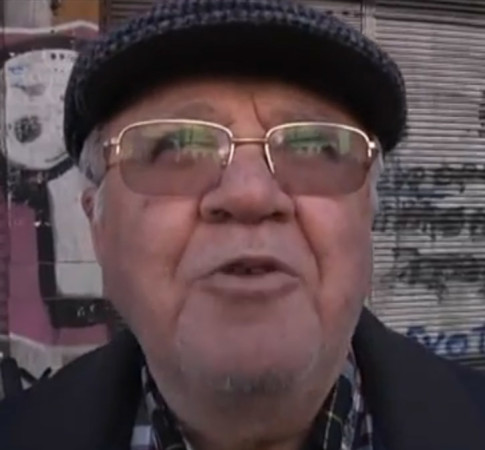

Pepe Escobar is the roving correspondent for Asia Times/Hong Kong, an analyst for RT and TomDispatch, and a frequent contributor to websites and radio shows ranging from the US to East Asia.

– China pivots everywhere (RT, Feb 20, 2015):

By Pepe Escobar

The world’s leading economy is on a roll as it enters a new year in the Chinese zodiac. Welcome to the Year of the Sheep. Or Goat. Or Ram. Or, technically, the Green Wooden Sheep (or Goat).

Even the best Chinese linguists can’t agree on how to translate it into English. Who cares?

The hyper-connected average Chinese – juggling among his five smart devices (smartphones, tablets, e-readers) – is bravely advancing a real commercial revolution. In China (and the rest of Asia) online transactions are now worth twice the combined value of transactions in the US and Europe.

Read moreChina Pivots Everywhere