– Batista’s OGX Files Bankruptcy: Largest Ever In Latin American History (ZeroHedge, Oct 30, 2013):

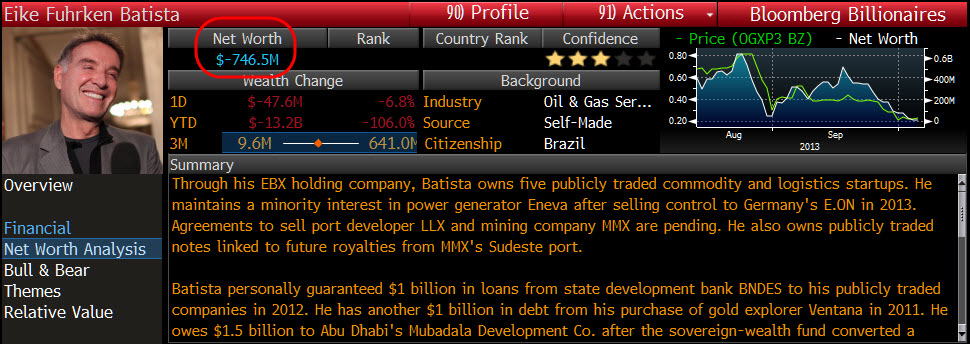

In line with what we discussed last night, once cajillionaire Eike Batista’s net wealth has now collapsed to less than -$746.5 Million according to Bloomberg as Veja notes, his “take over the world” company OGX has declared bankruptcy following the breakdown of restructuring talks with bondholders:

- *OGX FILES FOR BANKRUPTCY PROTECTION IN RIO, BATISTA LAWYER SAYS

- *BATISTA’S OGX EXTENDS DECLINE TO 30% AFTER BANKRUPTCY FILING

- *BATISTA LAWYER BERMUDES COMMENTS ON FILING BY PHONE FROM RIO

The filing puts $3.6 billion of bonds into default – the largest corporate debt debacle on record for Latin America.

As of this morning his net worth was already -$745 million..