See also:

– EU Foreign Ministers Agree On Iranian Oil Embargo – Europe Is Shooting Itself In The Foot

From the article:

“Surely, when it comes to shooting itself in the foot, Europe truly has no equal.”

– Iran Stops Oil Sales To British, French Companies (ZeroHedge, Feb. 19, 2012):

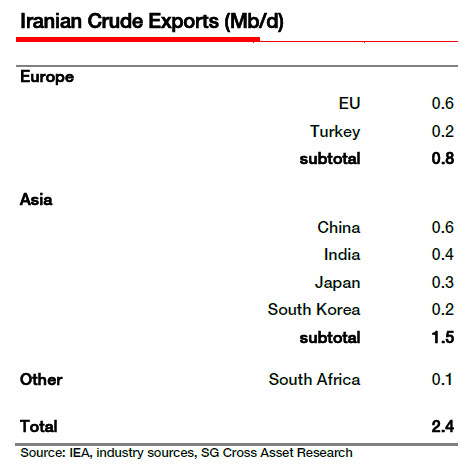

The geopolitical game theory escalates once again, as Iran, which four days ago halted exports to peripheral European countries took it up a notch, and has as of this morning halted sales to British and French companies. Reuters reports: “Iran has stopped selling crude to British and French companies, the oil ministry said on Sunday, in a retaliatory measure against fresh EU sanctions on the Islamic state’s lifeblood, oil. “Exporting crude to British and French companies has been stopped … we will sell our oil to new customers,” spokesman Alireza Nikzad was quoted as saying by the ministry of petroleum website.” Here is the actual statement from MOP.ir. As a reminder, on January 27 we said how Iran was about to “Turn Embargo Tables: To Pass Law Halting All Crude Exports To Europe.” And so it has – now, the relentless media campaign about China isolating Iran in response to American demands has to be respun: recall that in early February Reuters told us that “China will halve its crude oil imports from Iran in March compared to average monthly purchases a year ago, as a dispute over payments and prices stretches into a third month, oil industry sources involved in the deals said on Monday.” Apparently that may not have been the case, as there is no way Iran would have escalated as far as it has unless it had replacement buyers of one third of its crude. Incidentally, this is just as we predicted in “A Very Different Take On The “Iran Barters Gold For Food” Story.” The end result of this senseless gambit by the west: Europe has less oil, the Saudi fable that it has endless excess suplies is about the be seriously tested, China has just expanded a key crude supply route, and Russia is grinning through it all as Brent prices are about to spike. Iran didn’t invent chess for nothing.

This is what we cautioned in early February: