Added: Sept. 17, 2008

Source: YouTube

The man who trades freedom for security does not deserve nor will he ever receive either. – Benjamin Franklin

Added: Sept. 17, 2008

Source: YouTube

NEW YORK (Reuters) – Manic and increasingly desperate dealmaking gripped Wall Street on Wednesday as U.S. stocks plummeted to three-year lows amid new signs of distress in the global financial industry.

Morgan Stanley was discussing a merger with regional banking powerhouse Wachovia, the New York Times reported. CEO John Mack got a phone call from Wachovia on Wednesday but is also pursuing other options, the paper said.

“In this market, anything’s possible. It seems like the market wants the investment banking model to disappear,” said Danielle Schembri, bond analyst covering brokers at BNP Paribas in New York.

Washington Mutual , the country’s largest savings bank, put itself up for sale, sources said, confirming a New York Times report. Potential suitors include Citigroup, JPMorgan, Wells Fargo and HSBC, they added.

Read moreWall Street crisis deepens and Banks rush to do deals

Federal bank insurance fund dwindling, regulators consider options for replenishing it

WASHINGTON (AP) — Banks are not the only ones struggling in the growing financial crisis. The fund established to insure their deposits is also feeling the pinch, and the taxpayer may be the lender of last resort.

The Federal Deposit Insurance Corp., whose insurance fund has slipped below the minimum target level set by Congress, could be forced to tap tax dollars through a Treasury Department loan if Washington Mutual Inc., the nation’s largest thrift, or another struggling rival fails, economists and industry analysts said Tuesday.

China, which holds a fifth of its currency reserves in Fannie Mae and Freddie Mac debt, may cut the portion held in US dollars, according to China International Capital Corp (CICC), one of the nation’s biggest investment banks.

The US government this week seized control of the two mortgage-finance companies, which account for almost half of the home-loan market in the world’s biggest economy, to prevent defaults from crippling them. China holds up to $400 billion in the two firms’ debt, CICC Chief Economist Ha Jiming said in a report Thursday.

“The crisis has made Chinese officials realize it’s a bad idea to put all their eggs in one basket,” wrote Hong Kong-based Ha. “This will likely lead to greater diversification of foreign exchange reserve investments.”

China held $447.5 billion of US agency bonds as of June 2008, according to the CICC calculations using disclosures by the US Treasury. It is likely to reduce the portion of reserves in dollar assets from the current 60 percent by purchasing more non-dollar assets with new reserves, he said.

Sept. 9 (Bloomberg) — When the history is written on the collapse of Fannie Mae and Freddie Mac, it will go down in the annals of corporate scandals as one of the greatest accounting scams committed in broad daylight.

All anyone had to do to know the government-guaranteed mortgage financiers were insolvent was read their financial statements. You didn’t need a trained professional eye to discern this open secret, only a skeptical one.

Just last month, Fannie and Freddie said their regulatory capital was $47 billion and $37.1 billion, respectively, as of June 30. The Treasury Department now says it may have to inject as much as $200 billion of capital into the two companies. Nothing much changed at the companies in that span. They just couldn’t get the government to keep up the ruse any longer.

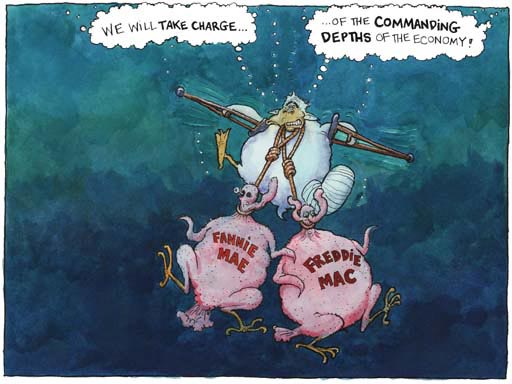

Steve Bell

Tuesday September 9 2008

Source: The Guardian

With yesterday’s announcement of the most massive federal bailout of all time, it’s now official: Fannie Mae and Freddie Mac, the two largest mortgage lenders on Earth, are bankrupt.

Some Washington bigwigs and bureaucrats will inevitably try to spin it. They’ll avoid the “b” word with vengeance. They’ll push the “c” word (conservatorship) with passion. And in the newspeak of 21st century bailouts, they’ll tell you “it all depends on what the definition of solvency is.”

The truth: Without their accounting smoke and mirrors, Fannie and Freddie have no capital. The government is seizing control of their operations. Their chief executives are getting fired. Common shareholders will be virtually wiped out. Preferred shareholders will get pennies. If that’s not wholesale bankruptcy, what is?

Read moreWhy Government Bailout Of Fannie And Freddie Will Fail

BEIJING, Sept 8 (Reuters) – The U.S. Treasury’s takeover of Fannie Mae and Freddie Mac is good news in the short term for China, the biggest holder of the giant mortgage lenders’ debt, but Beijing’s huge U.S. exposure still poses a serious risk, a prominent government researcher said on Monday.

China owned $376 billion of debt issued by U.S. government agencies, principally Fannie and Freddie, as of mid-2007.

The seizure of the two firms, prompted by worries over their shrinking capital, was the latest in a series of emergency steps taken by U.S. authorities to quell a year-long credit crisis that has helped push many economies toward recession. [ID:nN07479172]

“China has bought a lot of asset-backed securities, and there might be short-term improvement in price,” said He Fan, an economist with the Chinese Academy of Social Sciences.

But, taking a longer view, he said the bailout posed a problem: if the Treasury issues new debt to fund the rescue, should China be a buyer or not?

“For China, whether or not you buy the new treasuries, there will be losses: if you buy them, you’re getting deeper in the hole; if you don’t buy, your existing holdings will lose value,” He said.

Read moreChina frets at US risk after Fannie/Freddie bailout

THE events of the weekend begin the greatest intervention in the US economy by the Federal Government since the Great Depression, with the Bear Stearns rescue but a splutter on this road we must now travel.

If you were wondering what all the flag-waving at the Republican convention has been about, it is now clear. Americans are waving goodbye to the prosperity the nation has enjoyed since the Great Depression and a final goodbye to democracy. But while preparation for the most important decision made in the nation’s post-depression financial history towered above the conventions, I don’t think the fate of Freddie and Fannie and the remaining government-sponsored enterprises (GSEs) was mentioned during either convention.

Related article: Jim Rogers: US Is More Communist than China

And the politicians. President Bush has long authorised the Treasury to open its purse strings and, naturally, Treasury Secretary Henry Paulson said he did not expect the line of endless taxpayer credit to be used. This is like signing an authority to go to war and saying we don’t expect to go to war. Once the authority is given, it will happen. It was always laughable to expect otherwise. Paulson “briefed” John McCain and Barack Obama on the “plan”. The fact is that while America, and the world, wait to see who will govern, Mr Paulson has decided to take matters out of the politicians’ hands.

They willingly agreed. The ultimate political power, to spend taxpayers’ money, has been tossed away. Obviously the economy is too important to be left to the politicians. Instead it is to be put into “conservatorship”. It has come to this.

USA TODAY WASHINGTON – The unprecedented federal takeover of mortgage giants Freddie Mac and Fannie Mae announced on Sunday is a bold attempt to stabilize financial markets and restore the faltering housing market, but it thrusts trillions of dollars of risk directly onto taxpayers’ shoulders.

“You can call it a bailout, you can call it a safety net or you can call it a rescue package, but the bottom line is the American taxpayer is left footing the bill,” says Richard Yamarone, director of economic research at Argus Research.

Read moreTaxpayers take on trillions in risk in Fannie, Freddie takeover

The nationalization of Fannie Mae and Freddie Mac shows that the U.S. is “more communist than China right now” but its brand of socialism is meant only for the rich, investor Jim Rogers, CEO of Rogers Holdings, told CNBC Europe on Monday.

“America is more communist than China is right now. You can see that this is welfare of the rich, it is socialism for the rich… it’s just bailing out financial institutions,” Rogers said.

Stock markets jumped after the U.S. government’s decision to launch what could be its biggest federal bailout ever, in a bid to support the housing market and ward off more global financial market turbulence.

But Rogers said in the long term the move spelled trouble.

“This is madness, this is insanity, they have more than doubled the American national debt in one weekend for a bunch of crooks and incompetents. I’m not quite sure why I or anybody else should be paying for this,” Rogers told “Squawk Box Europe.”

European stocks soared on Monday, led by banks. UBS was up 11 percent, BNP Paribas up 8 percent, Credit Agricole up 11.1 percent and HBOS up 13.8 percent.

“You certainly gonna see a huge jump in any financial institutions which owned a lot of Fannie [FNM 0.75  -6.29 (-89.35%)

-6.29 (-89.35%) ![]() ] or Freddie [FRE 0.75

] or Freddie [FRE 0.75  -4.35 (-85.29%)

-4.35 (-85.29%) ![]() ] … because they don’t have to worry about going bankrupt all of a sudden,” Rogers said.

] … because they don’t have to worry about going bankrupt all of a sudden,” Rogers said.

“Bank stocks around the world are going through the roof, that’s ’cause they’ve all been bailed out. You don’t see the homeowners in Kansas going through the roof ’cause they’re not being bailed out,” he added.

Sept. 7 (Bloomberg) — William Poole, former president of the Federal Reserve Bank of St. Louis, said taxpayers may face a $300 billion bill to revive Fannie Mae and Freddie Mac, the mortgage giants being taken over by the Federal government.

“I would not be surprised if their total losses aggregate about 5 percent of their obligations” of about $6 trillion, Poole said today in an interview on Bloomberg Radio. “Five percent does not seem to me to be an outrageous guess.”

Read moreU.S. Losses on Fannie, Freddie May Be $300 Billion, Poole Says

Treasury chief Paulson unveils historic government takeover of twin mortgage buyers. Top executives are out.

NEW YORK (CNNMoney.com) — Federal officials on Sunday unveiled an extraordinary takeover of Fannie Mae and Freddie Mac, putting the government in charge of the twin mortgage giants and the $5 trillion in home loans they back.

The move, which allows the Treasury to provide as much as $200 billion in capital to the two companies, marks Washington’s most dramatic attempt yet to shore up the nation’s housing market, which is suffering from record foreclosures and falling prices.

THE US TREASURY will today announce a rescue of Fannie Mae and Freddie Mac, two giant American mortgage banks, in what is likely to be the biggest financial bail-out of recent history.

The move may trigger a bounce in global stock markets tomorrow. However, analysts warn that some of the uncertainties that plagued the markets last week, including worries over the duration of the credit crunch, will persist.

Read moreRecord bail-out in US of Fannie Mae and Freddie Mac

Henry M. Paulson Jr., the Treasury secretary, and Ben S. Bernanke, the Federal Reserve chairman

WASHINGTON – Senior officials from the Bush administration and the Federal Reserve on Friday called in top executives of Fannie Mae and Freddie Mac, the mortgage finance giants, and told them that the government was preparing to place the two companies under federal control, officials and company executives briefed on the discussions said.

Dollar and yuan currency at a bank in China. China’s central bank has accumulated about $1 trillion in United States debt.

HONG KONG – China’s central bank is in a bind.

It has been on a buying binge in the United States over the last seven years, snapping up roughly $1 trillion worth of Treasury bonds and mortgage-backed debt issued by Fannie Mae and Freddie Mac.

Those investments have been declining sharply in value when converted from dollars into the strong yuan, casting a spotlight on the central bank’s tiny capital base. The bank’s capital, just $3.2 billion, has not grown during the buying spree, despite private warnings from the International Monetary Fund.

Now the central bank needs an infusion of capital. Central banks can, of course, print more money, but that would stoke inflation. Instead, the People’s Bank of China has begun discussions with the finance ministry on ways to shore up its capital, said three people familiar with the discussions who insisted on anonymity because the subject is delicate in China.

The financial tsunami is already on its way. That is why the central banks have intervened on a massive scale to support the dollar, so that the tsunami will hit the economy a little later.

Asking a totally broke government to buy assets is a interesting idea. And who will ultimately pay for any government spending? The taxpayers – like always – will have to pay for it, up to the point where they too will ‘fail’, but there will be no bailout for them – like always.

___________________________________________________________________________

Sept. 4 (Bloomberg) — The U.S. government needs to start buying assets to stem a bourgeoning “financial tsunami,” according to Bill Gross, manager of the world’s biggest bond fund.

WASHINGTON (AP) – The number of troubled U.S. banks leaped to the highest level in about five years and bank profits plunged by 86 percent in the second quarter, as slumps in the housing and credit markets continued.

Federal Deposit Insurance Corp. data released Tuesday show 117 banks and thrifts were considered to be in trouble in the second quarter, up from 90 in the prior quarter and the biggest tally since mid-2003.

The number of unsold homes on the market in the United States is at levels not seen for at least 40 years, and prices are continuing to slide, according to a disheartening new survey.

With participants throughout the financial system saying that the credit crisis cannot end until the US housing market stabilises, the monthly data from the National Association of Realtors (NAR) failed to show any unequivocal improvement.

The July figures did show an increase in the number of buyers, lured by the prospect of getting a long-term bargain. However, two out of every five sales are now distressed sales – such as foreclosed homes put on the market by banks – and desperate sellers are continuing to drop their prices.

Aug. 22 (Bloomberg) — A failure of U.S. mortgage finance companies Fannie Mae and Freddie Mac could be a catastrophe for the global financial system, said Yu Yongding, a former adviser to China’s central bank.

“If the U.S. government allows Fannie and Freddie to fail and international investors are not compensated adequately, the consequences will be catastrophic,” Yu said in e-mailed answers to questions yesterday. “If it is not the end of the world, it is the end of the current international financial system.”

Freddie and Fannie shares touched 20-year lows yesterday on speculation that a government bailout will leave the stocks worthless. Treasury Secretary Henry Paulson won approval from the U.S. Congress last month to pump unlimited amounts of capital into the companies in an emergency.

Read moreFreddie, Fannie Failure Could Be World `Catastrophe,’ Yu Says

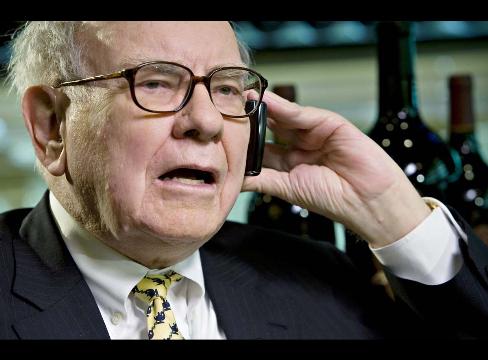

Aug. 22 (Bloomberg) — Fannie Mae and Freddie Mac, the two largest mortgage finance companies, “don’t have any net worth,” billionaire investor Warren Buffett said.

“The game is over” as independent companies said Buffett, the 77-year-old chairman of Berkshire Hathaway Inc., in an interview on CNBC today. “They were able to borrow without any of the normal restraints. They had a blank check from the federal government.”

VANCOUVER, B.C. – The U.S. financial crisis has cut so deep – and the government has taken on so much debt in misguided attempts to bail out such companies as Fannie Mae (FNM) and Freddie Mac (FRE) – that even larger financial shocks are still to come, global investing guru Jim Rogers said in an exclusive interview with Money Morning.

Indeed, the U.S. financial debacle is now so ingrained – and a so-called “Super Crash” so likely – that most Americans alive today won’t be around by the time the last of this credit-market mess is finally cleared away – if it ever is, Rogers said.

SINGAPORE (Reuters) – The worst of the global financial crisis is yet to come and a large U.S. bank will fail in the next few months as the world’s biggest economy hits further troubles, former IMF chief economist Kenneth Rogoff said on Tuesday.

“The U.S. is not out of the woods. I think the financial crisis is at the halfway point, perhaps. I would even go further to say ‘the worst is to come’,” he told a financial conference.

“We’re not just going to see mid-sized banks go under in the next few months, we’re going to see a whopper, we’re going to see a big one, one of the big investment banks or big banks,” said Rogoff, who is an economics professor at Harvard University and was the International Monetary Fund’s chief economist from 2001 to 2004.

Read moreLarge U.S. bank collapse seen ahead, says ex-IMF chief economist