See also:

– How to invest for a global-debt-bomb explosion; Prepare for an apocalyptic anarchy (Market Watch)

– Marc Faber on CNBC: All Governments Will Default On Their Debt, Including The US

Having the Bernanke puppet in place, the elite can now continue to collapse the system.

By Albert Edwards, Societe Generale

Mr Bernanke’s in-house Fed economists have found that the Fed wasn’t responsible for the boom which subsequently turned into the biggest bust since the 1930s. Are those the same Fed staffers whose research led Mr Bernanke to assert in Oct. 2005 that “there was no housing bubble to go bust”? The reasons for the US and the UK central banks inflating the bubble range from incompetence and negligence to just plain spinelessness. Let me propose an alternative thesis. Did the US and UK central banks collude with the politicians to ‘steal’ their nations’ income growth from the middle classes and hand it to the very rich?

Ben Bernanke?s recent speech at the American Economic Association made me feel sick. Like Alan Greenspan, he is still in denial. The pigmies that populate the political and monetary elites prefer to genuflect to the court of public opinion in a pathetic attempt to deflect blame from their own gross and unforgivable incompetence.

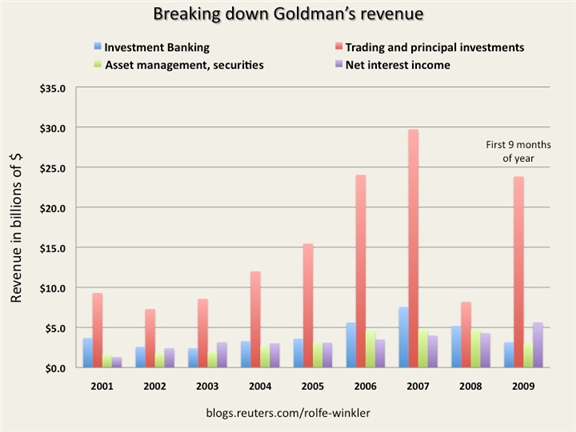

The US and UK have seen a huge rise in inequality over the last two decades, as growth in national income has been diverted almost exclusively to the top income earners (see chart below). The middle classes have seen median real incomes stagnate over that period and, as a consequence, corporate margins and profits have boomed.

Some recent reading has got me thinking as to whether the US and UK central banks were actively complicit in an aggressive re-distributive policy benefiting the very rich. Indeed, it has been amazing how little political backlash there has been against the stagnation of ordinary people?s earnings in the US and UK. Did central banks, in creating housing bubbles, help distract middle class attention from this re-distributive policy by allowing them to keep consuming via equity extraction? The emergence of extreme inequality might never otherwise have been tolerated by the electorate (see chart below). And now the bubbles have burst, along with central banks? credibility, what now?

(Click on images to enlarge.)

After reading Ben Bernanke?s speech, once again denying culpability for the bubble, I really didn?t know whether to laugh or cry (remember that Ben Bernanke, like Tim Geithner, was a key member of the Greenspan Fed). I feel like Peter Finch in the film Network, sticking my head out of the window and shouting “I’m as mad as hell and I’m not going to take it anymore!” Although criticism of the Fed (and the Bank of England) has now become louder and more widespread, I feel my longstanding derision for their actions during the so-called ?good years? puts me in a stronger position than some to offer further comment.

Opening my 2002-2005 file of old weeklies I did not have to go any further than the first paragraph of the top copy (end of December 2005). “As far as Alan Greenspan’s tenure at the Fed is concerned, we have spared few words of derision. We have made plain our views that the supposed US prosperity that has accompanied his tenure has been based on a grotesque mountain of debt. We have likened the economy to a Ponzi scheme which will ultimately collapse. He has allowed the funding of strong economic activity by mortgaging the US’s future against one bubble (equity) and then another (housing), which is now beginning to implode“. These are almost consensus thoughts now, but not then.

The pigmies that populate the political and monetary elites prefer to genuflect to the court of public opinion. Blaming the banks is simply a pathetic attempt to deflect the public fury from their own gross and unforgivable incompetence. We have stated before that banks are not the primary cause of the bust. Just as in Japan, a decade earlier, bank problems are a symptom of the bust. It is the monetary and regulatory authorities that are responsible for this mess. And it is not just obvious in retrospect. It was perfectly obvious from the beginning.

I was shocked by a recent survey of Wall Street and business economists, published in the Wall Street Journal (see Bernanke View Doubted 14 Jan? link). Asked whether they agreed or disagreed with the proposition ‘excessively easy Fed policy in the first half of the decade helped cause a bubble in house prices’, some 42, or 74% agreed with the proposition. So unbelievably there are still 12 economists surveyed who did not agree! Even more incredible, a majority of academic economists did not agree with the proposition. Maybe they have sympathy for a fellow academic or maybe they actually believe the preposterous proposition that the western central banks were not in control of the bubbles which were primarily due to tidal waves of surplus savings washing across from Asia.

John Taylor shows this to be nonsense. There was no global savings glut (see chart below)

Federal Reserve secrecy must be understood in the context of an intellectual dogma which Alan Greenspan inculcated into the fabric of the Federal Reserve and the economics profession, and which has severely harmed ordinary Americans. Bernanke’s ‘Great Moderation’ speech in 2004 didn’t even consider the idea that the economy was becoming more unstable, even as risks were being built into the system by the policies he encouraged. He ignored evidence of a crisis, saying in 2007 that the turmoil was contained to subprime mortgages, ignoring the bankruptcy of over 100 mortgage originators, and the clear evidence the crisis would spread. Now, even as the crisis is said to be subsiding, we still do not have credit markets that are able to function without substantial government support, we have not addressed institutions that are ‘too big to fail’ which the Fed oversees, bank credit availability is again shrinking (posing risk of further increasing already high unemployment), and toxic assets in the system on the books of both private banks and the Federal Reserve have still not seen price discovery.

Federal Reserve secrecy must be understood in the context of an intellectual dogma which Alan Greenspan inculcated into the fabric of the Federal Reserve and the economics profession, and which has severely harmed ordinary Americans. Bernanke’s ‘Great Moderation’ speech in 2004 didn’t even consider the idea that the economy was becoming more unstable, even as risks were being built into the system by the policies he encouraged. He ignored evidence of a crisis, saying in 2007 that the turmoil was contained to subprime mortgages, ignoring the bankruptcy of over 100 mortgage originators, and the clear evidence the crisis would spread. Now, even as the crisis is said to be subsiding, we still do not have credit markets that are able to function without substantial government support, we have not addressed institutions that are ‘too big to fail’ which the Fed oversees, bank credit availability is again shrinking (posing risk of further increasing already high unemployment), and toxic assets in the system on the books of both private banks and the Federal Reserve have still not seen price discovery.