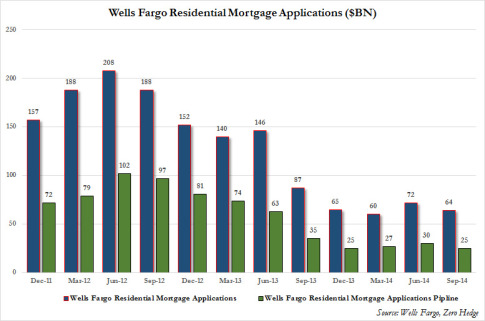

– Mortgage Application Pipeline At America’s Largest Mortgage Lender Drops To Lowest Since Lehman (ZeroHedge, Oct 14, 2014):

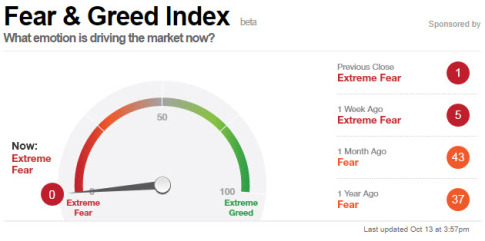

So much for the much hyped, if quite negligible, second quarter rebound in mortgage activity. After rates tumbled, and continued to tumble, there was some hope that at least the offset to the bond market screaming contraction and deflation (something even stocks have realized in recent days), would be more American’s buying homes, which naturally means applying for mortgages. Well, that dead cat bounce has come and gone. As America’s biggest mortgage lender, Wells Fargo, reported moments ago when it once again magically managed to report EPS and revenues which came right in line with expectations (of $2.11 and $21.2 billion), the US housing picture is once again the worst it has ever been (excluding those days around the Lehman bankruptcy when all of finance died for a few weeks).

Case in point: according to Wells Q3 Earnings Supplement, while Mortgage Applications declined from a transitory one year high of $72 billion in Q2 to $64 billion, this number is going far lower. The reason: Wells’ Morgage Application Pipeline just tumbled back to $25 billion, matching the lowest number since Lehman, and putting an end to any debate about the state of the US housing market.

In short: the only people buying houses in the US now are foreigners laundering their illegal, tax-exempt profits (ever fewer) and those as close to the Fed’s ZIRP as possible, and, of course, paying all cash. Everyone else: not so much.