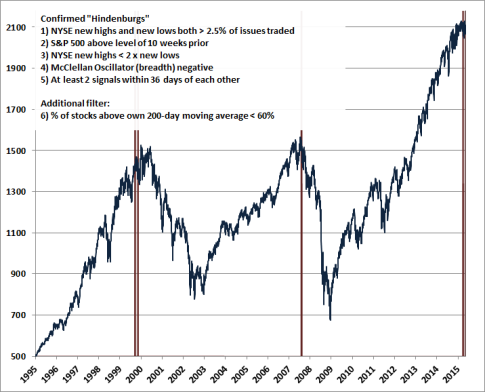

– When Hindenburg Omens Are Ominous (ZeroHedge, Aug 9, 2015):

I’ve frequently noted that Hindenburg “Omens” in their commonly presented form (NYSE new highs and new lows both greater than 2.5% of issues traded) appear so frequently that they have very little practical use, especially when they occur as single instances. While a large number of simultaneous new highs and new lows is indicative of some amount of internal dispersion across individual stocks, this situation often occurs in markets that have been somewhat range-bound.