What recovery?

– Bernanke set to begin Fed’s tapering of QE – but is the US economy ready? (Guardian Sep. 15, 2013):

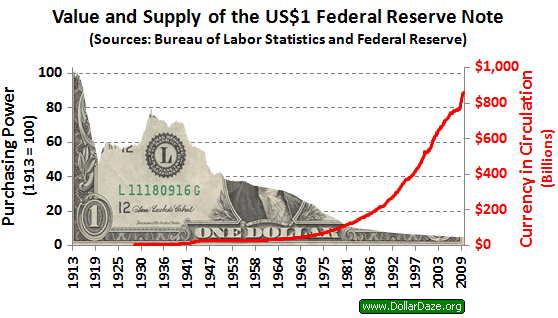

After years of the Fed pumping $85bn a month into financial markets, the strength of the American recovery will be tested

As Barack Obama gears up to announce Ben Bernanke’s successor, the Federal Reserve chairman is expected to make the deeply symbolic gesture this week of announcing the beginning of the end of quantitative easing – the drastic depression-busting policy that has led the Fed to pump an extraordinary $85bn (£54bn) a month into financial markets.

It will signal the Fed’s belief that the US economy is on the mend, but it could also frighten the markets and hit interest rates. So what exactly is Bernanke doing, why now – and how might it affect the UK and other countries?