The financial crisis will result in tax revenues from City bonuses alone falling by as much as £4bn next year, according to one of Britain’s most influential economic forecasting firms.

Restrictions on bonuses at the banks which the Government is helping to rescue will also have the unintended consequence of lowering tax revenues Photo: MICHAEL WALTER

As investment banks, hedge funds and private equity firms – three of the principal drivers of the Square Mile’s explosive growth of recent years – cut tens of thousands of jobs, the Centre for Economics and Business Research (CEBR) expects the Treasury to face an overall City-generated taxation “black hole” of more than £10bn.

The CEBR believes the Government will collect around £5bn less than previously-estimated in corporation tax, while tax generated by bonuses, National Insurance contributions and base salaries is likely to fall by around £6bn.

The bleak forecasts underline the many ways in which cutbacks in the City, which has become a crucial engine of national economic growth, will contribute to an expected recession in Britain.

Restrictions on bonuses at the banks which the Government is helping to rescue will also have the unintended consequence of lowering tax revenues from City firms.

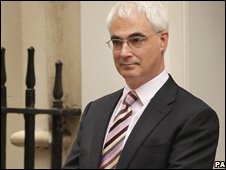

The deficit means Alistair Darling, the Chancellor, may need to borrow up to £110bn in the next financial year to plug the hole in the national balance sheet – almost three times the estimate of the £38bn forecast in his Budget statement last March.

Read moreCity of London recession to trigger £11bn tax revenue black hole