Message to US taxpayers: “We will get our bonuses….and you will pay for it!”

_________________________________________________________________________

Dec. 4 (Bloomberg) — American International Group Inc., whose bonuses and perks drew fire from lawmakers after the insurer accepted a federal bailout, will make special retention payments that more than double the salaries of some senior managers, according to a person familiar with the matter.

Some executives among 130 recipients will get more than $500,000, about 200 percent of their salaries, to stay through 2009, said the person, who declined to be named because the information hasn’t been publicly disclosed. An undetermined number of lower-paid employees will also get cash awards to dissuade them from quitting, the person said.

“It seems like more than what you’d need to pay to get people to stick around,” said David Schmidt, a senior consultant at executive pay firm James F. Reda & Associates. “Nobody’s hiring, so where are you going to go?”

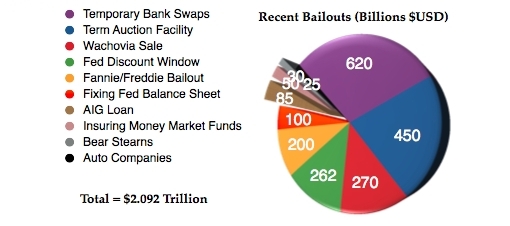

Chief Executive Officer Edward Liddy is encouraging top employees at AIG subsidiaries to remain so the units retain their value while he seeks buyers. The New York-based company is selling businesses, including its U.S. life insurance and retirement services operations, to repay loans in a $152.5 billion government rescue of AIG, which had a record $37.6 billion in net losses so far this year.

Best Interest

“We have to hold on to the talented people running our businesses,” said AIG spokesman Nicholas Ashooh, adding that many managers have lost much of their life savings. The executives “have deep business relationships that are not easily duplicated,” he said today in an e-mail. “Our competitors have been trying to hire them for years.”

Read moreAIG May Double Some Salaries With Retention Payments