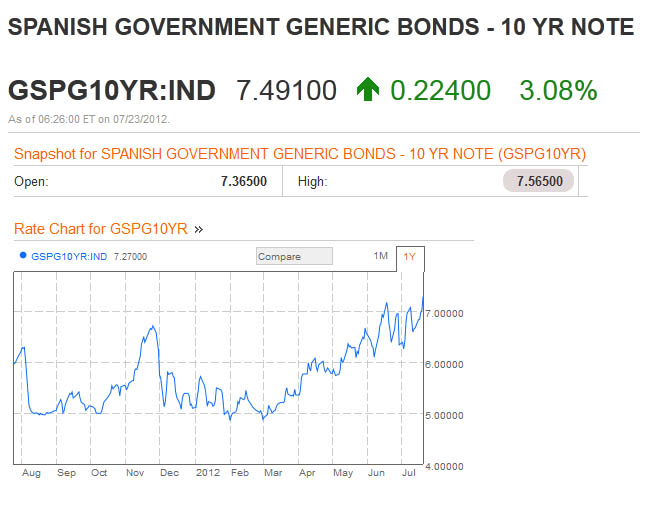

– Spanish 10 Year Trades On The Ugly Side Of 7.50% (ZeroHedge, July 23, 2012):

The last time a sovereign bond issue was imploding at this rate without the ECB’s intervention, Silvio Berlusconi was about to be forcibly retired. This time, however, we fail to see what the assorted globalist elements will benefit by having Rajoy displaced: after all he has been a studious and versatile pawn of the status quo, who squawks repeatedly and whenever needed that Spain is solvent and that its banks are not in need of a bailout. That said, stick a fork in Spain, and all those newsletter writers who were saying to buy its bonds, or equities: at last check the IBEX was down nearly 5%, after falling by the same amount on Friday. This is the equivalent of the Dow Jones tumbling by just about 600 points. The catalyst – the 10 Year which touched on 7.565% minutes earlier, as virtually all hope is now lost – it is now every country and region for himself, and he who panics first, panics best.