Full article here:

– Israel Starting Trouble in Argentina (The Rebel Website, Jan 21, 2015):

…

In 1994, a “suicide bombing” of a Jewish center in Argentina left 85 people dead. International Zionism was very quick to point the finger of blame at Iran. In other words, the Mossad did it!

In 2004, the Argentinian Jew Alberto Nisman was, after years of Jewish pressure, finally assigned to investigate the 1994 bombing. Nisman, as today’s Slimes reports, “became entangled in a labyrinthine plot that he traced to and its militant Lebanese ally, Hezbollah.” Evidently, its OK to spin “conspiracy theories” if they point to Muslims as the culprits.

…

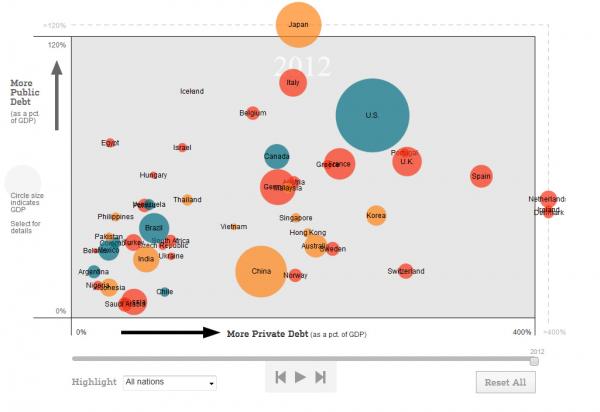

The Zionists are mad-as-hell with Argentina for doing business with Iran. Adding to that strong motive is de Kirchner’s refusal to pay the banksters what they feel they are “owed” on Argentina’s foreign debt; and her coziness with the Big Bad Putin and his BRICS trading bloc, which Argentina may be joining in the future.

…